Future of Cellophane in Sustainable Packaging

JUL 9, 20258 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Cellophane Evolution

Cellophane, a transparent film made from regenerated cellulose, has undergone significant evolution since its invention in the early 20th century. Initially developed as a waterproof coating for tablecloths, cellophane quickly found its way into the packaging industry due to its unique properties.

The 1920s and 1930s saw the rapid adoption of cellophane in food packaging, revolutionizing the way products were displayed and preserved. This period marked the beginning of cellophane's golden age, with continuous improvements in its production process and the development of moisture-proof coatings.

By the mid-20th century, cellophane had become a ubiquitous packaging material, used for everything from cigarettes to candy wrappers. Its popularity was driven by its transparency, flexibility, and ability to protect products from moisture and air.

However, the rise of petroleum-based plastics in the 1960s and 1970s began to challenge cellophane's dominance. These new materials offered similar properties at a lower cost, leading to a decline in cellophane usage across many industries.

The late 20th and early 21st centuries brought renewed interest in cellophane as environmental concerns grew. Its biodegradability and renewable source material (wood pulp) positioned it as a potential alternative to traditional plastics in the quest for more sustainable packaging solutions.

Recent years have seen significant advancements in cellophane technology. Researchers have focused on improving its barrier properties, enhancing its heat resistance, and developing new production methods that reduce environmental impact. These efforts have led to the creation of high-performance cellophane variants that can compete with synthetic plastics in terms of functionality.

The evolution of cellophane has also been marked by efforts to address its limitations. Innovations in moisture resistance, heat sealability, and printability have expanded its applications in modern packaging. Additionally, the development of compostable and marine biodegradable cellophane variants has further aligned the material with sustainability goals.

As the packaging industry continues to seek eco-friendly alternatives, cellophane is experiencing a renaissance. Its evolution from a simple transparent film to a versatile, sustainable packaging material reflects the changing priorities of consumers and businesses alike. The future of cellophane in sustainable packaging lies in its continued adaptation to meet the complex demands of modern packaging while maintaining its core environmental benefits.

The 1920s and 1930s saw the rapid adoption of cellophane in food packaging, revolutionizing the way products were displayed and preserved. This period marked the beginning of cellophane's golden age, with continuous improvements in its production process and the development of moisture-proof coatings.

By the mid-20th century, cellophane had become a ubiquitous packaging material, used for everything from cigarettes to candy wrappers. Its popularity was driven by its transparency, flexibility, and ability to protect products from moisture and air.

However, the rise of petroleum-based plastics in the 1960s and 1970s began to challenge cellophane's dominance. These new materials offered similar properties at a lower cost, leading to a decline in cellophane usage across many industries.

The late 20th and early 21st centuries brought renewed interest in cellophane as environmental concerns grew. Its biodegradability and renewable source material (wood pulp) positioned it as a potential alternative to traditional plastics in the quest for more sustainable packaging solutions.

Recent years have seen significant advancements in cellophane technology. Researchers have focused on improving its barrier properties, enhancing its heat resistance, and developing new production methods that reduce environmental impact. These efforts have led to the creation of high-performance cellophane variants that can compete with synthetic plastics in terms of functionality.

The evolution of cellophane has also been marked by efforts to address its limitations. Innovations in moisture resistance, heat sealability, and printability have expanded its applications in modern packaging. Additionally, the development of compostable and marine biodegradable cellophane variants has further aligned the material with sustainability goals.

As the packaging industry continues to seek eco-friendly alternatives, cellophane is experiencing a renaissance. Its evolution from a simple transparent film to a versatile, sustainable packaging material reflects the changing priorities of consumers and businesses alike. The future of cellophane in sustainable packaging lies in its continued adaptation to meet the complex demands of modern packaging while maintaining its core environmental benefits.

Eco-Packaging Demand

The demand for eco-friendly packaging solutions has surged in recent years, driven by increasing environmental awareness and regulatory pressures. Cellophane, a biodegradable material derived from renewable resources, is experiencing a resurgence in the sustainable packaging market. This renewed interest is fueled by consumer preferences for environmentally responsible products and corporate commitments to reduce plastic waste.

