PLA in Consumer Packaging: Market Trends and Projections

JUN 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PLA Packaging Evolution

The evolution of PLA (Polylactic Acid) packaging in the consumer market has been marked by significant technological advancements and shifting consumer preferences. Initially introduced as a biodegradable alternative to traditional plastics, PLA has undergone substantial improvements in its material properties and production processes over the past two decades.

In the early 2000s, PLA packaging was primarily limited to simple applications such as disposable cutlery and food containers. The material's brittleness and low heat resistance restricted its widespread adoption. However, by the mid-2000s, researchers and manufacturers had made substantial progress in enhancing PLA's mechanical properties through various techniques, including blending with other biopolymers and incorporating nanofillers.

The late 2000s and early 2010s saw a surge in PLA packaging applications, driven by increasing environmental awareness and stricter regulations on single-use plastics. During this period, PLA began to penetrate markets previously dominated by conventional plastics, such as beverage bottles, fresh produce packaging, and dairy product containers.

A significant milestone in PLA packaging evolution occurred in the mid-2010s with the development of heat-resistant PLA grades. This breakthrough expanded PLA's potential applications to include hot-fill packaging and microwaveable containers, further solidifying its position in the food packaging sector.

Recent years have witnessed advancements in PLA barrier properties, addressing one of the material's key limitations. Innovations in coating technologies and multi-layer structures have improved PLA's ability to preserve food quality and extend shelf life, making it increasingly competitive with traditional packaging materials.

The evolution of PLA packaging has also been characterized by improvements in its end-of-life management. Initially, the lack of proper composting infrastructure posed challenges to PLA's environmental benefits. However, the development of more efficient composting technologies and the establishment of industrial composting facilities have enhanced PLA's circularity potential.

Looking ahead, the PLA packaging landscape is poised for further innovation. Current research focuses on enhancing PLA's recyclability, developing bio-based additives to improve performance, and exploring novel production methods to reduce costs. These ongoing efforts are expected to drive the next phase of PLA packaging evolution, potentially leading to its broader adoption across various consumer goods sectors.

In the early 2000s, PLA packaging was primarily limited to simple applications such as disposable cutlery and food containers. The material's brittleness and low heat resistance restricted its widespread adoption. However, by the mid-2000s, researchers and manufacturers had made substantial progress in enhancing PLA's mechanical properties through various techniques, including blending with other biopolymers and incorporating nanofillers.

The late 2000s and early 2010s saw a surge in PLA packaging applications, driven by increasing environmental awareness and stricter regulations on single-use plastics. During this period, PLA began to penetrate markets previously dominated by conventional plastics, such as beverage bottles, fresh produce packaging, and dairy product containers.

A significant milestone in PLA packaging evolution occurred in the mid-2010s with the development of heat-resistant PLA grades. This breakthrough expanded PLA's potential applications to include hot-fill packaging and microwaveable containers, further solidifying its position in the food packaging sector.

Recent years have witnessed advancements in PLA barrier properties, addressing one of the material's key limitations. Innovations in coating technologies and multi-layer structures have improved PLA's ability to preserve food quality and extend shelf life, making it increasingly competitive with traditional packaging materials.

The evolution of PLA packaging has also been characterized by improvements in its end-of-life management. Initially, the lack of proper composting infrastructure posed challenges to PLA's environmental benefits. However, the development of more efficient composting technologies and the establishment of industrial composting facilities have enhanced PLA's circularity potential.

Looking ahead, the PLA packaging landscape is poised for further innovation. Current research focuses on enhancing PLA's recyclability, developing bio-based additives to improve performance, and exploring novel production methods to reduce costs. These ongoing efforts are expected to drive the next phase of PLA packaging evolution, potentially leading to its broader adoption across various consumer goods sectors.

Consumer Demand Analysis

The demand for PLA (Polylactic Acid) in consumer packaging has been steadily increasing in recent years, driven by growing environmental awareness and the shift towards sustainable alternatives to traditional plastics. Consumers are increasingly seeking eco-friendly packaging solutions, and PLA, being biodegradable and derived from renewable resources, has emerged as a promising option.

Market research indicates that the global PLA market for packaging applications is experiencing significant growth. This trend is particularly pronounced in developed regions such as North America and Europe, where stringent regulations on single-use plastics and heightened consumer consciousness are driving adoption. Emerging economies in Asia-Pacific are also showing increased interest in PLA packaging, albeit at a slower pace.

