Market Forecast: Isocyanate Demand and Supply Dynamics

JUL 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Isocyanate Industry Overview and Objectives

Isocyanates are a crucial class of chemicals widely used in the production of polyurethanes, which find applications in various industries such as automotive, construction, furniture, and electronics. The global isocyanate market has experienced significant growth over the past decade, driven by increasing demand for polyurethane-based products and technological advancements in manufacturing processes.

The isocyanate industry is characterized by its cyclical nature, closely tied to economic conditions and end-use sector performance. Key players in the market include BASF, Covestro, Wanhua Chemical, and Huntsman Corporation, among others. These companies have been investing heavily in research and development to improve product quality, reduce environmental impact, and expand their market presence.

The primary objectives of the isocyanate industry revolve around meeting growing demand while addressing environmental and safety concerns. Manufacturers are focusing on developing eco-friendly alternatives and improving production efficiency to reduce costs and minimize environmental footprint. Additionally, there is a strong emphasis on enhancing product performance to meet evolving customer requirements across various applications.

One of the major trends shaping the isocyanate industry is the shift towards bio-based and sustainable raw materials. This trend is driven by increasing environmental regulations and consumer preferences for green products. Companies are exploring innovative ways to incorporate renewable feedstocks into isocyanate production, aiming to reduce dependence on fossil-based raw materials.

The industry is also witnessing a geographical shift in production capacities. While traditionally dominated by North America and Europe, Asia-Pacific has emerged as a key region for isocyanate production and consumption. This shift is attributed to rapid industrialization, urbanization, and economic growth in countries like China and India.

Looking ahead, the isocyanate industry faces both opportunities and challenges. The growing demand for lightweight materials in automotive and aerospace industries presents significant growth potential for isocyanate-based products. However, volatility in raw material prices, stringent regulations, and concerns over health and environmental impacts pose challenges that the industry must address to ensure sustainable growth.

In conclusion, the isocyanate industry is poised for continued growth, driven by technological innovations, expanding applications, and increasing demand from emerging economies. The industry's future success will depend on its ability to balance economic growth with environmental sustainability and product safety.

The isocyanate industry is characterized by its cyclical nature, closely tied to economic conditions and end-use sector performance. Key players in the market include BASF, Covestro, Wanhua Chemical, and Huntsman Corporation, among others. These companies have been investing heavily in research and development to improve product quality, reduce environmental impact, and expand their market presence.

The primary objectives of the isocyanate industry revolve around meeting growing demand while addressing environmental and safety concerns. Manufacturers are focusing on developing eco-friendly alternatives and improving production efficiency to reduce costs and minimize environmental footprint. Additionally, there is a strong emphasis on enhancing product performance to meet evolving customer requirements across various applications.

One of the major trends shaping the isocyanate industry is the shift towards bio-based and sustainable raw materials. This trend is driven by increasing environmental regulations and consumer preferences for green products. Companies are exploring innovative ways to incorporate renewable feedstocks into isocyanate production, aiming to reduce dependence on fossil-based raw materials.

The industry is also witnessing a geographical shift in production capacities. While traditionally dominated by North America and Europe, Asia-Pacific has emerged as a key region for isocyanate production and consumption. This shift is attributed to rapid industrialization, urbanization, and economic growth in countries like China and India.

Looking ahead, the isocyanate industry faces both opportunities and challenges. The growing demand for lightweight materials in automotive and aerospace industries presents significant growth potential for isocyanate-based products. However, volatility in raw material prices, stringent regulations, and concerns over health and environmental impacts pose challenges that the industry must address to ensure sustainable growth.

In conclusion, the isocyanate industry is poised for continued growth, driven by technological innovations, expanding applications, and increasing demand from emerging economies. The industry's future success will depend on its ability to balance economic growth with environmental sustainability and product safety.

Global Isocyanate Market Demand Analysis

The global isocyanate market has experienced significant growth in recent years, driven by increasing demand across various end-use industries. Isocyanates, primarily used in the production of polyurethanes, find applications in diverse sectors such as construction, automotive, furniture, and electronics. The market demand for isocyanates is closely tied to the performance of these industries and overall economic conditions.

