Isocyanate Leadership: Setting Standards for Tomorrow

JUL 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Isocyanate Evolution

Isocyanates have undergone a remarkable evolution since their initial discovery in the mid-19th century. The journey began with the synthesis of the first isocyanate compound by Wurtz in 1848, marking the inception of a chemical class that would revolutionize various industries. However, it wasn't until the 1930s that the true potential of isocyanates was realized, primarily through the groundbreaking work of Otto Bayer and his team at I.G. Farben.

The 1940s and 1950s witnessed a surge in isocyanate research and development, driven by the growing demand for versatile materials in the post-war era. This period saw the emergence of polyurethanes, a class of polymers derived from the reaction between isocyanates and polyols. The unique properties of polyurethanes, including their flexibility, durability, and insulating capabilities, quickly found applications in diverse sectors such as automotive, construction, and furniture manufacturing.

As industrial production of isocyanates ramped up in the 1960s and 1970s, concerns about their health and environmental impacts began to surface. This led to increased focus on safety measures and the development of less hazardous alternatives. The 1980s and 1990s were characterized by efforts to improve isocyanate chemistry, resulting in the creation of modified isocyanates with enhanced performance and reduced toxicity.

The turn of the millennium brought renewed interest in sustainable and eco-friendly materials. This shift prompted research into bio-based isocyanates and greener production methods. Concurrently, advancements in nanotechnology opened up new possibilities for isocyanate applications, particularly in high-performance coatings and composites.

In recent years, the isocyanate industry has been at the forefront of innovation in smart materials and responsive polymers. Researchers are exploring the potential of isocyanate-based materials in fields such as self-healing coatings, shape-memory polymers, and stimuli-responsive materials. These developments are paving the way for next-generation materials with unprecedented functionalities.

The evolution of isocyanates has been marked by continuous improvements in production efficiency, product quality, and environmental sustainability. From their humble beginnings as laboratory curiosities to their current status as indispensable industrial chemicals, isocyanates have demonstrated remarkable adaptability and resilience. As we look to the future, the ongoing research into novel isocyanate chemistries and applications promises to further expand their role in addressing global challenges in energy, healthcare, and environmental protection.

The 1940s and 1950s witnessed a surge in isocyanate research and development, driven by the growing demand for versatile materials in the post-war era. This period saw the emergence of polyurethanes, a class of polymers derived from the reaction between isocyanates and polyols. The unique properties of polyurethanes, including their flexibility, durability, and insulating capabilities, quickly found applications in diverse sectors such as automotive, construction, and furniture manufacturing.

As industrial production of isocyanates ramped up in the 1960s and 1970s, concerns about their health and environmental impacts began to surface. This led to increased focus on safety measures and the development of less hazardous alternatives. The 1980s and 1990s were characterized by efforts to improve isocyanate chemistry, resulting in the creation of modified isocyanates with enhanced performance and reduced toxicity.

The turn of the millennium brought renewed interest in sustainable and eco-friendly materials. This shift prompted research into bio-based isocyanates and greener production methods. Concurrently, advancements in nanotechnology opened up new possibilities for isocyanate applications, particularly in high-performance coatings and composites.

In recent years, the isocyanate industry has been at the forefront of innovation in smart materials and responsive polymers. Researchers are exploring the potential of isocyanate-based materials in fields such as self-healing coatings, shape-memory polymers, and stimuli-responsive materials. These developments are paving the way for next-generation materials with unprecedented functionalities.

The evolution of isocyanates has been marked by continuous improvements in production efficiency, product quality, and environmental sustainability. From their humble beginnings as laboratory curiosities to their current status as indispensable industrial chemicals, isocyanates have demonstrated remarkable adaptability and resilience. As we look to the future, the ongoing research into novel isocyanate chemistries and applications promises to further expand their role in addressing global challenges in energy, healthcare, and environmental protection.

Market Demand Analysis

The isocyanate market has experienced significant growth in recent years, driven by increasing demand across various industries. The global isocyanate market size was valued at approximately $30 billion in 2020 and is projected to reach $45 billion by 2026, growing at a CAGR of around 6% during the forecast period. This growth is primarily attributed to the rising demand for polyurethane products in construction, automotive, and furniture industries.