The food and beverage industry represents the largest segment for PLA packaging demand. Consumers are actively seeking sustainable options for disposable food containers, beverage bottles, and food service ware. The cosmetics and personal care sector is another key area of growth, with brands responding to consumer preferences for environmentally friendly packaging solutions.

Retail chains and e-commerce platforms are also contributing to the rising demand for PLA packaging. Many retailers are setting sustainability targets and actively promoting products with eco-friendly packaging, which in turn influences consumer choices and increases awareness of PLA-based alternatives.

Consumer surveys reveal that a significant portion of shoppers are willing to pay a premium for products packaged in sustainable materials like PLA. This willingness is particularly strong among younger demographics and urban consumers, who tend to be more environmentally conscious and value-driven in their purchasing decisions.

However, challenges remain in terms of consumer education and perception. While awareness of PLA as a sustainable packaging material is growing, many consumers still lack a clear understanding of its benefits and proper disposal methods. This highlights the need for improved labeling, consumer education campaigns, and infrastructure development for composting and recycling PLA products.

The COVID-19 pandemic has had a mixed impact on PLA packaging demand. On one hand, it has accelerated the trend towards takeaway and delivery services, potentially increasing the use of disposable packaging. On the other hand, it has also heightened consumer awareness of health and hygiene issues, which could favor the adoption of biodegradable materials like PLA.

Looking ahead, projections suggest continued growth in consumer demand for PLA packaging. Factors such as increasing environmental regulations, corporate sustainability commitments, and evolving consumer preferences are expected to drive this trend. However, the rate of adoption may vary across different regions and product categories, influenced by factors such as local regulations, availability of composting infrastructure, and price competitiveness compared to traditional plastics.

Market research indicates that the global PLA market for packaging applications is experiencing significant growth. This trend is particularly pronounced in developed regions such as North America and Europe, where stringent regulations on single-use plastics and heightened consumer consciousness are driving adoption. Emerging economies in Asia-Pacific are also showing increased interest in PLA packaging, albeit at a slower pace.

The food and beverage industry represents the largest segment for PLA packaging demand. Consumers are actively seeking sustainable options for disposable food containers, beverage bottles, and food service ware. The cosmetics and personal care sector is another key area of growth, with brands responding to consumer preferences for environmentally friendly packaging solutions.

Retail chains and e-commerce platforms are also contributing to the rising demand for PLA packaging. Many retailers are setting sustainability targets and actively promoting products with eco-friendly packaging, which in turn influences consumer choices and increases awareness of PLA-based alternatives.

Consumer surveys reveal that a significant portion of shoppers are willing to pay a premium for products packaged in sustainable materials like PLA. This willingness is particularly strong among younger demographics and urban consumers, who tend to be more environmentally conscious and value-driven in their purchasing decisions.

However, challenges remain in terms of consumer education and perception. While awareness of PLA as a sustainable packaging material is growing, many consumers still lack a clear understanding of its benefits and proper disposal methods. This highlights the need for improved labeling, consumer education campaigns, and infrastructure development for composting and recycling PLA products.

The COVID-19 pandemic has had a mixed impact on PLA packaging demand. On one hand, it has accelerated the trend towards takeaway and delivery services, potentially increasing the use of disposable packaging. On the other hand, it has also heightened consumer awareness of health and hygiene issues, which could favor the adoption of biodegradable materials like PLA.

Looking ahead, projections suggest continued growth in consumer demand for PLA packaging. Factors such as increasing environmental regulations, corporate sustainability commitments, and evolving consumer preferences are expected to drive this trend. However, the rate of adoption may vary across different regions and product categories, influenced by factors such as local regulations, availability of composting infrastructure, and price competitiveness compared to traditional plastics.

PLA Technical Challenges

Despite the growing popularity of PLA in consumer packaging, several technical challenges persist that hinder its widespread adoption. One of the primary issues is the material's inherent brittleness, which limits its application in certain packaging formats. This characteristic can lead to cracking or breaking during transportation and handling, potentially compromising the integrity of the packaged products.