In the construction sector, isocyanates are extensively used in insulation materials, sealants, and adhesives. The growing emphasis on energy-efficient buildings and sustainable construction practices has led to increased adoption of polyurethane-based products, thereby boosting isocyanate demand. The automotive industry represents another major consumer of isocyanates, utilizing them in the production of seat cushions, headrests, and various interior components. As vehicle production continues to rise globally, particularly in emerging markets, the demand for isocyanates in this sector is expected to grow steadily.

The furniture industry has also contributed significantly to the isocyanate market's expansion. The use of flexible polyurethane foams in mattresses, sofas, and other upholstered furniture has become widespread, driving up isocyanate consumption. Additionally, the electronics sector utilizes isocyanates in the manufacturing of protective coatings and encapsulants for electronic components, further diversifying the market demand.

Geographically, Asia-Pacific has emerged as the largest consumer of isocyanates, with China leading the regional demand. The rapid industrialization, urbanization, and growing middle-class population in this region have fueled the demand for isocyanate-based products across various applications. North America and Europe follow as significant markets, driven by established industries and ongoing technological advancements.

The market demand for isocyanates is influenced by several factors, including raw material prices, environmental regulations, and technological innovations. Fluctuations in the prices of key raw materials, such as benzene and toluene, can impact the overall production costs and, consequently, market dynamics. Stringent environmental regulations regarding the use and disposal of isocyanates have led to increased focus on developing eco-friendly alternatives and improving production processes to minimize environmental impact.

Looking ahead, the global isocyanate market is poised for continued growth, albeit at a more moderate pace. Emerging applications in sectors such as medical devices, 3D printing, and renewable energy are expected to create new opportunities for isocyanate producers. However, challenges such as potential health hazards associated with isocyanate exposure and the development of bio-based alternatives may influence market dynamics in the long term.

In the construction sector, isocyanates are extensively used in insulation materials, sealants, and adhesives. The growing emphasis on energy-efficient buildings and sustainable construction practices has led to increased adoption of polyurethane-based products, thereby boosting isocyanate demand. The automotive industry represents another major consumer of isocyanates, utilizing them in the production of seat cushions, headrests, and various interior components. As vehicle production continues to rise globally, particularly in emerging markets, the demand for isocyanates in this sector is expected to grow steadily.

The furniture industry has also contributed significantly to the isocyanate market's expansion. The use of flexible polyurethane foams in mattresses, sofas, and other upholstered furniture has become widespread, driving up isocyanate consumption. Additionally, the electronics sector utilizes isocyanates in the manufacturing of protective coatings and encapsulants for electronic components, further diversifying the market demand.

Geographically, Asia-Pacific has emerged as the largest consumer of isocyanates, with China leading the regional demand. The rapid industrialization, urbanization, and growing middle-class population in this region have fueled the demand for isocyanate-based products across various applications. North America and Europe follow as significant markets, driven by established industries and ongoing technological advancements.

The market demand for isocyanates is influenced by several factors, including raw material prices, environmental regulations, and technological innovations. Fluctuations in the prices of key raw materials, such as benzene and toluene, can impact the overall production costs and, consequently, market dynamics. Stringent environmental regulations regarding the use and disposal of isocyanates have led to increased focus on developing eco-friendly alternatives and improving production processes to minimize environmental impact.

Looking ahead, the global isocyanate market is poised for continued growth, albeit at a more moderate pace. Emerging applications in sectors such as medical devices, 3D printing, and renewable energy are expected to create new opportunities for isocyanate producers. However, challenges such as potential health hazards associated with isocyanate exposure and the development of bio-based alternatives may influence market dynamics in the long term.

Current Challenges in Isocyanate Production

The isocyanate industry currently faces several significant challenges in production processes and market dynamics. One of the primary issues is the volatility of raw material prices, particularly for key feedstocks like toluene and benzene. These fluctuations directly impact production costs and profit margins, making it difficult for manufacturers to maintain stable pricing strategies.

Environmental concerns and regulatory pressures pose another major challenge. Isocyanate production involves the use of hazardous chemicals and generates potentially harmful emissions. Stricter environmental regulations, especially in developed countries, are forcing manufacturers to invest heavily in cleaner technologies and emission control systems. This not only increases production costs but also requires continuous innovation in process engineering.

