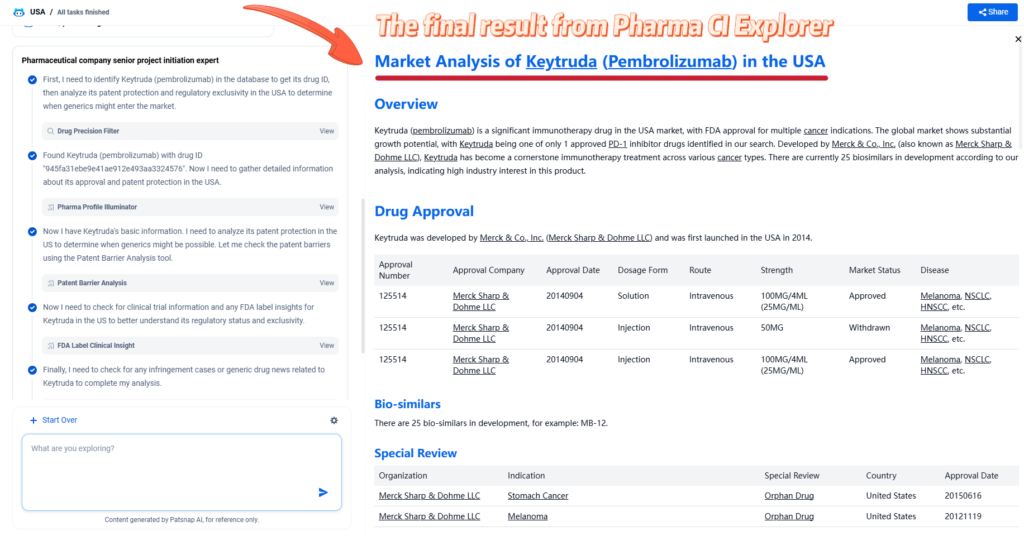

Overview

Keytruda (pembrolizumab) is a leading immunotherapy drug in the US market, with 1 approved drug and 25 biosimilar products in development, demonstrating significant market interest. Developed by Merck & Co. (Merck Sharp & Dohme LLC), Keytruda has become a cornerstone of cancer immunotherapy with numerous approvals across multiple indications, including melanoma, non-small cell lung cancer, head and neck cancer, and many others. The drug has received multiple special designations including Breakthrough Therapy, Priority Review, Orphan Drug, and Accelerated Approval designations for various indications, highlighting its clinical significance.

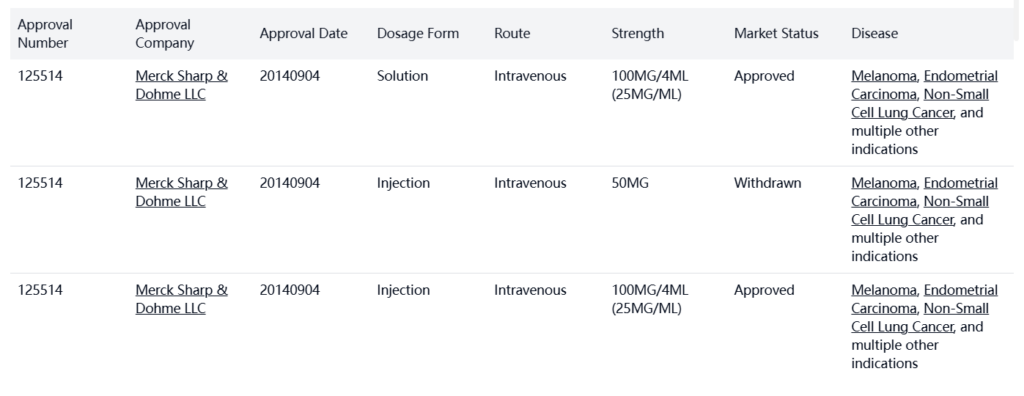

Drug Approval

Keytruda was developed by Merck Sharp & Dohme LLC and launched in the USA in 2014.

- Bio-similars: There are 25 biosimilar products in development, including MB-12

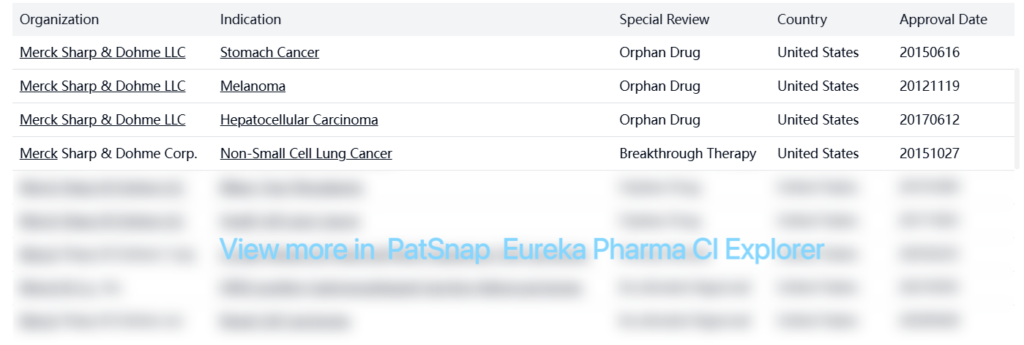

Special Review

Note: Table truncated for brevity – Keytruda has received over 40 special designations

Patent Barrier

Registration Patent Analysis

The patent analysis reveals a notable absence of core patents (FDA Orange Book patents) for Keytruda in the US. The search returned no core patents, which is significant because biologic drugs are typically protected by multiple layers of patents.

