Strategic Insights into Cellophane Market Transformations

JUL 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Cellophane Evolution

Cellophane, a transparent film made from regenerated cellulose, has undergone significant transformations since its inception in the early 20th century. The evolution of cellophane technology has been marked by continuous improvements in production processes, material properties, and applications.

Initially developed as a moisture-proof packaging material, cellophane's journey began with its invention by Jacques E. Brandenberger in 1908. The early production methods were labor-intensive and costly, limiting its widespread adoption. However, the 1920s saw a breakthrough with the development of a more efficient manufacturing process by DuPont, which revolutionized the industry and made cellophane more accessible.

The mid-20th century witnessed further advancements in cellophane technology, particularly in enhancing its barrier properties. Researchers focused on improving moisture resistance and gas permeability, expanding its use in food packaging and preservation. This period also saw the introduction of coatings and laminates, which significantly broadened cellophane's functionality and market appeal.

In the latter half of the 20th century, cellophane faced competition from synthetic polymers like polyethylene and polypropylene. This challenge spurred innovation in cellophane production, leading to the development of more sustainable and eco-friendly manufacturing processes. The industry began to emphasize cellophane's biodegradability and renewable sourcing as key advantages over petroleum-based alternatives.

The turn of the 21st century marked a renewed interest in cellophane due to growing environmental concerns. Manufacturers focused on reducing the environmental impact of production, exploring bio-based additives, and improving end-of-life recyclability. This period also saw the emergence of novel applications beyond packaging, such as in electronics and medical devices.

Recent years have witnessed a surge in research aimed at enhancing cellophane's properties and expanding its applications. Nanotechnology has played a crucial role in this evolution, with the development of nanocellulose-reinforced cellophane films offering superior strength and barrier properties. Additionally, smart packaging concepts incorporating cellophane with sensors and indicators have opened new avenues for intelligent food packaging solutions.

The ongoing evolution of cellophane is characterized by a focus on sustainability, advanced functionalities, and integration with emerging technologies. As the market demands more environmentally friendly materials, cellophane continues to adapt, positioning itself as a viable alternative to synthetic plastics in various industries. The future of cellophane lies in its ability to meet the growing demand for sustainable, high-performance materials while leveraging technological advancements to expand its capabilities and applications.

Initially developed as a moisture-proof packaging material, cellophane's journey began with its invention by Jacques E. Brandenberger in 1908. The early production methods were labor-intensive and costly, limiting its widespread adoption. However, the 1920s saw a breakthrough with the development of a more efficient manufacturing process by DuPont, which revolutionized the industry and made cellophane more accessible.

The mid-20th century witnessed further advancements in cellophane technology, particularly in enhancing its barrier properties. Researchers focused on improving moisture resistance and gas permeability, expanding its use in food packaging and preservation. This period also saw the introduction of coatings and laminates, which significantly broadened cellophane's functionality and market appeal.

In the latter half of the 20th century, cellophane faced competition from synthetic polymers like polyethylene and polypropylene. This challenge spurred innovation in cellophane production, leading to the development of more sustainable and eco-friendly manufacturing processes. The industry began to emphasize cellophane's biodegradability and renewable sourcing as key advantages over petroleum-based alternatives.

The turn of the 21st century marked a renewed interest in cellophane due to growing environmental concerns. Manufacturers focused on reducing the environmental impact of production, exploring bio-based additives, and improving end-of-life recyclability. This period also saw the emergence of novel applications beyond packaging, such as in electronics and medical devices.

Recent years have witnessed a surge in research aimed at enhancing cellophane's properties and expanding its applications. Nanotechnology has played a crucial role in this evolution, with the development of nanocellulose-reinforced cellophane films offering superior strength and barrier properties. Additionally, smart packaging concepts incorporating cellophane with sensors and indicators have opened new avenues for intelligent food packaging solutions.

The ongoing evolution of cellophane is characterized by a focus on sustainability, advanced functionalities, and integration with emerging technologies. As the market demands more environmentally friendly materials, cellophane continues to adapt, positioning itself as a viable alternative to synthetic plastics in various industries. The future of cellophane lies in its ability to meet the growing demand for sustainable, high-performance materials while leveraging technological advancements to expand its capabilities and applications.

Market Demand Analysis

The cellophane market has witnessed significant transformations in recent years, driven by evolving consumer preferences, technological advancements, and environmental concerns. The demand for cellophane, a thin, transparent sheet made from regenerated cellulose, has been influenced by various factors across different industries.