The energy-intensive nature of isocyanate production is becoming increasingly problematic in the face of rising energy costs and global efforts to reduce carbon footprints. Manufacturers are under pressure to improve energy efficiency and explore alternative energy sources, which often requires significant capital investment and process redesigns.

Supply chain disruptions have emerged as a critical issue, particularly in the wake of global events like the COVID-19 pandemic. The industry's reliance on complex, global supply networks has exposed vulnerabilities, leading to production delays and increased costs. This has highlighted the need for more resilient and diversified supply chains.

Capacity management presents another challenge. The cyclical nature of demand in end-use industries, such as construction and automotive, makes it difficult to balance production capacity with market needs. Overcapacity during downturns can lead to price pressures, while undercapacity during upswings can result in supply shortages and lost market opportunities.

Technical challenges in production processes continue to persist. Improving reaction selectivity, reducing byproduct formation, and enhancing product purity remain ongoing areas of focus. These technical hurdles not only affect product quality but also impact production efficiency and waste management.

The industry also faces challenges in developing safer alternatives to traditional isocyanates, particularly in response to health concerns associated with exposure. This necessitates significant R&D investment in new chemistries and production methods, which can be both costly and time-consuming.

Lastly, the isocyanate industry must contend with increasing competition from alternative materials and technologies. As industries seek more sustainable and environmentally friendly options, isocyanate producers need to innovate and adapt to maintain their market position. This requires a delicate balance between improving existing products and processes and developing new, more sustainable offerings.

Environmental concerns and regulatory pressures pose another major challenge. Isocyanate production involves the use of hazardous chemicals and generates potentially harmful emissions. Stricter environmental regulations, especially in developed countries, are forcing manufacturers to invest heavily in cleaner technologies and emission control systems. This not only increases production costs but also requires continuous innovation in process engineering.

The energy-intensive nature of isocyanate production is becoming increasingly problematic in the face of rising energy costs and global efforts to reduce carbon footprints. Manufacturers are under pressure to improve energy efficiency and explore alternative energy sources, which often requires significant capital investment and process redesigns.

Supply chain disruptions have emerged as a critical issue, particularly in the wake of global events like the COVID-19 pandemic. The industry's reliance on complex, global supply networks has exposed vulnerabilities, leading to production delays and increased costs. This has highlighted the need for more resilient and diversified supply chains.

Capacity management presents another challenge. The cyclical nature of demand in end-use industries, such as construction and automotive, makes it difficult to balance production capacity with market needs. Overcapacity during downturns can lead to price pressures, while undercapacity during upswings can result in supply shortages and lost market opportunities.

Technical challenges in production processes continue to persist. Improving reaction selectivity, reducing byproduct formation, and enhancing product purity remain ongoing areas of focus. These technical hurdles not only affect product quality but also impact production efficiency and waste management.

The industry also faces challenges in developing safer alternatives to traditional isocyanates, particularly in response to health concerns associated with exposure. This necessitates significant R&D investment in new chemistries and production methods, which can be both costly and time-consuming.

Lastly, the isocyanate industry must contend with increasing competition from alternative materials and technologies. As industries seek more sustainable and environmentally friendly options, isocyanate producers need to innovate and adapt to maintain their market position. This requires a delicate balance between improving existing products and processes and developing new, more sustainable offerings.

Existing Isocyanate Production Methods

01 Market analysis and forecasting for isocyanates

Various methods and systems are employed to analyze and forecast the demand and supply of isocyanates in the market. These include data collection, statistical analysis, and predictive modeling techniques to understand market trends, consumer behavior, and industry dynamics.- Market analysis and forecasting for isocyanates: Various methods and systems are employed to analyze and forecast the demand and supply of isocyanates in the market. These include data collection, statistical analysis, and predictive modeling techniques to assess market trends, production capacities, and consumption patterns.

- Production processes and optimization: Innovations in isocyanate production processes focus on improving efficiency, yield, and quality. This includes advancements in reaction conditions, catalysts, and purification methods to meet the growing demand while optimizing resource utilization.