Market research indicates a significant shift towards sustainable packaging options. The global green packaging market is projected to grow at a compound annual growth rate (CAGR) of 6% from 2021 to 2026. This growth is particularly pronounced in the food and beverage sector, where cellophane's properties align well with industry requirements for product protection and shelf life extension.

Consumer surveys reveal that a majority of shoppers are willing to pay a premium for eco-friendly packaging. This trend is especially strong among younger demographics, with millennials and Gen Z consumers showing the highest preference for sustainable options. As a result, major retailers and brands are actively seeking alternatives to traditional plastic packaging, creating a favorable market environment for cellophane and other biodegradable materials.

The food industry represents the largest market segment for cellophane packaging, driven by its excellent barrier properties against moisture and gases. The material's transparency and printability also make it attractive for retail packaging applications. Additionally, the personal care and cosmetics industry is increasingly adopting cellophane for packaging, aligning with the growing demand for natural and eco-friendly products.

Regulatory initiatives worldwide are further propelling the demand for sustainable packaging solutions. Many countries have implemented or proposed bans on single-use plastics, creating opportunities for biodegradable alternatives like cellophane. The European Union's Circular Economy Action Plan and similar policies in other regions are expected to accelerate the adoption of eco-friendly packaging materials.

However, challenges remain in scaling up cellophane production to meet the growing demand. The material's higher cost compared to conventional plastics and limitations in certain performance characteristics present obstacles to widespread adoption. Ongoing research and development efforts are focused on improving cellophane's properties and reducing production costs to enhance its competitiveness in the sustainable packaging market.

Market research indicates a significant shift towards sustainable packaging options. The global green packaging market is projected to grow at a compound annual growth rate (CAGR) of 6% from 2021 to 2026. This growth is particularly pronounced in the food and beverage sector, where cellophane's properties align well with industry requirements for product protection and shelf life extension.

Consumer surveys reveal that a majority of shoppers are willing to pay a premium for eco-friendly packaging. This trend is especially strong among younger demographics, with millennials and Gen Z consumers showing the highest preference for sustainable options. As a result, major retailers and brands are actively seeking alternatives to traditional plastic packaging, creating a favorable market environment for cellophane and other biodegradable materials.

The food industry represents the largest market segment for cellophane packaging, driven by its excellent barrier properties against moisture and gases. The material's transparency and printability also make it attractive for retail packaging applications. Additionally, the personal care and cosmetics industry is increasingly adopting cellophane for packaging, aligning with the growing demand for natural and eco-friendly products.

Regulatory initiatives worldwide are further propelling the demand for sustainable packaging solutions. Many countries have implemented or proposed bans on single-use plastics, creating opportunities for biodegradable alternatives like cellophane. The European Union's Circular Economy Action Plan and similar policies in other regions are expected to accelerate the adoption of eco-friendly packaging materials.

However, challenges remain in scaling up cellophane production to meet the growing demand. The material's higher cost compared to conventional plastics and limitations in certain performance characteristics present obstacles to widespread adoption. Ongoing research and development efforts are focused on improving cellophane's properties and reducing production costs to enhance its competitiveness in the sustainable packaging market.

Cellophane Challenges

Despite its long history and widespread use, cellophane faces several significant challenges in the context of sustainable packaging. One of the primary issues is its limited biodegradability. While cellophane is derived from natural cellulose, the manufacturing process often involves chemical treatments that can hinder its decomposition in natural environments. This has led to concerns about its long-term environmental impact, particularly in marine ecosystems where plastic pollution is a growing problem.

Another challenge is the energy-intensive production process of cellophane. The conversion of wood pulp or cotton linters into cellophane requires substantial amounts of energy and chemicals, raising questions about its overall environmental footprint. This energy consumption contributes to greenhouse gas emissions, potentially offsetting some of the material's eco-friendly attributes.

Recyclability presents another hurdle for cellophane. While theoretically recyclable, the infrastructure for collecting and processing cellophane is not as well-established as it is for other packaging materials. Many recycling facilities are not equipped to handle cellophane effectively, leading to a significant portion of the material ending up in landfills or incineration plants.

The moisture sensitivity of cellophane also poses challenges in certain packaging applications. Its tendency to absorb moisture can limit its use in high-humidity environments or for products that require long-term moisture barrier properties. This limitation can lead to increased food waste or the need for additional protective layers, potentially negating some of its sustainability benefits.

