Market Analysis on Demand for Bioelectronic Interface Technologies

OCT 15, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bioelectronic Interface Technology Evolution and Objectives

Bioelectronic interfaces represent a convergence of electronics and biology, enabling direct communication between electronic devices and biological systems. This field has evolved significantly over the past several decades, transitioning from rudimentary electrode-based systems to sophisticated, miniaturized implantable devices capable of both sensing and stimulating biological signals with high precision.

The evolution of bioelectronic interfaces began in the 1950s with basic neural recording techniques. By the 1970s, the first cochlear implants demonstrated practical applications of neural interfaces. The 1990s saw significant miniaturization and improved biocompatibility, while the 2000s brought wireless capabilities and enhanced signal processing algorithms. Recent advancements have focused on flexible electronics, nanomaterials, and closed-loop systems that can adapt to physiological changes in real-time.

Current technological trajectories indicate several promising directions, including the development of biodegradable electronics that eliminate the need for removal surgeries, ultra-low power consumption devices enabling longer implantation periods, and improved neural decoding algorithms leveraging artificial intelligence to interpret complex biological signals more accurately.

The primary objectives in this field center around enhancing biocompatibility to reduce foreign body responses and tissue damage, improving spatial and temporal resolution of signal detection, developing more energy-efficient systems for extended operation, and creating minimally invasive deployment methods to reduce surgical complications.

Long-term technical goals include achieving seamless integration between electronic systems and biological tissues, developing self-powering capabilities through energy harvesting from the body, and creating adaptive interfaces that can reconfigure themselves in response to changing biological conditions or therapeutic needs.

Significant challenges remain in achieving these objectives, particularly regarding long-term stability in the harsh biological environment, signal fidelity in the presence of noise and artifacts, and the development of materials that can maintain performance while minimizing inflammatory responses. The field is also working toward standardization of testing protocols and regulatory pathways to accelerate clinical translation.

The convergence of nanotechnology, materials science, and computational approaches is expected to drive the next generation of bioelectronic interfaces, potentially enabling unprecedented applications in neurological disorders, cardiovascular monitoring, and human-machine interfaces. These developments align with broader trends toward personalized medicine and point-of-care diagnostics, positioning bioelectronic interfaces as a critical enabling technology for future healthcare paradigms.

The evolution of bioelectronic interfaces began in the 1950s with basic neural recording techniques. By the 1970s, the first cochlear implants demonstrated practical applications of neural interfaces. The 1990s saw significant miniaturization and improved biocompatibility, while the 2000s brought wireless capabilities and enhanced signal processing algorithms. Recent advancements have focused on flexible electronics, nanomaterials, and closed-loop systems that can adapt to physiological changes in real-time.

Current technological trajectories indicate several promising directions, including the development of biodegradable electronics that eliminate the need for removal surgeries, ultra-low power consumption devices enabling longer implantation periods, and improved neural decoding algorithms leveraging artificial intelligence to interpret complex biological signals more accurately.

The primary objectives in this field center around enhancing biocompatibility to reduce foreign body responses and tissue damage, improving spatial and temporal resolution of signal detection, developing more energy-efficient systems for extended operation, and creating minimally invasive deployment methods to reduce surgical complications.

Long-term technical goals include achieving seamless integration between electronic systems and biological tissues, developing self-powering capabilities through energy harvesting from the body, and creating adaptive interfaces that can reconfigure themselves in response to changing biological conditions or therapeutic needs.

Significant challenges remain in achieving these objectives, particularly regarding long-term stability in the harsh biological environment, signal fidelity in the presence of noise and artifacts, and the development of materials that can maintain performance while minimizing inflammatory responses. The field is also working toward standardization of testing protocols and regulatory pathways to accelerate clinical translation.

The convergence of nanotechnology, materials science, and computational approaches is expected to drive the next generation of bioelectronic interfaces, potentially enabling unprecedented applications in neurological disorders, cardiovascular monitoring, and human-machine interfaces. These developments align with broader trends toward personalized medicine and point-of-care diagnostics, positioning bioelectronic interfaces as a critical enabling technology for future healthcare paradigms.

Market Demand Analysis for Bioelectronic Interfaces

The bioelectronic interface technology market is experiencing unprecedented growth, driven by increasing applications in healthcare, neural engineering, and human-machine interaction. Current market valuations indicate the global bioelectronic medicine market reached approximately 19 billion USD in 2022, with projections suggesting a compound annual growth rate of 7-8% through 2030. This growth trajectory is supported by substantial investments from both private and public sectors, with venture capital funding for bioelectronic startups exceeding 1.5 billion USD in 2022 alone.

Healthcare applications represent the largest demand segment, with neural implants for conditions such as Parkinson's disease, epilepsy, and chronic pain management showing significant clinical adoption. The aging global population and rising prevalence of neurological disorders are creating sustained demand, with over 50 million people worldwide suffering from epilepsy and 10 million from Parkinson's disease who could potentially benefit from these technologies.