Another significant challenge is PLA's relatively low heat resistance compared to conventional plastics. This limitation restricts its use in hot-fill applications or for packaging products that require heat sterilization. The material's glass transition temperature, typically around 60°C, means it can deform or lose its shape when exposed to higher temperatures, making it unsuitable for certain food and beverage packaging applications.

Moisture sensitivity is also a concern for PLA-based packaging. The material tends to absorb moisture from the environment, which can lead to hydrolysis and degradation of its mechanical properties over time. This characteristic necessitates careful consideration of storage conditions and shelf life for PLA-packaged products, particularly in high-humidity environments.

The barrier properties of PLA present another technical hurdle. Compared to traditional petroleum-based plastics, PLA exhibits higher permeability to gases such as oxygen and carbon dioxide. This can result in reduced shelf life for certain products, especially those sensitive to oxidation or requiring specific atmospheric conditions for preservation.

Processing challenges also exist in the manufacturing of PLA packaging. The material's narrow processing window and sensitivity to thermal degradation during extrusion or injection molding can lead to inconsistencies in product quality and increased production costs. Additionally, achieving optimal crystallinity in PLA products to enhance their mechanical and barrier properties requires precise control of processing conditions.

Compatibility with existing recycling infrastructure poses a further challenge. While PLA is biodegradable under specific conditions, it can contaminate conventional plastic recycling streams if not properly sorted. The lack of widespread industrial composting facilities also limits the practical end-of-life options for PLA packaging in many regions.

Addressing these technical challenges requires ongoing research and development efforts. Innovations in PLA formulations, such as the incorporation of additives or blending with other biopolymers, are being explored to enhance its performance characteristics. Advances in processing technologies and the development of specialized equipment for PLA manufacturing are also crucial for overcoming these limitations and expanding the material's applicability in consumer packaging.

Another significant challenge is PLA's relatively low heat resistance compared to conventional plastics. This limitation restricts its use in hot-fill applications or for packaging products that require heat sterilization. The material's glass transition temperature, typically around 60°C, means it can deform or lose its shape when exposed to higher temperatures, making it unsuitable for certain food and beverage packaging applications.

Moisture sensitivity is also a concern for PLA-based packaging. The material tends to absorb moisture from the environment, which can lead to hydrolysis and degradation of its mechanical properties over time. This characteristic necessitates careful consideration of storage conditions and shelf life for PLA-packaged products, particularly in high-humidity environments.

The barrier properties of PLA present another technical hurdle. Compared to traditional petroleum-based plastics, PLA exhibits higher permeability to gases such as oxygen and carbon dioxide. This can result in reduced shelf life for certain products, especially those sensitive to oxidation or requiring specific atmospheric conditions for preservation.

Processing challenges also exist in the manufacturing of PLA packaging. The material's narrow processing window and sensitivity to thermal degradation during extrusion or injection molding can lead to inconsistencies in product quality and increased production costs. Additionally, achieving optimal crystallinity in PLA products to enhance their mechanical and barrier properties requires precise control of processing conditions.

Compatibility with existing recycling infrastructure poses a further challenge. While PLA is biodegradable under specific conditions, it can contaminate conventional plastic recycling streams if not properly sorted. The lack of widespread industrial composting facilities also limits the practical end-of-life options for PLA packaging in many regions.

Addressing these technical challenges requires ongoing research and development efforts. Innovations in PLA formulations, such as the incorporation of additives or blending with other biopolymers, are being explored to enhance its performance characteristics. Advances in processing technologies and the development of specialized equipment for PLA manufacturing are also crucial for overcoming these limitations and expanding the material's applicability in consumer packaging.

Current PLA Solutions

01 Biodegradable packaging applications

PLA is increasingly used in biodegradable packaging solutions, addressing environmental concerns and meeting consumer demand for sustainable products. This trend is driving growth in the food packaging, disposable cutlery, and single-use container markets.- Biodegradable packaging applications: PLA is increasingly used in biodegradable packaging solutions, addressing environmental concerns and meeting consumer demand for sustainable products. This trend is driving growth in the food packaging, disposable cutlery, and retail packaging sectors.

- Medical and pharmaceutical applications: The biocompatibility and biodegradability of PLA make it ideal for medical applications such as implants, drug delivery systems, and tissue engineering scaffolds. This sector is experiencing significant growth and innovation.