Cost considerations further complicate the widespread adoption of cellophane as a sustainable packaging solution. While prices have decreased over time, cellophane remains more expensive than many conventional plastic alternatives. This cost differential can be a significant barrier for companies looking to transition to more sustainable packaging options, especially in price-sensitive markets.

Lastly, there is the challenge of consumer perception and education. Despite its natural origins, cellophane is often mistaken for plastic by consumers. This misconception can lead to improper disposal and hinder efforts to promote cellophane as an eco-friendly alternative. Overcoming this knowledge gap requires significant investment in consumer education and clear labeling practices.

Another challenge is the energy-intensive production process of cellophane. The conversion of wood pulp or cotton linters into cellophane requires substantial amounts of energy and chemicals, raising questions about its overall environmental footprint. This energy consumption contributes to greenhouse gas emissions, potentially offsetting some of the material's eco-friendly attributes.

Recyclability presents another hurdle for cellophane. While theoretically recyclable, the infrastructure for collecting and processing cellophane is not as well-established as it is for other packaging materials. Many recycling facilities are not equipped to handle cellophane effectively, leading to a significant portion of the material ending up in landfills or incineration plants.

The moisture sensitivity of cellophane also poses challenges in certain packaging applications. Its tendency to absorb moisture can limit its use in high-humidity environments or for products that require long-term moisture barrier properties. This limitation can lead to increased food waste or the need for additional protective layers, potentially negating some of its sustainability benefits.

Cost considerations further complicate the widespread adoption of cellophane as a sustainable packaging solution. While prices have decreased over time, cellophane remains more expensive than many conventional plastic alternatives. This cost differential can be a significant barrier for companies looking to transition to more sustainable packaging options, especially in price-sensitive markets.

Lastly, there is the challenge of consumer perception and education. Despite its natural origins, cellophane is often mistaken for plastic by consumers. This misconception can lead to improper disposal and hinder efforts to promote cellophane as an eco-friendly alternative. Overcoming this knowledge gap requires significant investment in consumer education and clear labeling practices.

Current Green Solutions

01 Cellophane in packaging applications

Cellophane is widely used in packaging applications due to its transparency, flexibility, and barrier properties. It is particularly useful for food packaging, where it can help preserve freshness and extend shelf life. Cellophane can be used alone or in combination with other materials to create various packaging solutions.- Cellophane production and modification: Various methods and processes for producing and modifying cellophane are described. These include techniques for improving the properties of cellophane, such as its strength, flexibility, and barrier characteristics. The modifications may involve chemical treatments or the incorporation of additives to enhance the material's performance for specific applications.

- Packaging applications of cellophane: Cellophane is widely used in packaging applications due to its transparency, flexibility, and barrier properties. The patents describe various packaging solutions utilizing cellophane, including food packaging, consumer product packaging, and industrial packaging. Some innovations focus on improving the sealing properties and extending the shelf life of packaged products.

- Biodegradable and eco-friendly cellophane: Developments in biodegradable and environmentally friendly cellophane materials are presented. These innovations aim to address sustainability concerns by creating cellophane-like materials that can decompose naturally or be recycled more easily. Some approaches involve modifying the cellulose structure or incorporating biodegradable additives.

- Cellophane-based composite materials: The creation of composite materials incorporating cellophane is described in several patents. These composites may combine cellophane with other materials to achieve specific properties or functionalities. Applications include reinforced materials, multi-layer films, and specialized coatings for various industries.

- Cellophane in medical and pharmaceutical applications: The use of cellophane in medical and pharmaceutical applications is explored in some patents. These innovations may involve using cellophane as a component in drug delivery systems, medical packaging, or as a material for medical devices. The biocompatibility and barrier properties of cellophane make it suitable for certain medical applications.