Consumer markets are emerging as another significant demand driver, particularly in brain-computer interfaces for gaming, virtual reality, and productivity applications. Companies like Neuralink and Kernel have attracted considerable attention with their consumer-oriented neural interface products, though mass market penetration remains limited by current technological constraints and regulatory considerations.

Military and defense sectors represent a smaller but rapidly growing market segment, with investments focusing on enhanced soldier capabilities, remote operation systems, and rehabilitation technologies for injured personnel. The US Department of Defense has allocated over 100 million USD to bioelectronic interface research programs in recent budget cycles.

Geographically, North America dominates the market with approximately 45% share, followed by Europe at 30% and Asia-Pacific at 20%. However, the Asia-Pacific region is expected to show the highest growth rate in the coming decade, driven by increasing healthcare expenditure, technological adoption, and government initiatives in countries like China, Japan, and South Korea.

Key market barriers include high development costs, with typical R&D cycles for implantable bioelectronic devices exceeding 5-7 years and requiring investments of 50-100 million USD before commercialization. Regulatory approval processes remain lengthy and complex, particularly for invasive technologies, with FDA approval timelines averaging 3-5 years for novel bioelectronic implants.

Customer adoption faces challenges related to cost (with advanced neural implants typically priced between 10,000-50,000 USD), concerns about long-term biocompatibility, and data privacy considerations. However, reimbursement policies are gradually evolving to support these technologies, with several major insurers now covering bioelectronic treatments for specific conditions.

Healthcare applications represent the largest demand segment, with neural implants for conditions such as Parkinson's disease, epilepsy, and chronic pain management showing significant clinical adoption. The aging global population and rising prevalence of neurological disorders are creating sustained demand, with over 50 million people worldwide suffering from epilepsy and 10 million from Parkinson's disease who could potentially benefit from these technologies.

Consumer markets are emerging as another significant demand driver, particularly in brain-computer interfaces for gaming, virtual reality, and productivity applications. Companies like Neuralink and Kernel have attracted considerable attention with their consumer-oriented neural interface products, though mass market penetration remains limited by current technological constraints and regulatory considerations.

Military and defense sectors represent a smaller but rapidly growing market segment, with investments focusing on enhanced soldier capabilities, remote operation systems, and rehabilitation technologies for injured personnel. The US Department of Defense has allocated over 100 million USD to bioelectronic interface research programs in recent budget cycles.

Geographically, North America dominates the market with approximately 45% share, followed by Europe at 30% and Asia-Pacific at 20%. However, the Asia-Pacific region is expected to show the highest growth rate in the coming decade, driven by increasing healthcare expenditure, technological adoption, and government initiatives in countries like China, Japan, and South Korea.

Key market barriers include high development costs, with typical R&D cycles for implantable bioelectronic devices exceeding 5-7 years and requiring investments of 50-100 million USD before commercialization. Regulatory approval processes remain lengthy and complex, particularly for invasive technologies, with FDA approval timelines averaging 3-5 years for novel bioelectronic implants.

Customer adoption faces challenges related to cost (with advanced neural implants typically priced between 10,000-50,000 USD), concerns about long-term biocompatibility, and data privacy considerations. However, reimbursement policies are gradually evolving to support these technologies, with several major insurers now covering bioelectronic treatments for specific conditions.

Current Technological Landscape and Challenges

Bioelectronic interface technologies have witnessed remarkable advancement over the past decade, with significant breakthroughs in neural interfaces, wearable biosensors, and implantable devices. Currently, the global landscape is characterized by a diverse ecosystem of academic research institutions, medical technology companies, and technology giants investing heavily in this domain. The United States and Europe lead in terms of research output and commercial applications, while China, Japan, and South Korea are rapidly closing the gap with increased funding and strategic initiatives.

Despite impressive progress, the field faces substantial technical challenges. Biocompatibility remains a critical concern, as long-term implantation often triggers immune responses leading to device degradation and tissue damage. Current materials science approaches have yielded promising biocompatible coatings, but complete integration with biological systems without adverse reactions remains elusive.

Signal fidelity and stability present another significant hurdle. Bioelectronic interfaces must maintain consistent performance in the dynamic biological environment, where factors such as tissue movement, electrode degradation, and signal drift compromise reliability. The signal-to-noise ratio deteriorates over time, limiting the longevity of implanted devices to typically 3-5 years before replacement becomes necessary.

Power management constitutes a fundamental constraint. While external devices can rely on conventional batteries, implantable technologies require innovative energy solutions. Wireless power transfer technologies show promise but face efficiency limitations when transmitting through biological tissues. Energy harvesting from biological sources (such as glucose or mechanical movement) remains in early experimental stages with output levels insufficient for many applications.

Miniaturization challenges persist as researchers strive to develop less invasive devices without compromising functionality. Current manufacturing techniques struggle to integrate multiple sensing modalities, processing capabilities, and communication systems into microscale devices suitable for biological integration.

Data processing and interpretation represent increasingly complex challenges as the volume and dimensionality of biological data grow. Real-time processing of neural signals, for instance, requires sophisticated algorithms capable of extracting meaningful information from noisy biological data while operating within the power and computational constraints of implantable systems.