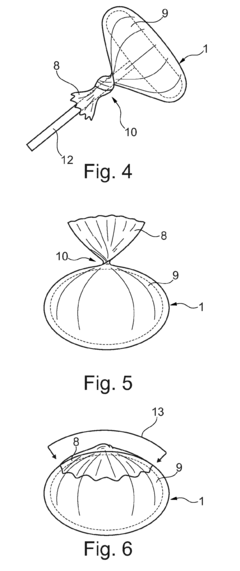

In the food packaging sector, cellophane continues to be a popular choice due to its excellent barrier properties against moisture, gases, and bacteria. The growing emphasis on food safety and extended shelf life has led to increased adoption of cellophane in packaging for fresh produce, bakery items, and confectionery products. Additionally, the rise of convenience foods and on-the-go consumption habits has further boosted the demand for cellophane-based packaging solutions.

The cosmetics and personal care industry has also contributed to the market growth of cellophane. The material's transparency and ability to showcase product aesthetics have made it a preferred choice for packaging beauty and skincare products. As consumers become more conscious of product presentation and visual appeal, the demand for cellophane in this sector is expected to continue its upward trajectory.

Environmental concerns and sustainability initiatives have had a dual impact on the cellophane market. On one hand, the biodegradable nature of cellophane has positioned it as an eco-friendly alternative to traditional plastic packaging, aligning with the growing consumer preference for sustainable products. This has led to increased adoption in industries seeking to reduce their environmental footprint. On the other hand, the emergence of new bio-based and compostable materials has introduced competition, challenging cellophane's market share in certain applications.

The pharmaceutical industry has shown a steady demand for cellophane, particularly in blister packaging for tablets and capsules. The material's excellent barrier properties and compatibility with various drug formulations have made it a reliable choice for pharmaceutical packaging. As the global pharmaceutical market expands, driven by factors such as population growth and increasing healthcare expenditure, the demand for cellophane in this sector is expected to grow correspondingly.

Market analysis indicates that the Asia-Pacific region is emerging as a key growth driver for the cellophane market. Rapid industrialization, urbanization, and changing consumer lifestyles in countries like China and India have led to increased demand for packaged goods, subsequently boosting the cellophane market. The region's expanding middle-class population and rising disposable incomes are further contributing to this trend.

Despite these positive trends, the cellophane market faces challenges from alternative packaging materials and evolving regulatory landscapes. The development of advanced synthetic polymers with superior properties and the push towards reducing single-use packaging materials have created competitive pressures on the cellophane industry. Market players are responding by investing in research and development to enhance cellophane's properties and explore new applications, ensuring its continued relevance in the packaging industry.

In the food packaging sector, cellophane continues to be a popular choice due to its excellent barrier properties against moisture, gases, and bacteria. The growing emphasis on food safety and extended shelf life has led to increased adoption of cellophane in packaging for fresh produce, bakery items, and confectionery products. Additionally, the rise of convenience foods and on-the-go consumption habits has further boosted the demand for cellophane-based packaging solutions.

The cosmetics and personal care industry has also contributed to the market growth of cellophane. The material's transparency and ability to showcase product aesthetics have made it a preferred choice for packaging beauty and skincare products. As consumers become more conscious of product presentation and visual appeal, the demand for cellophane in this sector is expected to continue its upward trajectory.

Environmental concerns and sustainability initiatives have had a dual impact on the cellophane market. On one hand, the biodegradable nature of cellophane has positioned it as an eco-friendly alternative to traditional plastic packaging, aligning with the growing consumer preference for sustainable products. This has led to increased adoption in industries seeking to reduce their environmental footprint. On the other hand, the emergence of new bio-based and compostable materials has introduced competition, challenging cellophane's market share in certain applications.

The pharmaceutical industry has shown a steady demand for cellophane, particularly in blister packaging for tablets and capsules. The material's excellent barrier properties and compatibility with various drug formulations have made it a reliable choice for pharmaceutical packaging. As the global pharmaceutical market expands, driven by factors such as population growth and increasing healthcare expenditure, the demand for cellophane in this sector is expected to grow correspondingly.

Market analysis indicates that the Asia-Pacific region is emerging as a key growth driver for the cellophane market. Rapid industrialization, urbanization, and changing consumer lifestyles in countries like China and India have led to increased demand for packaged goods, subsequently boosting the cellophane market. The region's expanding middle-class population and rising disposable incomes are further contributing to this trend.