02 Production and modification of cellophane

Various methods and processes are employed to produce and modify cellophane to enhance its properties. These may include chemical treatments, surface modifications, or the incorporation of additives to improve characteristics such as strength, flexibility, or barrier properties. Innovations in production techniques aim to optimize cellophane performance for specific applications.Expand Specific Solutions03 Cellophane in composite materials

Cellophane is used as a component in composite materials, often combined with other polymers or materials to create products with enhanced properties. These composites may offer improved strength, durability, or functionality compared to cellophane alone, expanding its potential applications in various industries.Expand Specific Solutions04 Biodegradable and eco-friendly cellophane alternatives

Research and development efforts are focused on creating biodegradable and eco-friendly alternatives to traditional cellophane. These innovations aim to address environmental concerns while maintaining the desirable properties of cellophane. New materials and production methods are being explored to reduce the environmental impact of packaging materials.Expand Specific Solutions05 Cellophane in specialized applications

Cellophane finds use in various specialized applications beyond traditional packaging. These may include medical and pharmaceutical uses, electronic components, or artistic and decorative purposes. The unique properties of cellophane make it suitable for diverse applications across different industries.Expand Specific Solutions

Key Industry Players

The future of cellophane in sustainable packaging is evolving within a competitive landscape characterized by increasing market maturity and growing demand for eco-friendly solutions. The industry is transitioning from early adoption to mainstream acceptance, driven by consumer awareness and regulatory pressures. Market size is expanding as more companies seek sustainable alternatives, with projections indicating significant growth potential. Technologically, cellophane is advancing rapidly, with companies like Toyobo, Mitsubishi Polyester Film, and UPM-Kymmene leading innovations in biodegradability, barrier properties, and production efficiency. These advancements are positioning cellophane as a viable competitor to traditional plastics in various packaging applications.

Toyobo Co., Ltd.

Technical Solution: Toyobo has made significant advancements in sustainable packaging materials that could replace traditional cellophane. Their BIOPRANA® film is a plant-based, biodegradable material with excellent gas barrier properties, making it suitable for food packaging applications[13]. Toyobo has also developed VYLOAMIDE®, a bio-based nylon with high heat resistance and low moisture absorption, which can be used in flexible packaging[14]. The company's focus on circular economy principles is evident in their research into recyclable barrier films and coatings that maintain the functionality of cellophane while improving environmental performance[15].

Strengths: Strong R&D in bio-based materials, established presence in the packaging industry, and diverse product portfolio. Weaknesses: Potential higher costs for bio-based alternatives and challenges in matching all performance characteristics of traditional cellophane.

Stora Enso Oyj

Technical Solution: Stora Enso has developed innovative cellulose-based materials as alternatives to cellophane. Their MicroFibrillar Cellulose (MFC) technology creates ultra-thin, strong, and transparent films from wood fibers[4]. These films offer excellent barrier properties against oxygen and grease, making them suitable for food packaging applications. Stora Enso has also introduced Papira®, a renewable and biodegradable material that can replace plastic in various packaging solutions[5]. The company's focus on forest-based biomaterials aligns with the growing demand for sustainable packaging options, positioning them as a key player in the future of cellophane alternatives[6].

Strengths: Renewable raw materials, biodegradability, and strong research capabilities in cellulose-based technologies. Weaknesses: Higher production costs and potential limitations in certain high-moisture applications.

Cellophane Innovations

Decomposable packaging synthesized cellophane

PatentInactiveTW200848264A

Innovation

- Combining biodegradable moisture-proof film with cellophane to create a synthesized cellophane that is both moisture-resistant and decomposable.

- Developing a moisture-proof structure for cellophane that doesn't compromise its decomposability.

- Creating a packaging material that addresses both moisture resistance and environmental concerns in a single product.

Base material for forming a cellulose packaging material and the use thereof

PatentWO2024164057A1

Innovation

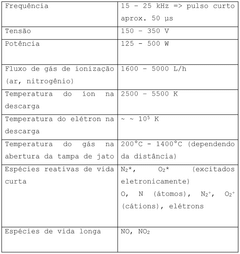

- A base material composed of 98% to 99% cellulose and 1% to 2% inert silicon-based material, featuring a plasma-pre-treated cellulosic substrate, a nanofibrillated cellulose film layer for gas barrier, and an atmospheric plasma-coated inner layer for liquid barrier, ensuring waterproof and recyclable packaging.

Regulatory Landscape

The regulatory landscape surrounding cellophane in sustainable packaging is evolving rapidly as governments and international bodies increasingly focus on environmental protection and waste reduction. In recent years, many countries have implemented or proposed regulations aimed at reducing single-use plastics and promoting more sustainable packaging solutions.

