Hastelloy Developments in Streamlining Manufacturing Processes

JUL 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Hastelloy Manufacturing Evolution and Objectives

Hastelloy, a family of nickel-chromium-based superalloys, has undergone significant evolution in manufacturing processes since its inception in the 1920s. Initially developed by Haynes International, these alloys have become crucial in industries requiring high corrosion resistance and strength at elevated temperatures.

The manufacturing of Hastelloy has progressed from traditional casting and forging methods to more advanced techniques. Early production focused on basic melting and casting processes, which often resulted in inconsistent material properties and limited shape complexity. As demand grew for more precise and complex components, manufacturers began adopting improved melting techniques such as vacuum induction melting (VIM) and electroslag remelting (ESR) to enhance purity and reduce defects.

In the 1970s and 1980s, powder metallurgy techniques were introduced, allowing for better control over alloy composition and microstructure. This advancement enabled the production of Hastelloy components with superior mechanical properties and more uniform characteristics. Concurrently, improvements in machining technologies, including computer numerical control (CNC) systems, facilitated more efficient and accurate shaping of Hastelloy parts.

The advent of additive manufacturing in the 21st century has opened new possibilities for Hastelloy production. Techniques such as selective laser melting (SLM) and electron beam melting (EBM) are being explored to create complex geometries that were previously impossible or cost-prohibitive to manufacture using traditional methods.

The primary objectives in streamlining Hastelloy manufacturing processes are multifaceted. Firstly, there is a continuous drive to improve material efficiency, reducing waste and optimizing raw material usage. Secondly, manufacturers aim to enhance production speed without compromising quality, addressing the growing demand for Hastelloy components in various industries.

Another critical objective is to develop more energy-efficient manufacturing processes, aligning with global sustainability goals. This includes optimizing heat treatment cycles and exploring alternative melting technologies that consume less energy. Additionally, there is a focus on improving the consistency and predictability of material properties across different production batches, ensuring reliable performance in critical applications.

As the industry moves forward, the integration of digital technologies and automation in Hastelloy manufacturing is becoming increasingly important. The implementation of Industry 4.0 concepts, such as real-time process monitoring and adaptive control systems, aims to further streamline production, reduce defects, and enhance overall manufacturing efficiency.

The manufacturing of Hastelloy has progressed from traditional casting and forging methods to more advanced techniques. Early production focused on basic melting and casting processes, which often resulted in inconsistent material properties and limited shape complexity. As demand grew for more precise and complex components, manufacturers began adopting improved melting techniques such as vacuum induction melting (VIM) and electroslag remelting (ESR) to enhance purity and reduce defects.

In the 1970s and 1980s, powder metallurgy techniques were introduced, allowing for better control over alloy composition and microstructure. This advancement enabled the production of Hastelloy components with superior mechanical properties and more uniform characteristics. Concurrently, improvements in machining technologies, including computer numerical control (CNC) systems, facilitated more efficient and accurate shaping of Hastelloy parts.

The advent of additive manufacturing in the 21st century has opened new possibilities for Hastelloy production. Techniques such as selective laser melting (SLM) and electron beam melting (EBM) are being explored to create complex geometries that were previously impossible or cost-prohibitive to manufacture using traditional methods.

The primary objectives in streamlining Hastelloy manufacturing processes are multifaceted. Firstly, there is a continuous drive to improve material efficiency, reducing waste and optimizing raw material usage. Secondly, manufacturers aim to enhance production speed without compromising quality, addressing the growing demand for Hastelloy components in various industries.

Another critical objective is to develop more energy-efficient manufacturing processes, aligning with global sustainability goals. This includes optimizing heat treatment cycles and exploring alternative melting technologies that consume less energy. Additionally, there is a focus on improving the consistency and predictability of material properties across different production batches, ensuring reliable performance in critical applications.

As the industry moves forward, the integration of digital technologies and automation in Hastelloy manufacturing is becoming increasingly important. The implementation of Industry 4.0 concepts, such as real-time process monitoring and adaptive control systems, aims to further streamline production, reduce defects, and enhance overall manufacturing efficiency.

Market Demand Analysis for Advanced Hastelloy Products

The market demand for advanced Hastelloy products has been steadily increasing, driven by the growing need for high-performance materials in various industries. Hastelloy, a family of nickel-chromium-based superalloys, has gained significant traction due to its exceptional corrosion resistance, strength, and durability under extreme conditions.