Despite these positive trends, the cellophane market faces challenges from alternative packaging materials and evolving regulatory landscapes. The development of advanced synthetic polymers with superior properties and the push towards reducing single-use packaging materials have created competitive pressures on the cellophane industry. Market players are responding by investing in research and development to enhance cellophane's properties and explore new applications, ensuring its continued relevance in the packaging industry.

Technical Challenges

The cellophane market is currently facing several significant technical challenges that are shaping its transformation. One of the primary issues is the environmental impact of traditional cellophane production. The conventional manufacturing process relies heavily on carbon disulfide, a toxic and environmentally harmful chemical. This has led to increased pressure from regulatory bodies and environmentally conscious consumers to develop more sustainable production methods.

Another major challenge lies in the biodegradability of cellophane. While cellophane is derived from natural cellulose, the addition of various coatings and treatments to enhance its properties often compromises its biodegradability. This has created a dichotomy between the material's perceived eco-friendliness and its actual environmental impact, prompting researchers to explore new coating technologies that maintain cellophane's desirable properties without hindering its biodegradability.

The rising demand for enhanced barrier properties presents another technical hurdle. As the packaging industry evolves, there is an increasing need for cellophane films with improved moisture, gas, and aroma barrier characteristics. Achieving these properties while maintaining the material's transparency, flexibility, and eco-friendly nature poses a significant challenge for manufacturers and material scientists.

Cost-effectiveness remains a persistent issue in cellophane production. The complex manufacturing process and the need for specialized equipment contribute to higher production costs compared to some synthetic alternatives. This economic factor has driven research into more efficient production methods and the exploration of alternative raw materials to reduce overall costs without compromising quality.

The integration of smart packaging technologies with cellophane presents both opportunities and challenges. Incorporating features such as sensors, indicators, or RFID tags into cellophane packaging while maintaining its core properties and recyclability is a complex technical endeavor that requires innovative approaches in material science and manufacturing processes.

Lastly, the scalability of new, more sustainable cellophane production technologies is a significant challenge. While promising alternatives to traditional methods have been developed in laboratory settings, translating these innovations to large-scale industrial production while ensuring consistent quality and economic viability remains a major hurdle for the industry.

These technical challenges are driving innovation in the cellophane market, pushing manufacturers and researchers to develop new solutions that balance performance, sustainability, and economic viability. The resolution of these challenges will play a crucial role in shaping the future of the cellophane industry and its position in the broader packaging and materials market.

Another major challenge lies in the biodegradability of cellophane. While cellophane is derived from natural cellulose, the addition of various coatings and treatments to enhance its properties often compromises its biodegradability. This has created a dichotomy between the material's perceived eco-friendliness and its actual environmental impact, prompting researchers to explore new coating technologies that maintain cellophane's desirable properties without hindering its biodegradability.

The rising demand for enhanced barrier properties presents another technical hurdle. As the packaging industry evolves, there is an increasing need for cellophane films with improved moisture, gas, and aroma barrier characteristics. Achieving these properties while maintaining the material's transparency, flexibility, and eco-friendly nature poses a significant challenge for manufacturers and material scientists.

Cost-effectiveness remains a persistent issue in cellophane production. The complex manufacturing process and the need for specialized equipment contribute to higher production costs compared to some synthetic alternatives. This economic factor has driven research into more efficient production methods and the exploration of alternative raw materials to reduce overall costs without compromising quality.

The integration of smart packaging technologies with cellophane presents both opportunities and challenges. Incorporating features such as sensors, indicators, or RFID tags into cellophane packaging while maintaining its core properties and recyclability is a complex technical endeavor that requires innovative approaches in material science and manufacturing processes.

Lastly, the scalability of new, more sustainable cellophane production technologies is a significant challenge. While promising alternatives to traditional methods have been developed in laboratory settings, translating these innovations to large-scale industrial production while ensuring consistent quality and economic viability remains a major hurdle for the industry.

These technical challenges are driving innovation in the cellophane market, pushing manufacturers and researchers to develop new solutions that balance performance, sustainability, and economic viability. The resolution of these challenges will play a crucial role in shaping the future of the cellophane industry and its position in the broader packaging and materials market.