Regulatory frameworks worldwide have not kept pace with technological advancements, creating uncertainty for developers. The FDA in the United States has established guidelines for some bioelectronic medical devices, but novel interfaces often fall into regulatory gray areas, extending development timelines and increasing costs.

Geographical distribution of expertise shows concentration in technology hubs with strong medical research infrastructure. The Boston-Cambridge corridor, San Francisco Bay Area, and Minneapolis in the US; Munich and Cambridge in Europe; and emerging clusters in Shenzhen and Seoul represent the primary innovation centers where cross-disciplinary collaboration between engineers, neuroscientists, and medical professionals drives progress in this field.

Despite impressive progress, the field faces substantial technical challenges. Biocompatibility remains a critical concern, as long-term implantation often triggers immune responses leading to device degradation and tissue damage. Current materials science approaches have yielded promising biocompatible coatings, but complete integration with biological systems without adverse reactions remains elusive.

Signal fidelity and stability present another significant hurdle. Bioelectronic interfaces must maintain consistent performance in the dynamic biological environment, where factors such as tissue movement, electrode degradation, and signal drift compromise reliability. The signal-to-noise ratio deteriorates over time, limiting the longevity of implanted devices to typically 3-5 years before replacement becomes necessary.

Power management constitutes a fundamental constraint. While external devices can rely on conventional batteries, implantable technologies require innovative energy solutions. Wireless power transfer technologies show promise but face efficiency limitations when transmitting through biological tissues. Energy harvesting from biological sources (such as glucose or mechanical movement) remains in early experimental stages with output levels insufficient for many applications.

Miniaturization challenges persist as researchers strive to develop less invasive devices without compromising functionality. Current manufacturing techniques struggle to integrate multiple sensing modalities, processing capabilities, and communication systems into microscale devices suitable for biological integration.

Data processing and interpretation represent increasingly complex challenges as the volume and dimensionality of biological data grow. Real-time processing of neural signals, for instance, requires sophisticated algorithms capable of extracting meaningful information from noisy biological data while operating within the power and computational constraints of implantable systems.

Regulatory frameworks worldwide have not kept pace with technological advancements, creating uncertainty for developers. The FDA in the United States has established guidelines for some bioelectronic medical devices, but novel interfaces often fall into regulatory gray areas, extending development timelines and increasing costs.

Geographical distribution of expertise shows concentration in technology hubs with strong medical research infrastructure. The Boston-Cambridge corridor, San Francisco Bay Area, and Minneapolis in the US; Munich and Cambridge in Europe; and emerging clusters in Shenzhen and Seoul represent the primary innovation centers where cross-disciplinary collaboration between engineers, neuroscientists, and medical professionals drives progress in this field.

Current Bioelectronic Interface Solutions

01 Neural interface technologies

Neural interface technologies involve the development of devices that can directly interact with the nervous system. These interfaces can record neural activity, stimulate neurons, or both, enabling communication between the brain and external devices. Applications include neuroprosthetics, brain-computer interfaces, and treatments for neurological disorders. These technologies typically use electrodes or sensor arrays that can detect electrical signals from neurons and may incorporate signal processing algorithms to interpret neural activity patterns.- Neural-electronic interfaces for biosensing: Neural-electronic interfaces enable direct communication between biological neural systems and electronic devices. These technologies incorporate biocompatible materials and microelectrode arrays that can detect and record neural signals with high precision. Advanced biosensing capabilities allow for real-time monitoring of neural activity, which has applications in neurological research, diagnostics, and the development of neural prosthetics. These interfaces often utilize nanomaterials to improve signal transduction and biocompatibility.

- Implantable bioelectronic devices: Implantable bioelectronic devices represent a significant advancement in medical technology, allowing for long-term integration with biological tissues. These devices incorporate biocompatible materials and specialized coatings to minimize immune responses and enhance tissue integration. They can monitor physiological parameters, deliver therapeutic stimulation, or restore lost biological functions. Design considerations include power management, wireless communication capabilities, and miniaturization to ensure minimal invasiveness while maintaining functionality.

- Flexible and wearable bioelectronic sensors: Flexible and wearable bioelectronic sensors are designed to conform to the body's contours while maintaining reliable signal detection. These technologies utilize stretchable substrates, conductive polymers, and thin-film electronics to create comfortable, non-invasive monitoring systems. They can continuously track various physiological parameters including heart rate, temperature, and biochemical markers in bodily fluids. The integration of wireless communication modules enables real-time data transmission to healthcare providers or personal devices for continuous health monitoring.

- Molecular and cellular bioelectronic interfaces: Molecular and cellular bioelectronic interfaces operate at the microscopic level, enabling direct interaction with biological molecules and cells. These technologies incorporate specialized surface modifications and biomolecular recognition elements to achieve high specificity in detecting cellular activities or biomolecules. Applications include lab-on-a-chip devices, cell-based biosensors, and systems for drug discovery. Advanced fabrication techniques allow for precise patterning of bioactive molecules on electronic substrates to create functional bioelectronic systems.