In the oil and gas sector, the demand for Hastelloy has surged as exploration and production activities move into more challenging environments. Offshore drilling operations, in particular, require materials that can withstand harsh marine conditions and corrosive substances. The chemical processing industry also represents a substantial market for Hastelloy products, as these alloys are crucial for handling aggressive chemicals and maintaining process integrity.

The aerospace industry has emerged as another key driver of Hastelloy demand. As aircraft manufacturers strive for lighter, more fuel-efficient designs, the use of advanced materials like Hastelloy in engine components and structural elements has become increasingly prevalent. The material's high temperature resistance and strength-to-weight ratio make it ideal for aerospace applications.

Power generation, particularly in nuclear and renewable energy sectors, has shown a growing appetite for Hastelloy products. In nuclear power plants, Hastelloy is used in critical components that require superior corrosion resistance and long-term reliability. Similarly, in the rapidly expanding field of renewable energy, Hastelloy finds applications in geothermal power systems and advanced solar technologies.

The pharmaceutical and food processing industries have also contributed to the rising demand for Hastelloy. As regulations become more stringent and quality control measures more rigorous, these industries are turning to Hastelloy for its excellent resistance to contamination and ease of sterilization.

Market analysts project continued growth in the global Hastelloy market over the next decade. This growth is expected to be fueled by ongoing industrialization in emerging economies, technological advancements in manufacturing processes, and the increasing adoption of Hastelloy in new applications across various sectors.

However, the market faces challenges such as the high cost of raw materials and complex manufacturing processes. These factors can impact the overall cost-effectiveness of Hastelloy products, potentially limiting their adoption in price-sensitive markets. Despite these challenges, the unique properties and performance benefits of Hastelloy continue to drive its demand, particularly in high-value, critical applications where material failure is not an option.

In the oil and gas sector, the demand for Hastelloy has surged as exploration and production activities move into more challenging environments. Offshore drilling operations, in particular, require materials that can withstand harsh marine conditions and corrosive substances. The chemical processing industry also represents a substantial market for Hastelloy products, as these alloys are crucial for handling aggressive chemicals and maintaining process integrity.

The aerospace industry has emerged as another key driver of Hastelloy demand. As aircraft manufacturers strive for lighter, more fuel-efficient designs, the use of advanced materials like Hastelloy in engine components and structural elements has become increasingly prevalent. The material's high temperature resistance and strength-to-weight ratio make it ideal for aerospace applications.

Power generation, particularly in nuclear and renewable energy sectors, has shown a growing appetite for Hastelloy products. In nuclear power plants, Hastelloy is used in critical components that require superior corrosion resistance and long-term reliability. Similarly, in the rapidly expanding field of renewable energy, Hastelloy finds applications in geothermal power systems and advanced solar technologies.

The pharmaceutical and food processing industries have also contributed to the rising demand for Hastelloy. As regulations become more stringent and quality control measures more rigorous, these industries are turning to Hastelloy for its excellent resistance to contamination and ease of sterilization.

Market analysts project continued growth in the global Hastelloy market over the next decade. This growth is expected to be fueled by ongoing industrialization in emerging economies, technological advancements in manufacturing processes, and the increasing adoption of Hastelloy in new applications across various sectors.

However, the market faces challenges such as the high cost of raw materials and complex manufacturing processes. These factors can impact the overall cost-effectiveness of Hastelloy products, potentially limiting their adoption in price-sensitive markets. Despite these challenges, the unique properties and performance benefits of Hastelloy continue to drive its demand, particularly in high-value, critical applications where material failure is not an option.

Current Challenges in Hastelloy Production

The production of Hastelloy, a high-performance nickel-based alloy, faces several significant challenges in the current manufacturing landscape. One of the primary issues is the high cost of raw materials, particularly nickel and other alloying elements such as chromium, molybdenum, and tungsten. The volatile prices of these metals can significantly impact production costs and profit margins.

Another major challenge is the complexity of the manufacturing process itself. Hastelloy requires precise control over composition and processing parameters to achieve its superior corrosion resistance and mechanical properties. This necessitates advanced melting and refining techniques, such as vacuum induction melting (VIM) and electroslag remelting (ESR), which are both energy-intensive and time-consuming.