Current Solutions

01 Cellophane production and modification

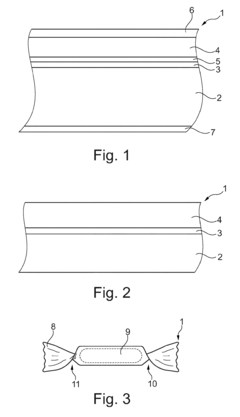

Various methods for producing and modifying cellophane are described, including improvements in the manufacturing process, chemical treatments to enhance properties, and techniques for creating specialized cellophane products. These innovations aim to improve the material's strength, flexibility, and barrier properties for diverse applications.- Cellophane in packaging applications: Cellophane is widely used in packaging applications due to its transparency, flexibility, and barrier properties. It is utilized for wrapping various products, including food items, consumer goods, and industrial materials. The material's ability to protect contents while allowing visibility makes it popular in the packaging industry.

- Cellophane production and processing methods: Various methods and processes are employed in the production and processing of cellophane. These include techniques for improving its physical properties, enhancing its durability, and modifying its surface characteristics. Innovations in cellophane manufacturing focus on increasing efficiency and reducing environmental impact.

- Cellophane in biomedical applications: Cellophane finds applications in the biomedical field due to its biocompatibility and unique properties. It is used in various medical devices, drug delivery systems, and tissue engineering applications. Research in this area focuses on developing novel cellophane-based materials for specific medical purposes.

- Cellophane in electronic and energy applications: Cellophane is being explored for use in electronic and energy-related applications. Its properties make it suitable for developing flexible electronic components, energy storage devices, and sensors. Research in this field aims to create innovative cellophane-based materials with enhanced electrical and thermal properties.

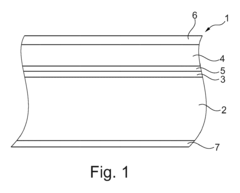

- Cellophane modifications and composites: Researchers are developing modified cellophane materials and composites to enhance its properties and expand its applications. These modifications include chemical treatments, incorporation of nanoparticles, and creation of multi-layer structures. The goal is to improve cellophane's strength, barrier properties, and functionality for various industrial uses.

02 Packaging applications of cellophane

Cellophane is widely used in packaging applications due to its transparency, flexibility, and barrier properties. Innovations in this area include specialized packaging designs, multi-layer structures incorporating cellophane, and methods for improving the material's performance in food and consumer product packaging.Expand Specific Solutions03 Biodegradable and eco-friendly cellophane

Research and development efforts focus on creating biodegradable and environmentally friendly versions of cellophane. This includes modifications to the material composition, incorporation of natural additives, and development of production processes that reduce environmental impact while maintaining desired properties.Expand Specific Solutions04 Cellophane in medical and pharmaceutical applications

Cellophane finds use in various medical and pharmaceutical applications due to its biocompatibility and barrier properties. Innovations in this area include specialized coatings, sterilization techniques, and the development of cellophane-based drug delivery systems or medical packaging solutions.Expand Specific Solutions05 Cellophane in electronic and display technologies

Advancements in cellophane technology have led to its use in electronic and display applications. This includes the development of conductive cellophane films, incorporation of cellophane in flexible displays, and the use of cellophane as a substrate or protective layer in various electronic devices.Expand Specific Solutions

Industry Leaders

The cellophane market is experiencing significant transformations, driven by technological advancements and shifting consumer preferences. Currently in a mature growth phase, the market is witnessing moderate expansion with a focus on sustainable and biodegradable alternatives. Key players like DuPont de Nemours, Inc. and Novozymes A/S are leading innovation efforts, particularly in bio-based cellophane production. The market's technological maturity varies, with traditional cellophane manufacturing well-established, while eco-friendly alternatives are still evolving. Companies such as SCHOTT AG and International Business Machines Corp. are contributing to process improvements and smart packaging solutions, indicating a trend towards integration of advanced technologies in this sector.

Novozymes A/S

Technical Solution: Novozymes A/S has been at the forefront of developing enzymatic technologies to improve cellophane production and enhance its biodegradability. Their approach focuses on using specialized enzymes to modify cellulose structures during the cellophane manufacturing process, resulting in improved material properties and reduced environmental impact[9]. Novozymes has developed enzyme cocktails that can break down cellulose more efficiently, allowing for the production of cellophane with enhanced clarity and strength. The company has also invested in research to create enzymes that accelerate the biodegradation of cellophane in various environments, addressing concerns about plastic pollution[10]. Novozymes' enzymatic solutions have the potential to significantly reduce the energy and chemical inputs required in cellophane production, making the process more sustainable and cost-effective[11].

Strengths: Expertise in enzymatic technologies, focus on improving sustainability and biodegradability. Weaknesses: Reliance on partnerships with cellophane manufacturers for implementation, potential regulatory hurdles for enzymatically modified materials.