- Data processing and communication systems for bioelectronic interfaces: Data processing and communication systems are essential components of bioelectronic interface technologies, handling the acquisition, processing, and transmission of biological signals. These systems incorporate specialized algorithms for signal filtering, feature extraction, and pattern recognition to interpret complex biological data. Low-power wireless communication protocols enable efficient data transmission while minimizing energy consumption. Cloud-based platforms and edge computing solutions provide scalable data storage and analysis capabilities, facilitating remote monitoring and personalized healthcare applications.

02 Bioelectronic sensing platforms

Bioelectronic sensing platforms integrate biological components with electronic systems to detect and measure biological signals or analytes. These platforms may use enzymes, antibodies, or other biomolecules as recognition elements coupled with electronic transducers to convert biological events into measurable electrical signals. Applications include point-of-care diagnostics, continuous health monitoring, and environmental sensing. Advanced platforms may incorporate microfluidics, nanomaterials, or flexible electronics to enhance sensitivity and usability.Expand Specific Solutions03 Implantable bioelectronic devices

Implantable bioelectronic devices are designed to function within the body for extended periods, providing therapeutic interventions or monitoring physiological parameters. These devices must address challenges of biocompatibility, power supply, and long-term stability in the biological environment. Materials and coatings are developed to minimize foreign body responses and enhance integration with surrounding tissues. Applications include cardiac pacemakers, neurostimulators, drug delivery systems, and continuous glucose monitors.Expand Specific Solutions04 Flexible and wearable bioelectronics

Flexible and wearable bioelectronic technologies are designed to conform to the body's contours and movements while maintaining functionality. These devices typically use stretchable substrates, conductive polymers, or thin-film electronics that can bend and flex without performance degradation. Applications include skin-mounted sensors, electronic tattoos, smart textiles, and conformable electrode arrays. These technologies enable continuous monitoring of physiological parameters in daily life settings without restricting movement or causing discomfort.Expand Specific Solutions05 Bioelectronic data processing and communication systems

Bioelectronic data processing and communication systems handle the acquisition, processing, transmission, and interpretation of signals from bioelectronic interfaces. These systems may incorporate specialized algorithms for noise reduction, feature extraction, and pattern recognition to interpret complex biological signals. Wireless communication protocols are developed to transmit data securely while minimizing power consumption. Cloud-based platforms and mobile applications may be used for data storage, visualization, and analysis, enabling remote monitoring and telemedicine applications.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The bioelectronic interface technologies market is currently in a growth phase, characterized by increasing convergence between electronics and biological systems. The global market size is projected to expand significantly, driven by applications in healthcare monitoring, neural interfaces, and diagnostics. From a technological maturity perspective, established players like Agilent Technologies, Infineon Technologies, and Philips are advancing commercial applications, while academic institutions such as MIT, Johns Hopkins, and Northwestern University are pioneering fundamental research breakthroughs. Research-focused companies like ACEA Bio and Carterra are bridging the gap between academic innovation and commercial viability. The competitive landscape features a mix of large medical device manufacturers, specialized biotech firms, and academic spinoffs, with increasing collaboration between industry and research institutions accelerating technology transfer and commercialization pathways.

Massachusetts Institute of Technology

Technical Solution: MIT has pioneered advanced bioelectronic interfaces that bridge biological systems with electronic devices. Their technology focuses on flexible, biocompatible materials that can seamlessly integrate with living tissue. MIT researchers have developed nanoscale sensors capable of detecting specific biomarkers and neural signals with unprecedented precision. Their platform incorporates wireless power and data transmission capabilities, enabling long-term implantation without battery replacement requirements. The institute has made significant breakthroughs in neural interfaces that can record from thousands of neurons simultaneously while minimizing tissue damage and inflammatory responses. MIT's bioelectronic interfaces utilize advanced signal processing algorithms that filter noise and extract meaningful biological signals, enhancing the reliability of data collection for both research and clinical applications.

Strengths: Superior material science expertise allowing for highly biocompatible interfaces; exceptional signal processing capabilities; strong interdisciplinary collaboration between engineering and biological sciences. Weaknesses: Higher production costs compared to conventional technologies; complex manufacturing processes that may limit scalability; potential regulatory hurdles for clinical translation.

The Regents of the University of Michigan

Technical Solution: The University of Michigan has developed comprehensive bioelectronic interface technologies focusing on neural recording and stimulation systems. Their platform features ultra-small, high-density electrode arrays manufactured using advanced microfabrication techniques that minimize tissue damage while maximizing signal quality. Michigan's technology incorporates custom integrated circuits that enable simultaneous recording from hundreds of channels with low power consumption. Their interfaces utilize proprietary coatings that reduce biofouling and extend device longevity in vivo. The university has pioneered closed-loop systems that can detect specific neural patterns and deliver targeted stimulation in response, creating adaptive bioelectronic therapies. Michigan's interfaces have demonstrated exceptional stability in chronic implantation scenarios, maintaining functionality for years rather than months as seen with conventional technologies.