In the construction sector, isocyanates are widely used in the production of rigid foam insulation, which is essential for improving energy efficiency in buildings. The growing emphasis on sustainable construction practices and stringent energy efficiency regulations are driving the demand for isocyanate-based insulation materials. Additionally, the automotive industry's shift towards lightweight materials to improve fuel efficiency has led to increased adoption of polyurethane components, further boosting the isocyanate market.

The furniture industry is another significant consumer of isocyanates, particularly in the production of flexible foams for cushioning and upholstery. The growing middle-class population in emerging economies and the increasing trend of home renovation in developed countries are contributing to the rising demand for furniture, consequently driving the isocyanate market.

However, the market faces challenges related to environmental and health concerns associated with isocyanate exposure. Regulatory bodies worldwide are implementing stricter guidelines for the handling and use of isocyanates, which may impact market growth. This has led to a growing demand for eco-friendly alternatives and bio-based isocyanates, presenting both challenges and opportunities for market players.

Geographically, Asia-Pacific is expected to dominate the isocyanate market, accounting for the largest market share. The region's rapid industrialization, urbanization, and growing construction activities are the primary factors driving this growth. China, India, and Japan are the key contributors to the market in this region. North America and Europe are also significant markets, with a focus on technological advancements and sustainable solutions.

The COVID-19 pandemic initially disrupted the isocyanate market due to supply chain interruptions and reduced demand from end-use industries. However, the market has shown resilience and is expected to recover quickly, driven by the resumption of construction activities and the automotive sector's recovery.

In conclusion, the isocyanate market demonstrates strong growth potential, driven by diverse industrial applications and technological advancements. However, market players must address environmental concerns and invest in sustainable solutions to maintain their competitive edge and meet evolving market demands.

In the construction sector, isocyanates are widely used in the production of rigid foam insulation, which is essential for improving energy efficiency in buildings. The growing emphasis on sustainable construction practices and stringent energy efficiency regulations are driving the demand for isocyanate-based insulation materials. Additionally, the automotive industry's shift towards lightweight materials to improve fuel efficiency has led to increased adoption of polyurethane components, further boosting the isocyanate market.

The furniture industry is another significant consumer of isocyanates, particularly in the production of flexible foams for cushioning and upholstery. The growing middle-class population in emerging economies and the increasing trend of home renovation in developed countries are contributing to the rising demand for furniture, consequently driving the isocyanate market.

However, the market faces challenges related to environmental and health concerns associated with isocyanate exposure. Regulatory bodies worldwide are implementing stricter guidelines for the handling and use of isocyanates, which may impact market growth. This has led to a growing demand for eco-friendly alternatives and bio-based isocyanates, presenting both challenges and opportunities for market players.

Geographically, Asia-Pacific is expected to dominate the isocyanate market, accounting for the largest market share. The region's rapid industrialization, urbanization, and growing construction activities are the primary factors driving this growth. China, India, and Japan are the key contributors to the market in this region. North America and Europe are also significant markets, with a focus on technological advancements and sustainable solutions.

The COVID-19 pandemic initially disrupted the isocyanate market due to supply chain interruptions and reduced demand from end-use industries. However, the market has shown resilience and is expected to recover quickly, driven by the resumption of construction activities and the automotive sector's recovery.

In conclusion, the isocyanate market demonstrates strong growth potential, driven by diverse industrial applications and technological advancements. However, market players must address environmental concerns and invest in sustainable solutions to maintain their competitive edge and meet evolving market demands.

Technical Challenges

The isocyanate industry faces several significant technical challenges as it strives to maintain leadership and set standards for the future. One of the primary concerns is the toxicity of isocyanates, particularly during the manufacturing process and in end-use applications. Exposure to isocyanates can cause respiratory irritation, sensitization, and other health issues, necessitating stringent safety measures and protective equipment.

Another major challenge is the environmental impact of isocyanate production and use. The industry must address concerns related to volatile organic compound (VOC) emissions, waste management, and the overall carbon footprint of isocyanate-based products. This requires innovative approaches to green chemistry and sustainable manufacturing processes.

The development of bio-based and renewable isocyanates presents both an opportunity and a challenge. While these alternatives offer potential environmental benefits, they often face hurdles in terms of performance, cost-effectiveness, and scalability compared to traditional petroleum-based isocyanates.