- Supply chain management and logistics: Effective supply chain management and logistics strategies are crucial for balancing isocyanate demand and supply. This involves inventory management, distribution network optimization, and transportation planning to ensure timely delivery and minimize supply disruptions.

- Environmental and safety considerations: As demand for isocyanates grows, there is an increased focus on environmental and safety aspects of production and handling. This includes developing eco-friendly production methods, improving worker safety, and implementing proper storage and transportation protocols.

- Applications and market diversification: The demand for isocyanates is driven by diverse applications across industries. Research and development efforts are focused on exploring new applications and improving existing ones to expand market opportunities and balance supply with evolving demand patterns.

02 Production processes and optimization

Innovations in isocyanate production processes focus on improving efficiency, reducing costs, and increasing yield. This includes advancements in reaction conditions, catalysts, and process control systems to meet the growing demand for isocyanates in various industries.Expand Specific Solutions03 Supply chain management for isocyanates

Effective supply chain management strategies are crucial for balancing isocyanate demand and supply. This involves inventory management, logistics optimization, and demand forecasting to ensure a steady supply of raw materials and finished products across the value chain.Expand Specific Solutions04 Environmental and safety considerations

As the demand for isocyanates grows, there is an increased focus on environmental and safety aspects of production and handling. This includes developing eco-friendly production methods, improving worker safety, and implementing stringent quality control measures to meet regulatory requirements.Expand Specific Solutions05 Applications and market diversification

The expanding applications of isocyanates in various industries drive market growth and diversification. Research and development efforts focus on exploring new uses and improving existing applications to meet evolving market demands and create new opportunities for isocyanate producers.Expand Specific Solutions

Key Isocyanate Manufacturers and Suppliers

The market for isocyanates is in a mature growth phase, characterized by steady demand and established production processes. The global isocyanate market size is substantial, driven by robust applications in polyurethane production across various industries. Technologically, the field is well-developed, with major players like BASF, Covestro, and Wanhua Chemical Group leading in innovation and production capacity. These companies, along with others such as Mitsui Chemicals and Asahi Kasei, are continuously refining their processes to improve efficiency and sustainability. The competitive landscape is intense, with companies focusing on product differentiation and expanding their global footprint to maintain market share in this critical chemical sector.

BASF Corp.

Technical Solution: BASF has developed innovative isocyanate production technologies to meet growing market demand. Their patented gas-phase phosgenation process for TDI production increases efficiency by up to 80% compared to conventional liquid-phase methods[1]. BASF has also invested in expanding MDI capacity, with a new 300,000-metric-ton plant in Chongqing, China[2]. The company focuses on developing more sustainable polyurethane systems, including water-based and low-VOC formulations, to address environmental concerns[3]. BASF's isocyanate portfolio covers a wide range of products for various applications, from flexible foams to coatings and adhesives.

Strengths: Advanced production technology, broad product portfolio, focus on sustainability. Weaknesses: High dependence on petrochemical feedstocks, exposure to raw material price volatility.

Wanhua Chemical Group Co., Ltd.

Technical Solution: Wanhua Chemical is a global leader in isocyanate production, particularly MDI. The company has developed proprietary technology for large-scale, cost-effective MDI manufacturing. Wanhua's integrated production complex in Yantai, China, is one of the world's largest MDI facilities, with an annual capacity of over 1.7 million tons[4]. The company has also invested in overseas expansion, including a 400,000-ton MDI plant in Louisiana, USA[5]. Wanhua focuses on product innovation, developing specialized grades of MDI and TDI for high-performance applications in automotive, construction, and electronics sectors. Their research efforts include bio-based polyols and more environmentally friendly production processes[6].

Strengths: Large-scale production capacity, cost leadership, strong R&D capabilities. Weaknesses: Geographic concentration in China, potential overcapacity risks in the global market.

Innovative Isocyanate Synthesis Techniques

Measurement of total reactive isocyanate groups in samples using bifunctional nucleophiles such as 1,8-diaminonaphthalene (DAN)

PatentInactiveEP1579207A2

Innovation

- A method using 1,8-diaminonaphthalene (DAN) as a bifunctional nucleophilic isocyanate derivatizing agent that reacts with isocyanates to form a cyclic reaction product, allowing for the detection and quantification of total isocyanate groups regardless of the specific species present, using a two-step process of derivatization and cyclization.