Other Patent Barrier Analysis

The patent search identified numerous “other patents” related to Keytruda, but most of these are not primary composition-of-matter patents. Instead, they focus on:

- Formulation patents: Such as WO2023211868A1 for stable formulations of anti-ILT4 antibodies in combination with anti-PD-1 antibodies

- Method-of-use patents: Including numerous patents for combination therapies with other drugs

- Dosing regimen patents: For example, WO2020096915A1 for dosing regimens of anti-TIGIT antibody for cancer treatment

Most critically, patent EP1537878A1, which appears to be a key patent related to the PD-1 inhibition mechanism, is listed with an estimated expiry date of July 2, 2023, and is marked as “Inactive.”

One active US patent (US11053315B2) for anti-ILT4 antibodies has an estimated expiry date of July 24, 2038, but this appears to cover combination therapy rather than the core Keytruda molecule.

Another active US patent (US10618958B2) for anti-TIGIT antibodies has an estimated expiry date of August 17, 2035.

Clinical Results

Keytruda has been extensively studied in clinical trials across multiple cancer indications:

- Melanoma: KEYNOTE-006 and KEYNOTE-054 trials compared pembrolizumab dosing regimens to active comparators such as ipilimumab, with endpoints including overall response rate (ORR), duration of response (DOR), and overall survival (OS).

- Non-Small Cell Lung Cancer (NSCLC): KEYNOTE-010, KEYNOTE-407, and KEYNOTE-189 trials investigated pembrolizumab both as a single agent and in combination with chemotherapy for patients with metastatic NSCLC, stratified by PD-L1 expression levels.

- Head and Neck Squamous Cell Carcinoma (HNSCC): KEYNOTE-012 and KEYNOTE-048 examined pembrolizumab as a single agent and in combination with platinum-based chemotherapy and FU.

- Classical Hodgkin Lymphoma (cHL): KEYNOTE-204 compared pembrolizumab to brentuximab vedotin in patients with relapsed or refractory cHL .

- Renal Cell Carcinoma (RCC): KEYNOTE-426 combined pembrolizumab with axitinib in patients with advanced RCC.

Keytruda has also been evaluated in trials for urothelial carcinoma, triple-negative breast cancer (TNBC), gastrointestinal cancers, and microsatellite instability-high (MSI-H) or mismatch repair deficient (dMMR) cancers, among others.

Infringement Cases

No specific patent infringement cases related to Keytruda (pembrolizumab) were found in the search.

Policy and Regulatory Risk Warning

After a comprehensive search, Keytruda (pembrolizumab) is subject to the standard 12-year biologic exclusivity period in the United States under the Biologics Price Competition and Innovation Act (BPCIA). Given its first approval date of September 4, 2014, this exclusivity would expire on September 4, 2026. This is a critical regulatory barrier to biosimilar entry independent of patent protection.

Market Entry Assessment & Recommendations

Based on the analysis of patents and regulatory exclusivity for Keytruda in the USA, the following timeline and recommendations can be provided:

- Generic/Biosimilar Entry Timeline:

- Regulatory exclusivity expires: September 4, 2026 (12 years after original approval)

- Key mechanism-of-action patent (EP1537878A1) appears to have expired on July 2, 2023

- Remaining secondary patents extend to 2035-2038, but these cover combinations, formulations, and methods of use rather than the core molecule

- Expected Generic Entry: The earliest possible entry for biosimilar versions of Keytruda would be September 2026, after the expiration of the 12-year regulatory exclusivity period. However, Merck will likely assert its secondary patents to delay biosimilar entry.

- Recommendations for Innovator (Merck):

- Continue to develop combination therapies to extend the practical life of Keytruda

- Pursue additional indications to maximize market value before biosimilar entry

- Consider strategic pricing adjustments as biosimilar competition approaches

- Develop next-generation immunotherapies to maintain market leadership

- Prepare litigation strategies to enforce secondary patents against biosimilar manufacturers

- Recommendations for Biosimilar Developers:

- Begin preparing for regulatory submissions to be ready for potential launch after September 2026

- Consider patent challenge strategies against Merck’s secondary patents

- Develop value-added biosimilar formulations that may avoid certain formulation patents

- Invest in manufacturing capabilities to ensure competitive cost structure

- Consider partnership with established oncology companies for market access

The biosimilar market for Keytruda is expected to be highly competitive given the drug’s commercial success and the large number of biosimilars already in development. However, the complex nature of monoclonal antibody manufacturing and the need to demonstrate biosimilarity will limit the number of successful entrants.

In conclusion, generic/biosimilar versions of Keytruda are not expected to be available in the USA until at least September 2026, with potential delays beyond that date due to secondary patent litigation. The entry of multiple biosimilars would likely drive significant price competition in this important oncology market.

For more scientific and detailed information of Keytruda, try PatSnap Eureka Pharma CI Explorer.

Only takes 4 steps to unlock the detailed result 👇