Improving the efficiency and selectivity of isocyanate synthesis reactions remains an ongoing technical challenge. Researchers are exploring novel catalysts and reaction conditions to enhance yield, reduce byproducts, and minimize energy consumption in the production process.

The industry also grapples with the challenge of isocyanate stability and reactivity control. Isocyanates are highly reactive compounds, which can lead to unwanted side reactions, product degradation, and shortened shelf life. Developing effective stabilizers and storage solutions is crucial for maintaining product quality and safety.

Addressing the issue of isocyanate emissions during polyurethane foam production and curing is another significant technical hurdle. The industry is working on developing low-emission formulations and improved application techniques to minimize worker exposure and environmental impact.

As regulations become increasingly stringent, the isocyanate industry must also focus on developing analytical methods for accurate detection and quantification of isocyanates in various matrices. This is essential for ensuring compliance with safety standards and environmental regulations.

The challenge of recycling and end-of-life management for isocyanate-based products, particularly polyurethanes, is becoming more pressing. Developing efficient and economically viable recycling technologies for these materials is crucial for improving the industry's sustainability profile.

Lastly, the industry faces the ongoing challenge of educating and training workers and end-users on the safe handling and use of isocyanates. This requires continuous improvement of safety protocols, personal protective equipment, and training programs to minimize the risks associated with isocyanate exposure.

Another major challenge is the environmental impact of isocyanate production and use. The industry must address concerns related to volatile organic compound (VOC) emissions, waste management, and the overall carbon footprint of isocyanate-based products. This requires innovative approaches to green chemistry and sustainable manufacturing processes.

The development of bio-based and renewable isocyanates presents both an opportunity and a challenge. While these alternatives offer potential environmental benefits, they often face hurdles in terms of performance, cost-effectiveness, and scalability compared to traditional petroleum-based isocyanates.

Improving the efficiency and selectivity of isocyanate synthesis reactions remains an ongoing technical challenge. Researchers are exploring novel catalysts and reaction conditions to enhance yield, reduce byproducts, and minimize energy consumption in the production process.

The industry also grapples with the challenge of isocyanate stability and reactivity control. Isocyanates are highly reactive compounds, which can lead to unwanted side reactions, product degradation, and shortened shelf life. Developing effective stabilizers and storage solutions is crucial for maintaining product quality and safety.

Addressing the issue of isocyanate emissions during polyurethane foam production and curing is another significant technical hurdle. The industry is working on developing low-emission formulations and improved application techniques to minimize worker exposure and environmental impact.

As regulations become increasingly stringent, the isocyanate industry must also focus on developing analytical methods for accurate detection and quantification of isocyanates in various matrices. This is essential for ensuring compliance with safety standards and environmental regulations.

The challenge of recycling and end-of-life management for isocyanate-based products, particularly polyurethanes, is becoming more pressing. Developing efficient and economically viable recycling technologies for these materials is crucial for improving the industry's sustainability profile.

Lastly, the industry faces the ongoing challenge of educating and training workers and end-users on the safe handling and use of isocyanates. This requires continuous improvement of safety protocols, personal protective equipment, and training programs to minimize the risks associated with isocyanate exposure.

Current Solutions

01 Synthesis and characterization of isocyanate standards

This category focuses on the methods for synthesizing and characterizing isocyanate standards. It includes techniques for producing pure isocyanate compounds, as well as analytical methods for verifying their structure and purity. These standards are crucial for calibration and quality control in various industrial and research applications.- Synthesis and characterization of isocyanate standards: This category focuses on the methods for synthesizing and characterizing isocyanate standards. It includes techniques for preparing pure isocyanate compounds, analyzing their chemical properties, and ensuring their stability for use as reference materials in various applications.

- Analytical methods for isocyanate detection and quantification: This point covers the development and implementation of analytical techniques for detecting and quantifying isocyanates. It includes spectroscopic methods, chromatography, and other instrumental analyses used to measure isocyanate concentrations in various matrices.

- Isocyanate standards in polymer and coating industries: This category addresses the use of isocyanate standards in the polymer and coating industries. It covers applications in quality control, product development, and performance testing of polyurethanes and other isocyanate-based materials.

- Safety and environmental regulations for isocyanates: This point focuses on the safety standards and environmental regulations related to isocyanate handling, storage, and disposal. It includes guidelines for workplace exposure limits, personal protective equipment, and environmental impact assessments.