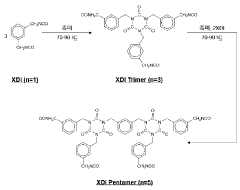

Xylene diisocyanate composition and method for producing isocyanurate

PatentWO2024144331A1

Innovation

- A xylene diisocyanate composition containing chloromethylbenzyl isocyanate in an optimized range (0.1% to 0.3% by weight) is used to enhance storage stability and reaction efficiency, preventing gelation and ensuring excellent film drying, heat resistance, and solvent compatibility, while allowing for the reuse of the xylene diisocyanate composition after reaction.

Environmental Regulations Impact on Isocyanates

Environmental regulations have become increasingly stringent in recent years, significantly impacting the isocyanate industry. These regulations aim to address concerns related to the potential health and environmental risks associated with isocyanate production and use. The most notable regulations include restrictions on volatile organic compound (VOC) emissions, workplace exposure limits, and product safety requirements.

In the United States, the Environmental Protection Agency (EPA) has implemented strict guidelines for isocyanate manufacturers and users under the Clean Air Act and the Toxic Substances Control Act. These regulations mandate the use of advanced emission control technologies and require comprehensive reporting of chemical releases. Similarly, the European Union has enacted REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) legislation, which places additional responsibilities on companies to manage the risks associated with isocyanates.

The impact of these regulations on the isocyanate market has been substantial. Manufacturers have been compelled to invest in cleaner production technologies and develop alternative formulations with lower environmental impact. This has led to increased production costs and, in some cases, reduced profit margins. However, it has also driven innovation in the industry, with companies developing new, more environmentally friendly isocyanate-based products.

One significant trend resulting from these regulations is the shift towards water-based and solvent-free polyurethane systems. These alternatives offer reduced VOC emissions and improved worker safety, aligning with regulatory requirements. Additionally, there has been a growing focus on bio-based isocyanates derived from renewable resources, which can help companies meet sustainability targets and comply with evolving environmental standards.

The regulatory landscape has also influenced market dynamics by creating barriers to entry for new players and potentially leading to industry consolidation. Established companies with the resources to invest in compliance and innovation are better positioned to navigate the complex regulatory environment. This has implications for market competition and could shape the future structure of the isocyanate industry.

Looking ahead, the regulatory pressure on the isocyanate industry is expected to intensify. Emerging concerns about microplastics and the circular economy may lead to new regulations affecting isocyanate-based products' lifecycle management. Companies in the sector must remain vigilant and proactive in adapting to these evolving regulatory challenges to maintain their market position and ensure long-term sustainability.

In the United States, the Environmental Protection Agency (EPA) has implemented strict guidelines for isocyanate manufacturers and users under the Clean Air Act and the Toxic Substances Control Act. These regulations mandate the use of advanced emission control technologies and require comprehensive reporting of chemical releases. Similarly, the European Union has enacted REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) legislation, which places additional responsibilities on companies to manage the risks associated with isocyanates.

The impact of these regulations on the isocyanate market has been substantial. Manufacturers have been compelled to invest in cleaner production technologies and develop alternative formulations with lower environmental impact. This has led to increased production costs and, in some cases, reduced profit margins. However, it has also driven innovation in the industry, with companies developing new, more environmentally friendly isocyanate-based products.

One significant trend resulting from these regulations is the shift towards water-based and solvent-free polyurethane systems. These alternatives offer reduced VOC emissions and improved worker safety, aligning with regulatory requirements. Additionally, there has been a growing focus on bio-based isocyanates derived from renewable resources, which can help companies meet sustainability targets and comply with evolving environmental standards.

The regulatory landscape has also influenced market dynamics by creating barriers to entry for new players and potentially leading to industry consolidation. Established companies with the resources to invest in compliance and innovation are better positioned to navigate the complex regulatory environment. This has implications for market competition and could shape the future structure of the isocyanate industry.