Strengths: Industry-leading microfabrication capabilities; extensive experience in long-term implantable electronics; strong track record of clinical translation. Weaknesses: Higher initial development costs; specialized expertise required for implementation; potential challenges with full wireless implementation in complex applications.

Critical Patents and Technical Innovations

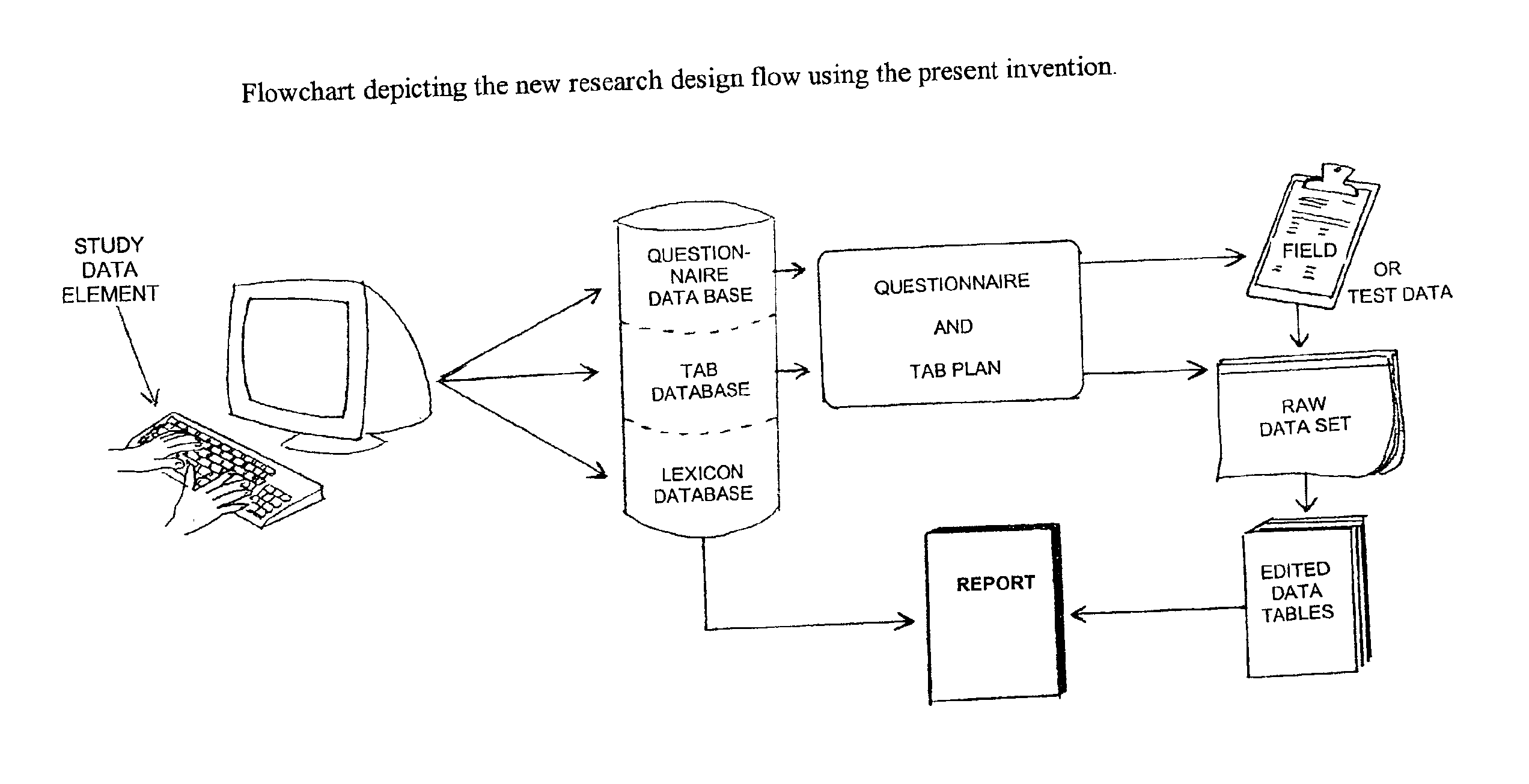

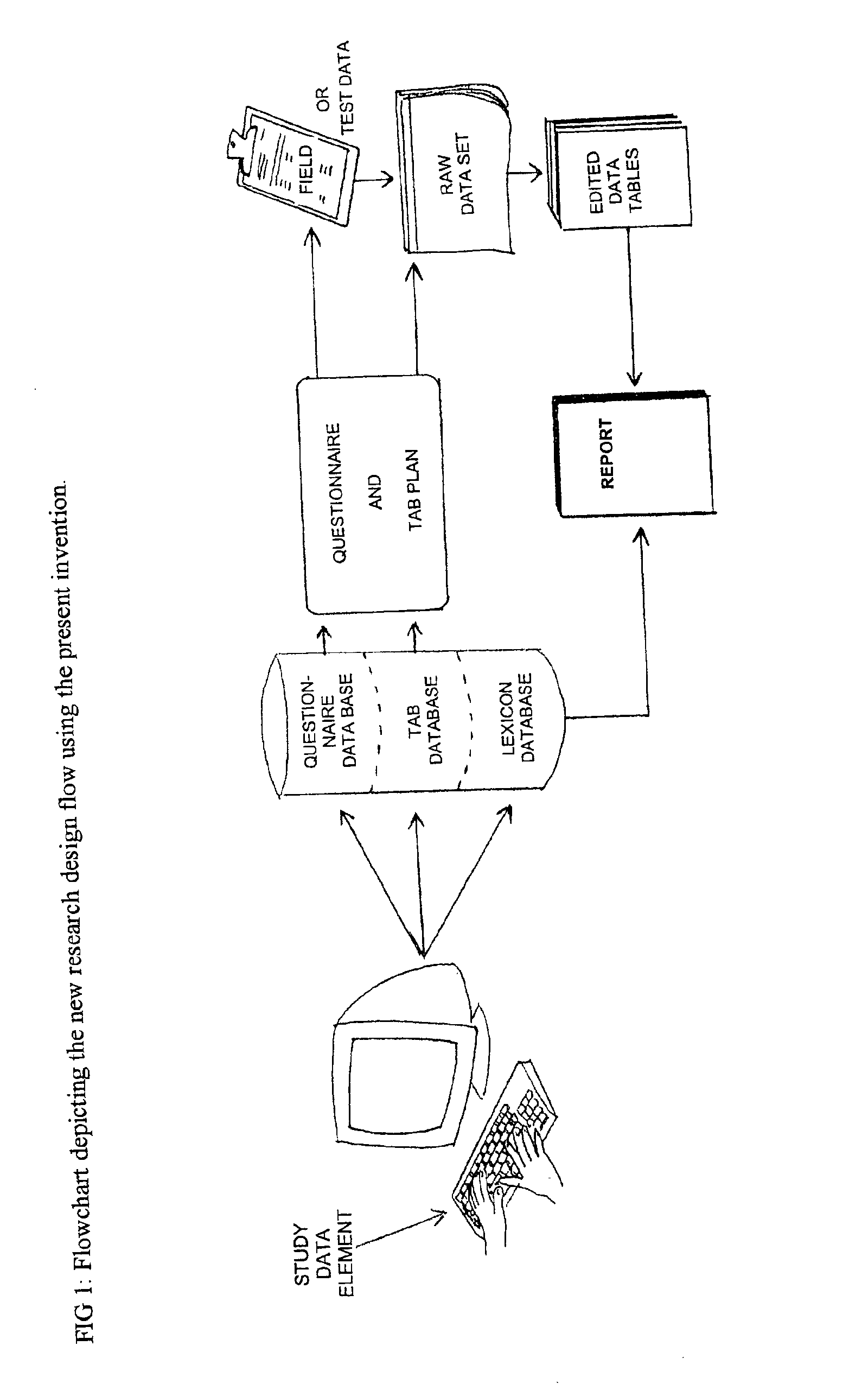

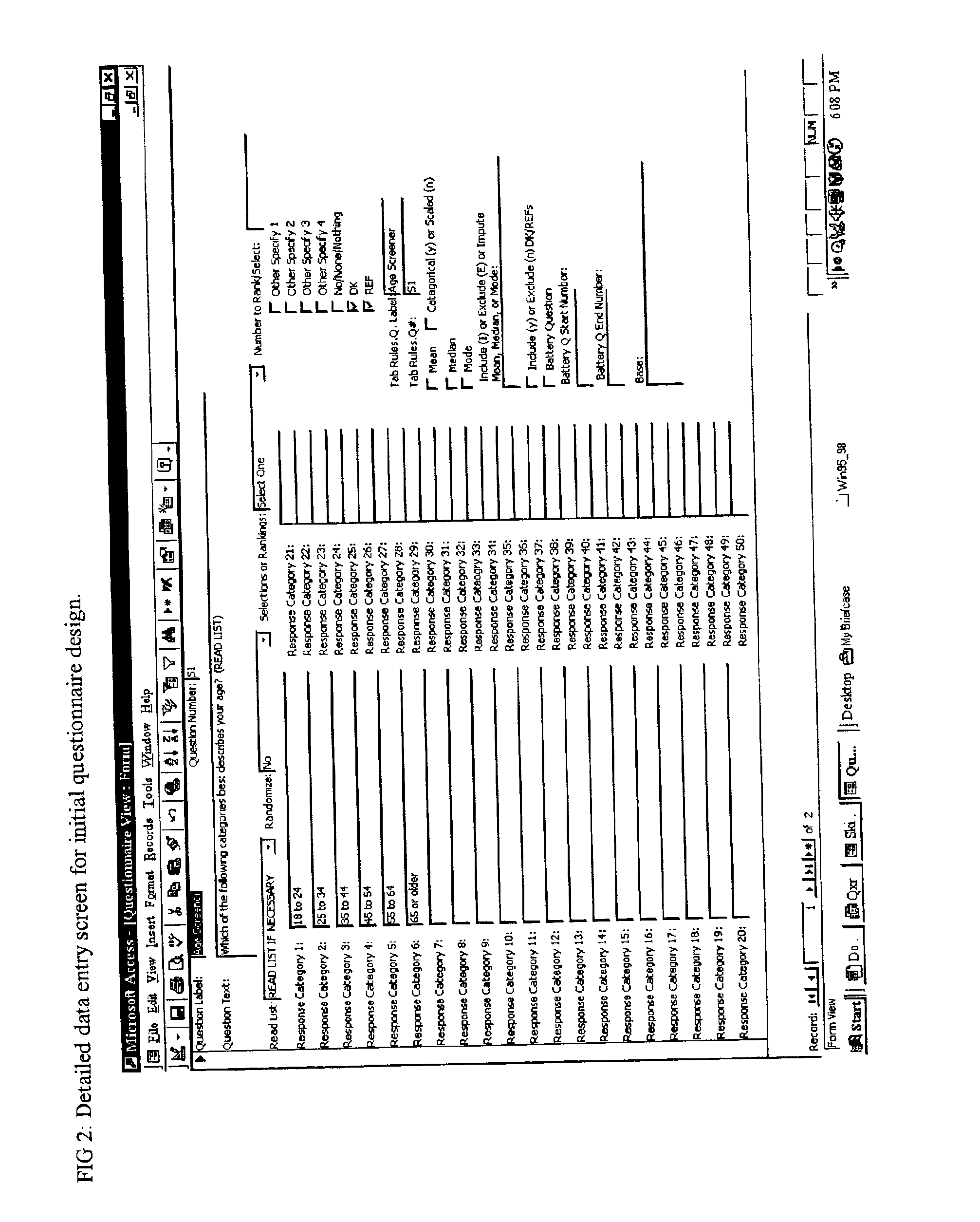

Method and apparatus for the design and analysis of market research studies

PatentInactiveUS6865578B2

Innovation

- A computer program that automates market research study design and analysis by using a database framework to store all data elements, applying rule-driven artificial intelligence to generate reports, and enabling wave-to-wave comparisons, statistical testing, and data cleaning, independent of field methodology, thus reducing redundant work and improving data consistency.