DSM IP Assets BV

Technical Solution: DSM has focused on developing bio-based alternatives to traditional cellophane, leveraging its expertise in materials science and biotechnology. The company has invested in research to create cellophane-like films from renewable resources such as algae and agricultural by-products[12]. DSM's approach involves using advanced fermentation and biopolymer processing techniques to produce films with properties similar to traditional cellophane but with improved environmental credentials. Their bio-based films offer enhanced biodegradability and compostability while maintaining the barrier properties required for packaging applications[13]. DSM has also developed coating technologies to improve the moisture resistance and heat-sealability of their bio-based films, expanding their potential applications in the food packaging industry[14].

Strengths: Strong focus on sustainability, expertise in bio-based materials. Weaknesses: Higher production costs compared to traditional cellophane, potential challenges in scaling up production.

Key Patents Review

Multilayer laminate comprising a paper-layer and a polymeric-layer

PatentInactiveEP2979863A1

Innovation

- A multilayer laminate comprising a paper-layer and a polymeric-layer, laminated together with an adhesive lamination-layer, achieving a grammage of ≤45 g/m², providing structural stability and deadfold properties for high-speed packaging while being environmentally friendly.

Patent

Innovation

- Development of bio-based and biodegradable cellophane alternatives to reduce environmental impact.

- Implementation of smart packaging technologies, integrating cellophane with sensors for real-time monitoring of product freshness and quality.

- Utilization of advanced manufacturing processes to produce ultra-thin cellophane films with improved strength and flexibility.

Sustainability Trends

The cellophane market is undergoing significant transformations driven by sustainability trends. As environmental concerns continue to shape consumer preferences and regulatory landscapes, the industry is adapting to meet these new demands. One of the primary sustainability trends impacting the cellophane market is the shift towards bio-based and biodegradable alternatives. Traditional cellophane, derived from wood pulp, is being reimagined with enhanced eco-friendly properties to align with circular economy principles.

Manufacturers are investing in research and development to create cellophane products that maintain their functional properties while reducing environmental impact. This includes exploring new raw material sources, such as agricultural waste and seaweed, to produce cellophane with a lower carbon footprint. Additionally, efforts are being made to improve the biodegradability of cellophane, ensuring it breaks down more efficiently in various environmental conditions.

The push for sustainability has also led to innovations in production processes. Energy-efficient manufacturing techniques and the use of renewable energy sources are becoming increasingly common in cellophane production facilities. This not only reduces the overall environmental impact but also helps companies meet stringent sustainability targets and comply with evolving regulations.

Recycling initiatives are gaining traction within the cellophane market. While traditional cellophane can be challenging to recycle due to its chemical composition, new technologies are emerging to address this issue. Advanced recycling methods, such as chemical recycling, are being explored to break down cellophane into its base components for reuse in new products.

The packaging industry, a major consumer of cellophane, is driving demand for more sustainable options. Brands are seeking packaging solutions that not only protect their products but also communicate their commitment to sustainability to environmentally conscious consumers. This has led to the development of cellophane variants with enhanced barrier properties and reduced thickness, minimizing material usage without compromising performance.

Collaboration across the value chain is becoming increasingly important in addressing sustainability challenges. Cellophane manufacturers are partnering with raw material suppliers, packaging designers, and end-users to create closed-loop systems and improve the overall sustainability profile of their products. These partnerships are fostering innovation and driving the adoption of more sustainable practices throughout the cellophane lifecycle.

As sustainability continues to be a key driver in the cellophane market, companies that successfully integrate these trends into their strategies are likely to gain a competitive edge. The market is expected to see further innovations in bio-based materials, recycling technologies, and sustainable production methods, reshaping the industry landscape in the coming years.

Manufacturers are investing in research and development to create cellophane products that maintain their functional properties while reducing environmental impact. This includes exploring new raw material sources, such as agricultural waste and seaweed, to produce cellophane with a lower carbon footprint. Additionally, efforts are being made to improve the biodegradability of cellophane, ensuring it breaks down more efficiently in various environmental conditions.

The push for sustainability has also led to innovations in production processes. Energy-efficient manufacturing techniques and the use of renewable energy sources are becoming increasingly common in cellophane production facilities. This not only reduces the overall environmental impact but also helps companies meet stringent sustainability targets and comply with evolving regulations.

Recycling initiatives are gaining traction within the cellophane market. While traditional cellophane can be challenging to recycle due to its chemical composition, new technologies are emerging to address this issue. Advanced recycling methods, such as chemical recycling, are being explored to break down cellophane into its base components for reuse in new products.