Looking ahead, the regulatory pressure on the isocyanate industry is expected to intensify. Emerging concerns about microplastics and the circular economy may lead to new regulations affecting isocyanate-based products' lifecycle management. Companies in the sector must remain vigilant and proactive in adapting to these evolving regulatory challenges to maintain their market position and ensure long-term sustainability.

Isocyanate Supply Chain Optimization Strategies

Optimizing the isocyanate supply chain is crucial for maintaining a competitive edge in the market and ensuring a stable supply of this essential chemical compound. To achieve this, companies must focus on several key strategies that address the unique challenges of isocyanate production and distribution.

One of the primary optimization strategies is vertical integration. By controlling multiple stages of the supply chain, from raw material sourcing to end-product manufacturing, companies can reduce costs, improve quality control, and enhance overall efficiency. This approach allows for better coordination between different production stages and can help mitigate supply disruptions.

Implementing advanced forecasting and demand planning tools is another critical strategy. By leveraging big data analytics and machine learning algorithms, companies can more accurately predict market demand fluctuations and adjust their production schedules accordingly. This proactive approach helps minimize inventory carrying costs while ensuring sufficient supply to meet customer needs.

Diversification of raw material sources is essential for supply chain resilience. Isocyanate production relies heavily on specific feedstocks, such as toluene and aniline. By establishing relationships with multiple suppliers across different geographical regions, companies can reduce their vulnerability to supply shocks and price volatility.

Investing in sustainable production methods is becoming increasingly important. This includes developing bio-based isocyanates and implementing energy-efficient manufacturing processes. Such initiatives not only reduce environmental impact but also help companies comply with evolving regulations and meet growing consumer demand for eco-friendly products.

Collaborative partnerships and strategic alliances play a crucial role in supply chain optimization. By forming joint ventures or long-term agreements with suppliers, distributors, and even competitors, companies can share resources, reduce risks, and improve overall supply chain efficiency. These partnerships can also facilitate knowledge sharing and innovation in production and logistics processes.

Lastly, embracing digital transformation and Industry 4.0 technologies can significantly enhance supply chain visibility and agility. Internet of Things (IoT) sensors, blockchain for traceability, and artificial intelligence for process optimization are just a few examples of technologies that can revolutionize isocyanate supply chain management. These tools enable real-time monitoring of inventory levels, production status, and logistics, allowing for rapid response to market changes and operational challenges.

One of the primary optimization strategies is vertical integration. By controlling multiple stages of the supply chain, from raw material sourcing to end-product manufacturing, companies can reduce costs, improve quality control, and enhance overall efficiency. This approach allows for better coordination between different production stages and can help mitigate supply disruptions.

Implementing advanced forecasting and demand planning tools is another critical strategy. By leveraging big data analytics and machine learning algorithms, companies can more accurately predict market demand fluctuations and adjust their production schedules accordingly. This proactive approach helps minimize inventory carrying costs while ensuring sufficient supply to meet customer needs.

Diversification of raw material sources is essential for supply chain resilience. Isocyanate production relies heavily on specific feedstocks, such as toluene and aniline. By establishing relationships with multiple suppliers across different geographical regions, companies can reduce their vulnerability to supply shocks and price volatility.

Investing in sustainable production methods is becoming increasingly important. This includes developing bio-based isocyanates and implementing energy-efficient manufacturing processes. Such initiatives not only reduce environmental impact but also help companies comply with evolving regulations and meet growing consumer demand for eco-friendly products.

Collaborative partnerships and strategic alliances play a crucial role in supply chain optimization. By forming joint ventures or long-term agreements with suppliers, distributors, and even competitors, companies can share resources, reduce risks, and improve overall supply chain efficiency. These partnerships can also facilitate knowledge sharing and innovation in production and logistics processes.

Lastly, embracing digital transformation and Industry 4.0 technologies can significantly enhance supply chain visibility and agility. Internet of Things (IoT) sensors, blockchain for traceability, and artificial intelligence for process optimization are just a few examples of technologies that can revolutionize isocyanate supply chain management. These tools enable real-time monitoring of inventory levels, production status, and logistics, allowing for rapid response to market changes and operational challenges.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!