The European Union has been at the forefront of this regulatory shift with its Single-Use Plastics Directive, which came into effect in 2021. While this directive primarily targets certain plastic products, it has indirectly influenced the cellophane market by encouraging the adoption of alternative materials. The EU's Circular Economy Action Plan also emphasizes the need for packaging to be reusable or recyclable by 2030, potentially impacting cellophane's future use.

In the United States, regulations vary by state, but there is a growing trend towards stricter packaging laws. California, for instance, has passed legislation requiring all packaging to be recyclable or compostable by 2032. This could potentially benefit cellophane, which is biodegradable, but may also lead to increased scrutiny of its production processes and overall environmental impact.

Asian countries, particularly China and Japan, have also introduced regulations to combat plastic pollution. China's ban on certain single-use plastics has indirectly boosted the demand for alternative materials like cellophane. However, the regulatory landscape in these regions remains complex and varies significantly between countries.

The global nature of supply chains means that companies using cellophane in packaging must navigate a complex web of international regulations. This has led to increased interest in harmonized standards and certifications for sustainable packaging materials. Organizations like the Sustainable Packaging Coalition are working to develop guidelines that align with various regulatory requirements worldwide.

Looking ahead, the regulatory landscape is likely to continue evolving, with a clear trend towards stricter environmental standards. Future regulations may focus more specifically on the life cycle assessment of packaging materials, including factors such as carbon footprint, water usage, and end-of-life disposal. This could present both challenges and opportunities for cellophane, depending on how it performs against these criteria.

As regulations tighten, there may also be increased focus on extended producer responsibility (EPR) schemes, which could significantly impact the economics of cellophane production and use. Companies in the packaging industry will need to stay agile and proactive in adapting to these regulatory changes to ensure compliance and maintain market competitiveness.

The European Union has been at the forefront of this regulatory shift with its Single-Use Plastics Directive, which came into effect in 2021. While this directive primarily targets certain plastic products, it has indirectly influenced the cellophane market by encouraging the adoption of alternative materials. The EU's Circular Economy Action Plan also emphasizes the need for packaging to be reusable or recyclable by 2030, potentially impacting cellophane's future use.

In the United States, regulations vary by state, but there is a growing trend towards stricter packaging laws. California, for instance, has passed legislation requiring all packaging to be recyclable or compostable by 2032. This could potentially benefit cellophane, which is biodegradable, but may also lead to increased scrutiny of its production processes and overall environmental impact.

Asian countries, particularly China and Japan, have also introduced regulations to combat plastic pollution. China's ban on certain single-use plastics has indirectly boosted the demand for alternative materials like cellophane. However, the regulatory landscape in these regions remains complex and varies significantly between countries.

The global nature of supply chains means that companies using cellophane in packaging must navigate a complex web of international regulations. This has led to increased interest in harmonized standards and certifications for sustainable packaging materials. Organizations like the Sustainable Packaging Coalition are working to develop guidelines that align with various regulatory requirements worldwide.

Looking ahead, the regulatory landscape is likely to continue evolving, with a clear trend towards stricter environmental standards. Future regulations may focus more specifically on the life cycle assessment of packaging materials, including factors such as carbon footprint, water usage, and end-of-life disposal. This could present both challenges and opportunities for cellophane, depending on how it performs against these criteria.

As regulations tighten, there may also be increased focus on extended producer responsibility (EPR) schemes, which could significantly impact the economics of cellophane production and use. Companies in the packaging industry will need to stay agile and proactive in adapting to these regulatory changes to ensure compliance and maintain market competitiveness.

Life Cycle Assessment

Life Cycle Assessment (LCA) plays a crucial role in evaluating the environmental impact of cellophane as a sustainable packaging material. This comprehensive analysis examines the entire lifecycle of cellophane, from raw material extraction to disposal or recycling, providing valuable insights into its sustainability credentials.