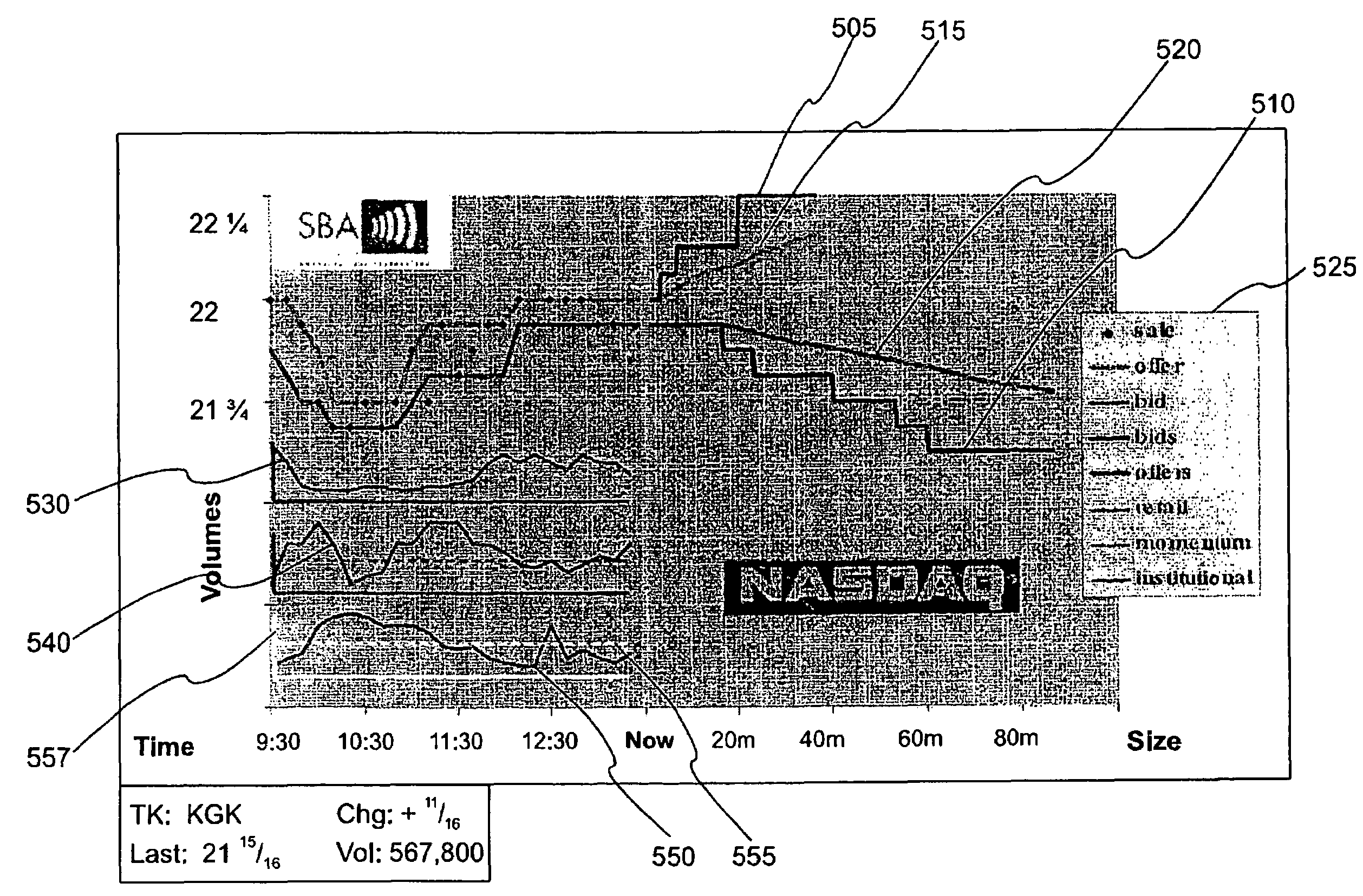

System and method for displaying market information