The stringent quality control requirements for Hastelloy production also pose significant challenges. Ensuring uniformity in composition and microstructure across large batches is crucial but difficult to achieve consistently. This often results in high rejection rates and increased production costs.

Machining and forming Hastelloy components present additional challenges due to the material's high strength and work-hardening characteristics. Traditional machining methods often lead to rapid tool wear and reduced productivity, necessitating the development of specialized cutting tools and techniques.

Environmental concerns and regulatory pressures are also becoming increasingly significant challenges in Hastelloy production. The energy-intensive processes and potential for hazardous emissions require manufacturers to invest in costly pollution control systems and adopt more sustainable practices.

Skilled labor shortages in the metallurgical industry further complicate Hastelloy production. The specialized knowledge required for handling advanced alloys and operating sophisticated equipment is becoming scarcer, leading to increased training costs and potential production bottlenecks.

Lastly, the long lead times associated with Hastelloy production can be a significant challenge in meeting market demands. The complex manufacturing process, combined with the need for extensive testing and certification, often results in extended production cycles, which can be problematic for time-sensitive applications in industries such as aerospace and chemical processing.

Another major challenge is the complexity of the manufacturing process itself. Hastelloy requires precise control over composition and processing parameters to achieve its superior corrosion resistance and mechanical properties. This necessitates advanced melting and refining techniques, such as vacuum induction melting (VIM) and electroslag remelting (ESR), which are both energy-intensive and time-consuming.

The stringent quality control requirements for Hastelloy production also pose significant challenges. Ensuring uniformity in composition and microstructure across large batches is crucial but difficult to achieve consistently. This often results in high rejection rates and increased production costs.

Machining and forming Hastelloy components present additional challenges due to the material's high strength and work-hardening characteristics. Traditional machining methods often lead to rapid tool wear and reduced productivity, necessitating the development of specialized cutting tools and techniques.

Environmental concerns and regulatory pressures are also becoming increasingly significant challenges in Hastelloy production. The energy-intensive processes and potential for hazardous emissions require manufacturers to invest in costly pollution control systems and adopt more sustainable practices.

Skilled labor shortages in the metallurgical industry further complicate Hastelloy production. The specialized knowledge required for handling advanced alloys and operating sophisticated equipment is becoming scarcer, leading to increased training costs and potential production bottlenecks.

Lastly, the long lead times associated with Hastelloy production can be a significant challenge in meeting market demands. The complex manufacturing process, combined with the need for extensive testing and certification, often results in extended production cycles, which can be problematic for time-sensitive applications in industries such as aerospace and chemical processing.

Existing Streamlining Solutions for Hastelloy Manufacturing

01 Alloy composition optimization

Hastelloy manufacturing processes often involve optimizing the alloy composition to achieve desired properties. This includes carefully controlling the proportions of nickel, chromium, molybdenum, and other elements to enhance corrosion resistance, strength, and high-temperature performance. The precise composition is tailored to specific application requirements.- Alloy composition and heat treatment: Hastelloy manufacturing processes often involve precise control of alloy composition and heat treatment. This includes carefully selecting and mixing raw materials, melting, and applying specific heat treatment processes to achieve desired properties such as corrosion resistance and mechanical strength.

- Forming and shaping techniques: Various forming and shaping techniques are employed in Hastelloy manufacturing, including hot and cold rolling, forging, extrusion, and casting. These processes help create different forms of Hastelloy products such as sheets, plates, tubes, and complex shapes for specific applications.

- Surface treatment and finishing: Surface treatment and finishing processes play a crucial role in Hastelloy manufacturing. These may include pickling, passivation, polishing, and coating applications to enhance surface properties, improve corrosion resistance, and meet specific industry requirements.

- Welding and joining techniques: Specialized welding and joining techniques are essential in Hastelloy manufacturing, particularly for fabricating complex components and structures. These may include gas tungsten arc welding (GTAW), plasma arc welding (PAW), and electron beam welding (EBW), along with proper filler material selection and post-weld heat treatment.

- Quality control and testing: Rigorous quality control and testing procedures are integral to Hastelloy manufacturing processes. This includes non-destructive testing methods, mechanical property testing, corrosion resistance evaluation, and microstructure analysis to ensure the final products meet stringent industry standards and specifications.