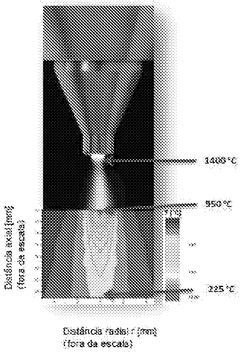

The production phase of cellophane involves the processing of renewable resources, primarily wood pulp or cotton linters. This stage typically requires significant energy inputs and chemical treatments. However, recent advancements in manufacturing technologies have led to more efficient processes, reducing the overall environmental footprint. Water consumption and chemical usage during production remain areas of concern, necessitating ongoing research and development to minimize these impacts.

During the use phase, cellophane demonstrates several advantages. Its excellent barrier properties against moisture and gases contribute to extended shelf life for packaged products, potentially reducing food waste. The material's inherent biodegradability also positions it favorably compared to conventional plastic packaging options. However, the extent and rate of biodegradation can vary depending on disposal conditions, highlighting the need for proper waste management infrastructure.

End-of-life considerations for cellophane are particularly promising. Unlike many synthetic plastics, cellophane can decompose in both industrial composting facilities and natural environments, albeit at different rates. This characteristic aligns well with circular economy principles and waste reduction goals. However, the lack of widespread composting infrastructure in many regions presents a challenge to fully realizing this potential benefit.

When comparing cellophane to alternative packaging materials through LCA, several factors emerge. While its production may be more energy-intensive than some petroleum-based plastics, cellophane's renewable sourcing and biodegradability often result in a lower overall environmental impact. The material's performance in areas such as carbon footprint, water usage, and end-of-life scenarios varies depending on specific production methods and disposal practices.

Future improvements in cellophane's lifecycle performance are likely to focus on several key areas. Enhancing production efficiency to reduce energy consumption and minimize chemical inputs is a primary goal. Additionally, developing cellophane variants with improved barrier properties could further extend product shelf life, amplifying its positive impact on food waste reduction. Research into accelerating biodegradation rates under various conditions may also contribute to its appeal as a sustainable packaging solution.

As regulations and consumer preferences continue to shift towards more environmentally friendly packaging options, the role of comprehensive LCA in guiding material choices becomes increasingly important. For cellophane to secure its position in the future of sustainable packaging, ongoing assessment and optimization of its lifecycle impacts will be essential, driving innovation and environmental stewardship in the packaging industry.

The production phase of cellophane involves the processing of renewable resources, primarily wood pulp or cotton linters. This stage typically requires significant energy inputs and chemical treatments. However, recent advancements in manufacturing technologies have led to more efficient processes, reducing the overall environmental footprint. Water consumption and chemical usage during production remain areas of concern, necessitating ongoing research and development to minimize these impacts.

During the use phase, cellophane demonstrates several advantages. Its excellent barrier properties against moisture and gases contribute to extended shelf life for packaged products, potentially reducing food waste. The material's inherent biodegradability also positions it favorably compared to conventional plastic packaging options. However, the extent and rate of biodegradation can vary depending on disposal conditions, highlighting the need for proper waste management infrastructure.

End-of-life considerations for cellophane are particularly promising. Unlike many synthetic plastics, cellophane can decompose in both industrial composting facilities and natural environments, albeit at different rates. This characteristic aligns well with circular economy principles and waste reduction goals. However, the lack of widespread composting infrastructure in many regions presents a challenge to fully realizing this potential benefit.

When comparing cellophane to alternative packaging materials through LCA, several factors emerge. While its production may be more energy-intensive than some petroleum-based plastics, cellophane's renewable sourcing and biodegradability often result in a lower overall environmental impact. The material's performance in areas such as carbon footprint, water usage, and end-of-life scenarios varies depending on specific production methods and disposal practices.

Future improvements in cellophane's lifecycle performance are likely to focus on several key areas. Enhancing production efficiency to reduce energy consumption and minimize chemical inputs is a primary goal. Additionally, developing cellophane variants with improved barrier properties could further extend product shelf life, amplifying its positive impact on food waste reduction. Research into accelerating biodegradation rates under various conditions may also contribute to its appeal as a sustainable packaging solution.

As regulations and consumer preferences continue to shift towards more environmentally friendly packaging options, the role of comprehensive LCA in guiding material choices becomes increasingly important. For cellophane to secure its position in the future of sustainable packaging, ongoing assessment and optimization of its lifecycle impacts will be essential, driving innovation and environmental stewardship in the packaging industry.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!