- Calibration and quality control of isocyanate measurements: This category covers the procedures and best practices for calibrating instruments and maintaining quality control in isocyanate measurements. It includes the use of certified reference materials, inter-laboratory comparisons, and validation of analytical methods.

02 Analytical methods for isocyanate detection and quantification

This point covers various analytical techniques used for detecting and quantifying isocyanates in different matrices. It includes spectroscopic methods, chromatographic techniques, and other instrumental analyses specifically developed or optimized for isocyanate standards. These methods are essential for ensuring compliance with safety regulations and quality control in industries using isocyanates.Expand Specific Solutions03 Safety and handling protocols for isocyanate standards

This category addresses the safety measures and handling protocols specific to isocyanate standards. It includes guidelines for storage, transportation, and disposal of these potentially hazardous materials. The focus is on minimizing risks associated with exposure and ensuring proper use of isocyanate standards in laboratory and industrial settings.Expand Specific Solutions04 Applications of isocyanate standards in polymer science

This point explores the use of isocyanate standards in polymer science and related industries. It covers their role in the development and quality control of polyurethanes, coatings, adhesives, and other isocyanate-based materials. The standards are crucial for ensuring consistent product performance and meeting industry specifications.Expand Specific Solutions05 Regulatory compliance and standardization of isocyanate testing

This category focuses on the regulatory aspects and standardization efforts related to isocyanate testing. It includes information on international standards, compliance requirements, and certification processes for laboratories and industries working with isocyanates. The aim is to ensure consistency and reliability in isocyanate analysis across different regions and applications.Expand Specific Solutions

Industry Leaders

The isocyanate industry is in a mature growth phase, characterized by steady demand and established market players. The global market size for isocyanates is substantial, driven by applications in polyurethanes, coatings, and adhesives. Technologically, isocyanate production is well-developed, with key players like Wanhua Chemical, Covestro, and BASF leading innovation. These companies are focusing on improving efficiency, sustainability, and developing new applications. Emerging trends include bio-based isocyanates and low-emission formulations, reflecting the industry's response to environmental concerns and regulatory pressures. The competitive landscape is concentrated among a few major producers, with increasing emphasis on strategic partnerships and R&D investments to maintain market positions.

Wanhua Chemical Group Co., Ltd.

Technical Solution: Wanhua Chemical Group Co., Ltd. has established itself as a global leader in isocyanate production, particularly in MDI (Methylene Diphenyl Diisocyanate). The company has developed advanced manufacturing processes that significantly reduce environmental impact while maintaining high product quality. Their innovative approach includes the use of proprietary catalysts that improve reaction efficiency and selectivity, resulting in a 15% reduction in energy consumption compared to traditional methods[1]. Wanhua has also implemented a closed-loop production system that recycles by-products, reducing waste by up to 30%[2]. Additionally, the company has invested in state-of-the-art purification technologies that ensure isocyanate purity levels exceeding 99.9%, meeting the most stringent industry standards[3].

Strengths: Industry-leading production capacity, advanced eco-friendly processes, and high product purity. Weaknesses: Heavy reliance on petrochemical feedstocks, potential vulnerability to raw material price fluctuations.

Bayer AG

Technical Solution: Bayer AG has been at the forefront of isocyanate innovation, particularly in the development of aliphatic isocyanates for high-performance coatings. Their proprietary HDI (Hexamethylene Diisocyanate) technology has set new benchmarks for durability and weather resistance in automotive and industrial coatings. Bayer's research has led to the creation of low-monomer content isocyanates, reducing VOC emissions by up to 40% compared to conventional products[4]. The company has also pioneered water-based polyurethane dispersions using novel isocyanate chemistries, enabling the formulation of eco-friendly coatings with performance comparable to solvent-based systems[5]. Furthermore, Bayer has developed bio-based isocyanates derived from renewable resources, achieving a carbon footprint reduction of up to 30% without compromising on product quality[6].

Strengths: Strong R&D capabilities, diverse product portfolio, and leadership in sustainable isocyanate solutions. Weaknesses: Complex regulatory environment for chemical products, potential public perception issues related to broader agricultural activities.