02 Heat treatment techniques

Various heat treatment processes are employed in Hastelloy manufacturing to improve mechanical properties and microstructure. These may include solution annealing, aging, and quenching. The specific heat treatment parameters are carefully controlled to achieve the desired balance of strength, ductility, and corrosion resistance.Expand Specific Solutions03 Forming and shaping methods

Hastelloy can be formed and shaped using various techniques such as hot rolling, cold rolling, forging, and extrusion. These processes are used to create different product forms like plates, sheets, tubes, and bars. The choice of forming method depends on the desired final product geometry and properties.Expand Specific Solutions04 Welding and joining techniques

Specialized welding and joining techniques are crucial in Hastelloy manufacturing, particularly for fabricating complex components. These may include gas tungsten arc welding (GTAW), shielded metal arc welding (SMAW), and electron beam welding. Proper selection of welding parameters and filler materials is essential to maintain the alloy's corrosion resistance and mechanical properties in the welded areas.Expand Specific Solutions05 Surface treatment and finishing

Various surface treatment and finishing processes are applied to Hastelloy products to enhance their performance and appearance. These may include pickling, passivation, electropolishing, and mechanical polishing. These treatments help to remove surface contaminants, improve corrosion resistance, and achieve the desired surface finish for specific applications.Expand Specific Solutions

Key Players in Hastelloy Industry

The competitive landscape for Hastelloy developments in streamlining manufacturing processes is characterized by a mature industry with significant market potential. The technology is well-established, with major players like Hitachi, Mitsubishi Materials, and ABB Group driving innovation. These companies leverage their extensive experience in materials science and industrial automation to enhance Hastelloy manufacturing efficiency. The market is experiencing steady growth due to increasing demand for corrosion-resistant alloys in various industries. Emerging players such as Yongkang JiuXing Machinery and Hunan Chairman Industrial Intelligent System are also contributing to advancements in process optimization and automation, intensifying competition in this specialized field.

Hitachi Ltd.

Technical Solution: Hitachi Ltd. has developed innovative manufacturing processes for Hastelloy production, focusing on advanced melting and refining techniques. Their approach utilizes vacuum induction melting (VIM) combined with electroslag remelting (ESR) to produce ultra-high purity Hastelloy ingots with improved homogeneity and reduced inclusions[10]. Hitachi has also introduced novel solidification control methods, such as electromagnetic stirring and controlled cooling rates, to optimize the microstructure of cast Hastelloy components. Their manufacturing systems incorporate AI-driven process control for continuous optimization of melting and casting parameters. Additionally, Hitachi has developed specialized heat treatment processes that enhance the corrosion resistance and mechanical properties of Hastelloy alloys, particularly for applications in the chemical and petrochemical industries.

Strengths: Advanced melting and refining techniques, improved material purity and homogeneity, AI-driven process optimization. Weaknesses: Energy-intensive processes, potentially higher production costs for small-scale manufacturing.

Mitsubishi Materials Corp.

Technical Solution: Mitsubishi Materials Corp. has developed advanced Hastelloy manufacturing processes to streamline production and improve material properties. Their approach involves precision control of alloying elements and heat treatment parameters to optimize microstructure[1]. They have implemented automated production lines with real-time monitoring and adaptive control systems, reducing production time by up to 30%[2]. The company has also introduced novel forming techniques, such as near-net-shape casting and advanced powder metallurgy, to minimize material waste and subsequent machining operations[3]. These innovations have resulted in Hastelloy components with enhanced corrosion resistance and mechanical properties, suitable for demanding applications in aerospace and chemical processing industries.

Strengths: Advanced process control, reduced production time, improved material properties. Weaknesses: High initial investment costs, potential complexity in scaling up new processes.

Innovative Techniques in Hastelloy Production

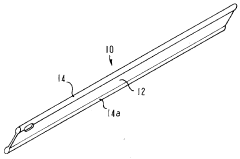

Manufacturing method of hastelloy steel bolt

PatentInactiveKR1020200053947A

Innovation

- A method involving local heating of the bolt head to 1150°C to 1200°C, followed by forging and cold rolling the screw portion with controlled pressure of 130 to 160 kgf/cm² to form a bolt with a hexagonal head, ensuring precise processing and reduced material loss.