- Textile and fiber industry adoption: PLA is gaining traction in the textile industry for producing eco-friendly fabrics and fibers. This trend is driven by the increasing demand for sustainable fashion and the need to reduce microplastic pollution from synthetic fibers.

- 3D printing and additive manufacturing: PLA is a popular material in the rapidly growing 3D printing industry due to its ease of use, low warping, and biodegradability. This trend is expected to continue as additive manufacturing becomes more widespread across various sectors.

- Technological advancements in PLA production: Ongoing research and development are focused on improving PLA production methods, enhancing its properties, and reducing costs. These advancements aim to make PLA more competitive with traditional petroleum-based plastics and expand its applications.

02 Medical and pharmaceutical applications

The biocompatibility and biodegradability of PLA make it an attractive material for medical and pharmaceutical applications. This includes drug delivery systems, implants, and tissue engineering scaffolds, contributing to market growth in the healthcare sector.Expand Specific Solutions03 Textile and fiber industry adoption

PLA is gaining traction in the textile and fiber industry as a sustainable alternative to traditional synthetic fibers. This trend is driven by the growing demand for eco-friendly fabrics in clothing, upholstery, and industrial textiles.Expand Specific Solutions04 Technological advancements in PLA production

Ongoing research and development efforts are focused on improving PLA production processes, enhancing material properties, and reducing costs. These advancements are expected to expand PLA's applications and market share across various industries.Expand Specific Solutions05 3D printing and additive manufacturing applications

PLA is widely used in 3D printing and additive manufacturing due to its ease of use, low warping, and biodegradability. This trend is driving growth in prototyping, custom manufacturing, and educational markets.Expand Specific Solutions

Key PLA Market Players

The PLA consumer packaging market is in a growth phase, driven by increasing environmental concerns and regulatory pressures. The market size is expanding rapidly, with projections indicating significant growth in the coming years. Technologically, PLA packaging is maturing, with companies like Total Research Corp, Stora Enso Oyj, and 3M Innovative Properties Co. leading innovation. Sulapac Oy and Lam'On Ltd. are emerging players, focusing on sustainable solutions. Established firms such as DuPont de Nemours, Inc. and Arkema France SA are leveraging their expertise to develop advanced PLA formulations. Universities and research institutions, including Nanjing Tech University and the University of Milano-Bicocca, are contributing to technological advancements, indicating a collaborative ecosystem driving the sector forward.

Sulapac Oy

Technical Solution: Sulapac Oy has developed a biodegradable and microplastic-free material made from wood and natural binders. Their PLA-based solution for consumer packaging combines wood chips with biodegradable polymers to create a material that looks like plastic but decomposes without leaving permanent microplastics. The company's technology allows for the production of rigid packaging items such as jars, bottles, and caps that are suitable for cosmetics, food, and other consumer goods.

Strengths: Fully biodegradable, microplastic-free, aesthetically pleasing wood-like appearance. Weaknesses: Higher production costs compared to traditional plastics, limited heat resistance.

Stora Enso Oyj

Technical Solution: Stora Enso has developed a range of bio-based packaging solutions, including those incorporating PLA. Their approach focuses on replacing fossil-based materials with renewable alternatives. They have created a portfolio of materials that combine PLA with wood fibers to produce packaging solutions that are both biodegradable and derived from renewable resources. These materials are used in various applications, including food packaging, beverage containers, and personal care product packaging.

Strengths: Strong integration of wood-based materials with PLA, extensive experience in sustainable packaging. Weaknesses: Dependency on forestry resources, potential challenges in scaling up production.

PLA Patent Landscape

Process for cellular biosynthesis of poly d-lactic acid and poly l-lactic acid

PatentActiveUS20210324429A1

Innovation

- Engineering eukaryotic cells, such as yeast strains, to redirect metabolic pathways for the direct biological synthesis of PLLA and PDLA from carbon sources like glucose, using enzymes like D-lactate dehydrogenase, propionyl-CoA transferase, and polyhydroxyalkanoate synthase to convert pyruvate into lactyl-CoA and subsequently polymerize it into the desired polymers.