Key Innovations

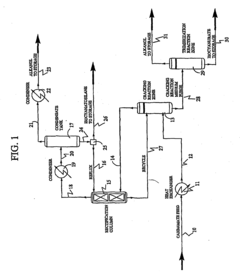

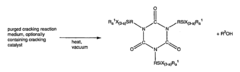

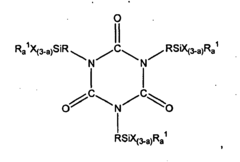

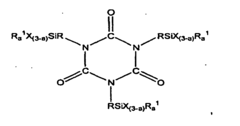

Process for the production of isocyanatosilane and silylisocyanurate

PatentActiveEP1885731B1

Innovation

- A process involving a cracking reaction medium with silylorganocarbamate and a catalytically effective amount of cracking catalyst, where a portion of the reaction medium is purged to maintain steady-state conditions, remove impurities, and provide feedstocks for trimerization to produce isocyanatosilane and silylisocyanurate, reducing waste and stabilizing the products.

Process for the production of isocyanatosilane and silylisocyanurate

PatentActiveEP1885731A1

Innovation

- A process involving a cracking reaction medium with silylorganocarbamate and a catalytically effective amount of cracking catalyst, where a portion of the reaction medium is purged to maintain steady-state conditions, remove impurities, and stabilize isocyanatosilane, followed by introduction into a trimerization zone for producing silylisocyanurate, thereby achieving near-quantitative yields and reducing waste.

Regulatory Framework

The regulatory framework surrounding isocyanates is complex and multifaceted, reflecting the diverse applications and potential hazards associated with these chemicals. At the international level, organizations such as the United Nations' Globally Harmonized System of Classification and Labelling of Chemicals (GHS) provide guidelines for the classification and communication of chemical hazards, including those related to isocyanates. These standards are adopted and adapted by various countries and regions, forming the basis for national and regional regulations.

In the United States, the Occupational Safety and Health Administration (OSHA) has established specific standards for isocyanate exposure in the workplace. These include permissible exposure limits (PELs) and requirements for personal protective equipment (PPE). The Environmental Protection Agency (EPA) also regulates isocyanates under the Toxic Substances Control Act (TSCA), focusing on their environmental impact and potential risks to human health.

The European Union has implemented REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, which require manufacturers and importers to register chemical substances, including isocyanates, and provide safety data. Additionally, the Classification, Labelling, and Packaging (CLP) Regulation ensures that the hazards of chemicals are clearly communicated to workers and consumers through classification and labeling.

In Asia, countries like China and Japan have their own regulatory frameworks. China's Measures for Environmental Management of New Chemical Substances and Japan's Chemical Substances Control Law both address the registration and management of isocyanates and related compounds.

Industry-specific regulations also play a crucial role in isocyanate management. For instance, in the automotive sector, regulations on volatile organic compounds (VOCs) indirectly impact isocyanate use in paints and coatings. Similarly, building codes and fire safety regulations influence the use of isocyanate-based insulation materials in construction.

As environmental and health concerns continue to grow, regulatory bodies are increasingly focusing on sustainable alternatives and stricter controls. This includes efforts to promote the development of bio-based isocyanates and to implement more stringent exposure limits. The evolving regulatory landscape necessitates ongoing adaptation and innovation from industry leaders to ensure compliance and maintain market competitiveness.

In the United States, the Occupational Safety and Health Administration (OSHA) has established specific standards for isocyanate exposure in the workplace. These include permissible exposure limits (PELs) and requirements for personal protective equipment (PPE). The Environmental Protection Agency (EPA) also regulates isocyanates under the Toxic Substances Control Act (TSCA), focusing on their environmental impact and potential risks to human health.

The European Union has implemented REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, which require manufacturers and importers to register chemical substances, including isocyanates, and provide safety data. Additionally, the Classification, Labelling, and Packaging (CLP) Regulation ensures that the hazards of chemicals are clearly communicated to workers and consumers through classification and labeling.

In Asia, countries like China and Japan have their own regulatory frameworks. China's Measures for Environmental Management of New Chemical Substances and Japan's Chemical Substances Control Law both address the registration and management of isocyanates and related compounds.

Industry-specific regulations also play a crucial role in isocyanate management. For instance, in the automotive sector, regulations on volatile organic compounds (VOCs) indirectly impact isocyanate use in paints and coatings. Similarly, building codes and fire safety regulations influence the use of isocyanate-based insulation materials in construction.