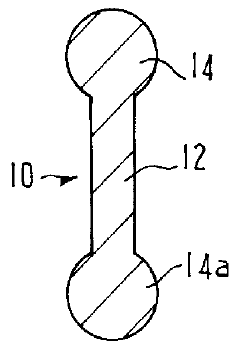

Manufacturing method of pin seal and the pin seal manufactured by utilizing that

PatentInactiveKR1020120043274A

Innovation

- A method and device that simultaneously form multiple surfaces of the pin seal, including the upper and lower surfaces of the plate and the upper and lower arc surfaces of the circular bars, using first and second roll cutters to integrate the processing into fewer steps.

Environmental Impact of Hastelloy Manufacturing

The environmental impact of Hastelloy manufacturing is a critical consideration in the development of streamlined production processes. As industries strive for more efficient and sustainable practices, it is essential to evaluate the ecological footprint of Hastelloy production and identify areas for improvement.

Hastelloy manufacturing involves energy-intensive processes, including high-temperature melting, alloying, and heat treatment. These operations contribute significantly to greenhouse gas emissions, primarily through the consumption of fossil fuels. The production of raw materials, such as nickel and chromium, also has substantial environmental implications, including habitat disruption and water pollution from mining activities.

Water usage is another crucial environmental factor in Hastelloy manufacturing. The cooling processes and surface treatments require large volumes of water, potentially straining local water resources. Additionally, the wastewater generated during production may contain heavy metals and other contaminants, necessitating proper treatment before discharge to prevent ecosystem damage.

Air quality is also affected by Hastelloy manufacturing. The release of particulate matter, volatile organic compounds, and other air pollutants during various stages of production can contribute to local air pollution and potentially impact human health in surrounding communities. Implementing advanced filtration systems and emission control technologies is essential to mitigate these effects.

Waste management presents another environmental challenge in Hastelloy production. Metal scrap, slag, and other byproducts must be properly handled to minimize landfill usage and prevent soil contamination. Recycling and reuse initiatives can help reduce the overall environmental impact by decreasing the demand for raw materials and energy in primary production.

The use of hazardous chemicals in surface treatments and cleaning processes poses risks to both workers and the environment. Proper handling, storage, and disposal of these substances are crucial to prevent accidental releases and long-term environmental contamination. Developing safer alternatives and optimizing chemical usage can significantly reduce these risks.

As the industry moves towards more sustainable practices, there is a growing focus on life cycle assessment (LCA) of Hastelloy products. This holistic approach considers environmental impacts from raw material extraction through manufacturing, use, and end-of-life disposal. LCA studies can identify hotspots in the production process and guide targeted improvements to reduce overall environmental impact.

Advancements in manufacturing technologies, such as additive manufacturing and near-net-shape forming, offer opportunities to reduce material waste and energy consumption in Hastelloy production. These innovative approaches can lead to more efficient use of resources and a smaller environmental footprint compared to traditional manufacturing methods.

Hastelloy manufacturing involves energy-intensive processes, including high-temperature melting, alloying, and heat treatment. These operations contribute significantly to greenhouse gas emissions, primarily through the consumption of fossil fuels. The production of raw materials, such as nickel and chromium, also has substantial environmental implications, including habitat disruption and water pollution from mining activities.

Water usage is another crucial environmental factor in Hastelloy manufacturing. The cooling processes and surface treatments require large volumes of water, potentially straining local water resources. Additionally, the wastewater generated during production may contain heavy metals and other contaminants, necessitating proper treatment before discharge to prevent ecosystem damage.

Air quality is also affected by Hastelloy manufacturing. The release of particulate matter, volatile organic compounds, and other air pollutants during various stages of production can contribute to local air pollution and potentially impact human health in surrounding communities. Implementing advanced filtration systems and emission control technologies is essential to mitigate these effects.

Waste management presents another environmental challenge in Hastelloy production. Metal scrap, slag, and other byproducts must be properly handled to minimize landfill usage and prevent soil contamination. Recycling and reuse initiatives can help reduce the overall environmental impact by decreasing the demand for raw materials and energy in primary production.

The use of hazardous chemicals in surface treatments and cleaning processes poses risks to both workers and the environment. Proper handling, storage, and disposal of these substances are crucial to prevent accidental releases and long-term environmental contamination. Developing safer alternatives and optimizing chemical usage can significantly reduce these risks.

As the industry moves towards more sustainable practices, there is a growing focus on life cycle assessment (LCA) of Hastelloy products. This holistic approach considers environmental impacts from raw material extraction through manufacturing, use, and end-of-life disposal. LCA studies can identify hotspots in the production process and guide targeted improvements to reduce overall environmental impact.