Polymer alcoholysis

PatentInactiveUS20180051156A1

Innovation

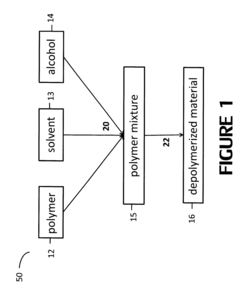

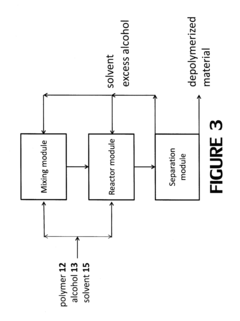

- A method involving contacting PLA with a solvent and an alcohol at a temperature below the boiling point of the polymeric mixture to achieve partial or complete degradation, reducing molecular weight and facilitating the production of oligomers and monomers, which can be reused as plasticizers or feedstock.

Sustainability Impacts

The sustainability impacts of PLA (Polylactic Acid) in consumer packaging are significant and multifaceted. As a biodegradable and compostable material derived from renewable resources, PLA offers several environmental advantages over traditional petroleum-based plastics.

One of the primary benefits of PLA is its reduced carbon footprint. The production of PLA typically generates fewer greenhouse gas emissions compared to conventional plastics, as it relies on plant-based feedstocks that absorb carbon dioxide during growth. This contributes to a lower overall environmental impact throughout the product lifecycle.

PLA's biodegradability is another crucial sustainability factor. Under proper composting conditions, PLA can break down into natural components within a few months, significantly reducing the accumulation of plastic waste in landfills and oceans. This characteristic aligns with the growing global emphasis on circular economy principles and waste reduction strategies.

The renewable nature of PLA's raw materials, such as corn starch or sugarcane, promotes sustainable resource management. Unlike fossil fuel-based plastics, PLA production does not deplete finite resources, making it a more sustainable long-term option for packaging applications.

However, the sustainability impacts of PLA are not without challenges. The agricultural practices used to grow feedstock crops can have environmental implications, including water usage, pesticide application, and land use changes. Balancing food production with bioplastic feedstock cultivation is an ongoing concern that requires careful management and policy considerations.

The end-of-life management of PLA also presents both opportunities and challenges. While PLA is compostable, it requires specific industrial composting facilities to break down effectively. The lack of widespread infrastructure for proper PLA disposal in many regions can limit its potential environmental benefits.

Energy consumption during PLA production is another factor to consider. While generally lower than that of conventional plastics, the energy requirements for PLA manufacturing can still be significant. Ongoing research and technological advancements aim to improve energy efficiency in PLA production processes.

As the market for PLA in consumer packaging grows, its sustainability impacts are likely to evolve. Improved production techniques, more efficient recycling systems, and increased consumer awareness about proper disposal methods could enhance PLA's positive environmental contributions. However, continued assessment and mitigation of potential negative impacts will be crucial to ensure that PLA truly delivers on its promise of sustainable packaging solutions.

One of the primary benefits of PLA is its reduced carbon footprint. The production of PLA typically generates fewer greenhouse gas emissions compared to conventional plastics, as it relies on plant-based feedstocks that absorb carbon dioxide during growth. This contributes to a lower overall environmental impact throughout the product lifecycle.

PLA's biodegradability is another crucial sustainability factor. Under proper composting conditions, PLA can break down into natural components within a few months, significantly reducing the accumulation of plastic waste in landfills and oceans. This characteristic aligns with the growing global emphasis on circular economy principles and waste reduction strategies.

The renewable nature of PLA's raw materials, such as corn starch or sugarcane, promotes sustainable resource management. Unlike fossil fuel-based plastics, PLA production does not deplete finite resources, making it a more sustainable long-term option for packaging applications.

However, the sustainability impacts of PLA are not without challenges. The agricultural practices used to grow feedstock crops can have environmental implications, including water usage, pesticide application, and land use changes. Balancing food production with bioplastic feedstock cultivation is an ongoing concern that requires careful management and policy considerations.

The end-of-life management of PLA also presents both opportunities and challenges. While PLA is compostable, it requires specific industrial composting facilities to break down effectively. The lack of widespread infrastructure for proper PLA disposal in many regions can limit its potential environmental benefits.

Energy consumption during PLA production is another factor to consider. While generally lower than that of conventional plastics, the energy requirements for PLA manufacturing can still be significant. Ongoing research and technological advancements aim to improve energy efficiency in PLA production processes.