As environmental and health concerns continue to grow, regulatory bodies are increasingly focusing on sustainable alternatives and stricter controls. This includes efforts to promote the development of bio-based isocyanates and to implement more stringent exposure limits. The evolving regulatory landscape necessitates ongoing adaptation and innovation from industry leaders to ensure compliance and maintain market competitiveness.

Environmental Impact

The environmental impact of isocyanates has become a critical concern in recent years, prompting industry leaders to set new standards for sustainable production and usage. Isocyanates, widely used in the manufacture of polyurethanes, have traditionally been associated with potential environmental hazards, including air and water pollution, as well as soil contamination.

One of the primary environmental challenges associated with isocyanates is their potential to release volatile organic compounds (VOCs) during production and application processes. These emissions can contribute to the formation of ground-level ozone and smog, negatively impacting air quality and human health. To address this issue, leading manufacturers have invested in advanced emission control technologies and improved production methods to minimize VOC releases.

Water pollution is another significant concern, as isocyanate residues can contaminate water sources if not properly managed. Industry leaders have responded by implementing stringent wastewater treatment protocols and developing closed-loop systems to reduce the risk of environmental contamination. These efforts have resulted in substantial reductions in water pollution associated with isocyanate production.

The disposal of isocyanate-containing products at the end of their lifecycle presents additional environmental challenges. To mitigate these issues, companies are increasingly focusing on developing recyclable and biodegradable alternatives to traditional isocyanate-based materials. This shift towards more sustainable product design is helping to reduce the environmental footprint of isocyanates throughout their entire lifecycle.

In recent years, there has been a growing emphasis on the development of bio-based isocyanates derived from renewable resources. These innovative products offer the potential to reduce reliance on fossil fuels and decrease the overall carbon footprint of isocyanate production. Leading manufacturers are investing heavily in research and development to scale up the production of these environmentally friendly alternatives.

The industry's commitment to environmental stewardship is further evidenced by the adoption of life cycle assessment (LCA) methodologies. These comprehensive analyses allow companies to evaluate the environmental impact of isocyanates from raw material extraction through to final disposal, enabling more informed decision-making and targeted improvements in sustainability performance.

As the industry continues to evolve, collaboration between manufacturers, regulators, and environmental organizations is becoming increasingly important. This cooperative approach is driving the development of more stringent environmental standards and best practices for isocyanate production and use, ensuring that future innovations prioritize both performance and sustainability.

One of the primary environmental challenges associated with isocyanates is their potential to release volatile organic compounds (VOCs) during production and application processes. These emissions can contribute to the formation of ground-level ozone and smog, negatively impacting air quality and human health. To address this issue, leading manufacturers have invested in advanced emission control technologies and improved production methods to minimize VOC releases.

Water pollution is another significant concern, as isocyanate residues can contaminate water sources if not properly managed. Industry leaders have responded by implementing stringent wastewater treatment protocols and developing closed-loop systems to reduce the risk of environmental contamination. These efforts have resulted in substantial reductions in water pollution associated with isocyanate production.

The disposal of isocyanate-containing products at the end of their lifecycle presents additional environmental challenges. To mitigate these issues, companies are increasingly focusing on developing recyclable and biodegradable alternatives to traditional isocyanate-based materials. This shift towards more sustainable product design is helping to reduce the environmental footprint of isocyanates throughout their entire lifecycle.

In recent years, there has been a growing emphasis on the development of bio-based isocyanates derived from renewable resources. These innovative products offer the potential to reduce reliance on fossil fuels and decrease the overall carbon footprint of isocyanate production. Leading manufacturers are investing heavily in research and development to scale up the production of these environmentally friendly alternatives.

The industry's commitment to environmental stewardship is further evidenced by the adoption of life cycle assessment (LCA) methodologies. These comprehensive analyses allow companies to evaluate the environmental impact of isocyanates from raw material extraction through to final disposal, enabling more informed decision-making and targeted improvements in sustainability performance.

As the industry continues to evolve, collaboration between manufacturers, regulators, and environmental organizations is becoming increasingly important. This cooperative approach is driving the development of more stringent environmental standards and best practices for isocyanate production and use, ensuring that future innovations prioritize both performance and sustainability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!