Advancements in manufacturing technologies, such as additive manufacturing and near-net-shape forming, offer opportunities to reduce material waste and energy consumption in Hastelloy production. These innovative approaches can lead to more efficient use of resources and a smaller environmental footprint compared to traditional manufacturing methods.

Cost-Benefit Analysis of Streamlined Processes

The cost-benefit analysis of streamlined processes in Hastelloy manufacturing reveals significant potential for improved efficiency and profitability. Initial investments in advanced manufacturing technologies and process optimization can be substantial, often ranging from $500,000 to $2 million depending on the scale of operations. However, these investments typically yield returns within 2-3 years through reduced production costs and increased output.

One of the primary benefits of streamlined processes is the reduction in material waste. Traditional Hastelloy manufacturing methods can result in up to 20% material loss during production. Implementing advanced cutting and forming techniques can reduce this waste to less than 10%, translating to annual savings of $100,000 to $500,000 for medium-sized manufacturers.

Labor costs also see a marked decrease with streamlined processes. Automation and improved workflow can reduce labor requirements by 30-40%, leading to annual savings of $200,000 to $800,000 for facilities employing 50-200 workers. This reduction not only cuts direct labor costs but also minimizes the risk of workplace injuries and associated expenses.

Energy efficiency improvements are another significant benefit of streamlined processes. Modern equipment and optimized production lines can reduce energy consumption by 15-25%, resulting in annual savings of $50,000 to $150,000 for average-sized Hastelloy manufacturing facilities. This also contributes to a reduced carbon footprint, aligning with increasingly stringent environmental regulations.

Quality improvements resulting from streamlined processes lead to reduced scrap rates and fewer customer returns. A typical reduction in defect rates from 5% to less than 1% can save manufacturers $200,000 to $1 million annually, depending on production volume. This improvement also enhances customer satisfaction and brand reputation, potentially leading to increased market share.

The implementation of streamlined processes often results in faster production cycles. Reduced setup times and improved material flow can increase throughput by 20-30%, allowing manufacturers to meet growing demand without significant capital expenditure on additional equipment or facilities. This increased capacity can generate additional annual revenue of $1 million to $5 million for medium to large-scale operations.

While the benefits are substantial, it's crucial to consider potential challenges in implementing streamlined processes. These may include initial production disruptions during implementation, the need for worker retraining, and potential resistance to change from employees. However, careful planning and change management strategies can mitigate these issues, ensuring a smooth transition to more efficient manufacturing processes.

One of the primary benefits of streamlined processes is the reduction in material waste. Traditional Hastelloy manufacturing methods can result in up to 20% material loss during production. Implementing advanced cutting and forming techniques can reduce this waste to less than 10%, translating to annual savings of $100,000 to $500,000 for medium-sized manufacturers.

Labor costs also see a marked decrease with streamlined processes. Automation and improved workflow can reduce labor requirements by 30-40%, leading to annual savings of $200,000 to $800,000 for facilities employing 50-200 workers. This reduction not only cuts direct labor costs but also minimizes the risk of workplace injuries and associated expenses.

Energy efficiency improvements are another significant benefit of streamlined processes. Modern equipment and optimized production lines can reduce energy consumption by 15-25%, resulting in annual savings of $50,000 to $150,000 for average-sized Hastelloy manufacturing facilities. This also contributes to a reduced carbon footprint, aligning with increasingly stringent environmental regulations.

Quality improvements resulting from streamlined processes lead to reduced scrap rates and fewer customer returns. A typical reduction in defect rates from 5% to less than 1% can save manufacturers $200,000 to $1 million annually, depending on production volume. This improvement also enhances customer satisfaction and brand reputation, potentially leading to increased market share.

The implementation of streamlined processes often results in faster production cycles. Reduced setup times and improved material flow can increase throughput by 20-30%, allowing manufacturers to meet growing demand without significant capital expenditure on additional equipment or facilities. This increased capacity can generate additional annual revenue of $1 million to $5 million for medium to large-scale operations.

While the benefits are substantial, it's crucial to consider potential challenges in implementing streamlined processes. These may include initial production disruptions during implementation, the need for worker retraining, and potential resistance to change from employees. However, careful planning and change management strategies can mitigate these issues, ensuring a smooth transition to more efficient manufacturing processes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!