As the market for PLA in consumer packaging grows, its sustainability impacts are likely to evolve. Improved production techniques, more efficient recycling systems, and increased consumer awareness about proper disposal methods could enhance PLA's positive environmental contributions. However, continued assessment and mitigation of potential negative impacts will be crucial to ensure that PLA truly delivers on its promise of sustainable packaging solutions.

Regulatory Framework

The regulatory framework surrounding PLA (Polylactic Acid) in consumer packaging is evolving rapidly as governments and international bodies recognize the need for sustainable alternatives to traditional plastics. In the United States, the Food and Drug Administration (FDA) has approved PLA for food contact applications, providing a significant boost to its use in packaging. The European Union, through its Packaging and Packaging Waste Directive, has set targets for recyclable and compostable packaging, indirectly promoting the adoption of PLA-based solutions.

Many countries have implemented or are considering regulations that favor biodegradable materials like PLA. For instance, France has banned single-use plastic packaging for many fruits and vegetables, creating opportunities for PLA alternatives. Similarly, Italy has mandated the use of compostable bags for fruit and vegetable packaging in supermarkets, further driving PLA adoption.

The regulatory landscape also includes standards and certifications for compostable materials. The ASTM D6400 in the United States and EN 13432 in Europe provide guidelines for the biodegradability and compostability of plastics, including PLA. These standards ensure that PLA products meet specific environmental criteria, enhancing consumer confidence and market acceptance.

However, the regulatory framework is not without challenges. The lack of harmonized global standards for biodegradable plastics can create confusion and hinder international trade. Additionally, some regions face issues with proper disposal and composting infrastructure, which can impact the effectiveness of PLA as a sustainable solution.

Emerging regulations are focusing on the entire lifecycle of packaging materials. Extended Producer Responsibility (EPR) schemes, being adopted in various countries, place the onus on manufacturers to manage the end-of-life of their products, including PLA packaging. This shift is likely to drive innovation in PLA formulations and recycling technologies.

The regulatory landscape is also influenced by broader environmental policies. Carbon pricing mechanisms and plastic taxes in some jurisdictions indirectly benefit PLA by making traditional plastics less economically attractive. As climate change concerns intensify, regulations supporting low-carbon materials like PLA are expected to become more prevalent.

Looking ahead, the regulatory framework for PLA in consumer packaging is likely to become more stringent and comprehensive. Policymakers are increasingly focusing on circular economy principles, which may lead to more specific regulations on the recyclability and compostability of PLA products. This evolving regulatory environment will play a crucial role in shaping the future market trends and projections for PLA in consumer packaging.

Many countries have implemented or are considering regulations that favor biodegradable materials like PLA. For instance, France has banned single-use plastic packaging for many fruits and vegetables, creating opportunities for PLA alternatives. Similarly, Italy has mandated the use of compostable bags for fruit and vegetable packaging in supermarkets, further driving PLA adoption.

The regulatory landscape also includes standards and certifications for compostable materials. The ASTM D6400 in the United States and EN 13432 in Europe provide guidelines for the biodegradability and compostability of plastics, including PLA. These standards ensure that PLA products meet specific environmental criteria, enhancing consumer confidence and market acceptance.

However, the regulatory framework is not without challenges. The lack of harmonized global standards for biodegradable plastics can create confusion and hinder international trade. Additionally, some regions face issues with proper disposal and composting infrastructure, which can impact the effectiveness of PLA as a sustainable solution.

Emerging regulations are focusing on the entire lifecycle of packaging materials. Extended Producer Responsibility (EPR) schemes, being adopted in various countries, place the onus on manufacturers to manage the end-of-life of their products, including PLA packaging. This shift is likely to drive innovation in PLA formulations and recycling technologies.

The regulatory landscape is also influenced by broader environmental policies. Carbon pricing mechanisms and plastic taxes in some jurisdictions indirectly benefit PLA by making traditional plastics less economically attractive. As climate change concerns intensify, regulations supporting low-carbon materials like PLA are expected to become more prevalent.

Looking ahead, the regulatory framework for PLA in consumer packaging is likely to become more stringent and comprehensive. Policymakers are increasingly focusing on circular economy principles, which may lead to more specific regulations on the recyclability and compostability of PLA products. This evolving regulatory environment will play a crucial role in shaping the future market trends and projections for PLA in consumer packaging.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!