The packaging industry, a major consumer of cellophane, is driving demand for more sustainable options. Brands are seeking packaging solutions that not only protect their products but also communicate their commitment to sustainability to environmentally conscious consumers. This has led to the development of cellophane variants with enhanced barrier properties and reduced thickness, minimizing material usage without compromising performance.

Collaboration across the value chain is becoming increasingly important in addressing sustainability challenges. Cellophane manufacturers are partnering with raw material suppliers, packaging designers, and end-users to create closed-loop systems and improve the overall sustainability profile of their products. These partnerships are fostering innovation and driving the adoption of more sustainable practices throughout the cellophane lifecycle.

As sustainability continues to be a key driver in the cellophane market, companies that successfully integrate these trends into their strategies are likely to gain a competitive edge. The market is expected to see further innovations in bio-based materials, recycling technologies, and sustainable production methods, reshaping the industry landscape in the coming years.

Regulatory Framework

The regulatory framework surrounding the cellophane market plays a crucial role in shaping its transformations and future trajectory. Governments worldwide have implemented various regulations to address environmental concerns, product safety, and trade practices within the industry.

Environmental regulations have become increasingly stringent, focusing on the sustainability and biodegradability of cellophane products. Many countries have introduced measures to reduce single-use plastics, which has indirectly impacted the cellophane market. These regulations often mandate the use of eco-friendly alternatives or impose taxes on non-biodegradable packaging materials.

Product safety regulations have also evolved, particularly in the food packaging sector. Regulatory bodies such as the FDA in the United States and the EFSA in Europe have established strict guidelines for food contact materials, including cellophane. These regulations ensure that cellophane products meet specific migration limits for chemicals and do not pose health risks to consumers.

Trade regulations and tariffs significantly influence the global cellophane market. Changes in trade agreements and import/export policies can affect the competitiveness of cellophane producers in different regions. For instance, recent trade tensions between major economies have led to shifts in supply chains and market dynamics.

Labeling and packaging regulations have become more comprehensive, requiring manufacturers to provide detailed information about the composition, recyclability, and proper disposal of cellophane products. This has increased transparency in the market and influenced consumer choices.

Waste management regulations have also impacted the cellophane industry. Many countries have implemented extended producer responsibility (EPR) schemes, requiring manufacturers to take responsibility for the entire lifecycle of their products, including disposal and recycling.

The regulatory landscape is continuously evolving, with a growing emphasis on circular economy principles. This has led to the development of new standards and certifications for biodegradable and compostable materials, which cellophane manufacturers must adapt to remain competitive.

As regulations become more complex and varied across different regions, cellophane producers face challenges in ensuring compliance across their global operations. This has led to increased investment in research and development to create products that meet diverse regulatory requirements while maintaining performance and cost-effectiveness.

Environmental regulations have become increasingly stringent, focusing on the sustainability and biodegradability of cellophane products. Many countries have introduced measures to reduce single-use plastics, which has indirectly impacted the cellophane market. These regulations often mandate the use of eco-friendly alternatives or impose taxes on non-biodegradable packaging materials.

Product safety regulations have also evolved, particularly in the food packaging sector. Regulatory bodies such as the FDA in the United States and the EFSA in Europe have established strict guidelines for food contact materials, including cellophane. These regulations ensure that cellophane products meet specific migration limits for chemicals and do not pose health risks to consumers.

Trade regulations and tariffs significantly influence the global cellophane market. Changes in trade agreements and import/export policies can affect the competitiveness of cellophane producers in different regions. For instance, recent trade tensions between major economies have led to shifts in supply chains and market dynamics.

Labeling and packaging regulations have become more comprehensive, requiring manufacturers to provide detailed information about the composition, recyclability, and proper disposal of cellophane products. This has increased transparency in the market and influenced consumer choices.

Waste management regulations have also impacted the cellophane industry. Many countries have implemented extended producer responsibility (EPR) schemes, requiring manufacturers to take responsibility for the entire lifecycle of their products, including disposal and recycling.

The regulatory landscape is continuously evolving, with a growing emphasis on circular economy principles. This has led to the development of new standards and certifications for biodegradable and compostable materials, which cellophane manufacturers must adapt to remain competitive.

As regulations become more complex and varied across different regions, cellophane producers face challenges in ensuring compliance across their global operations. This has led to increased investment in research and development to create products that meet diverse regulatory requirements while maintaining performance and cost-effectiveness.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!