PatentInactiveUS7308428B1

Innovation

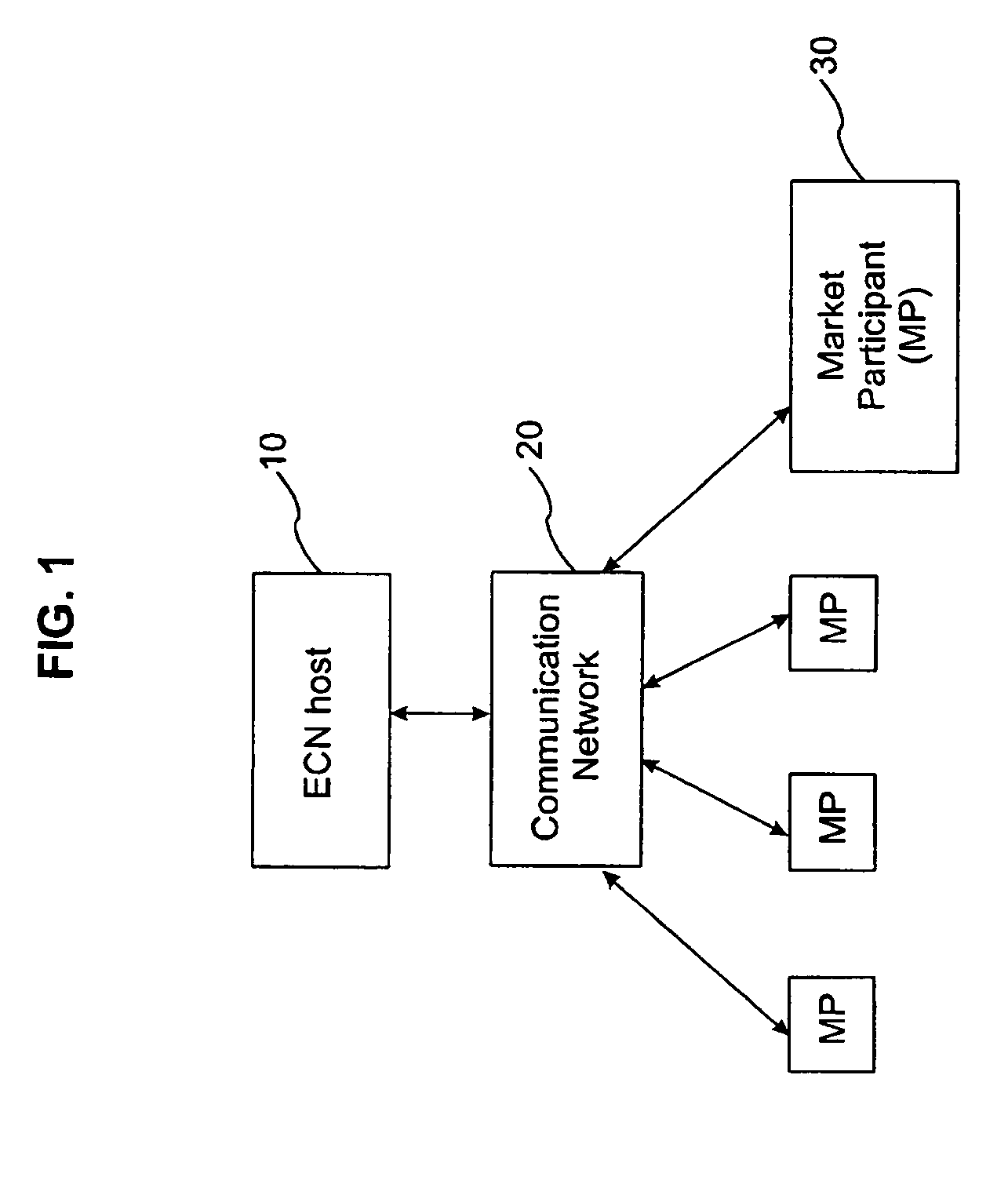

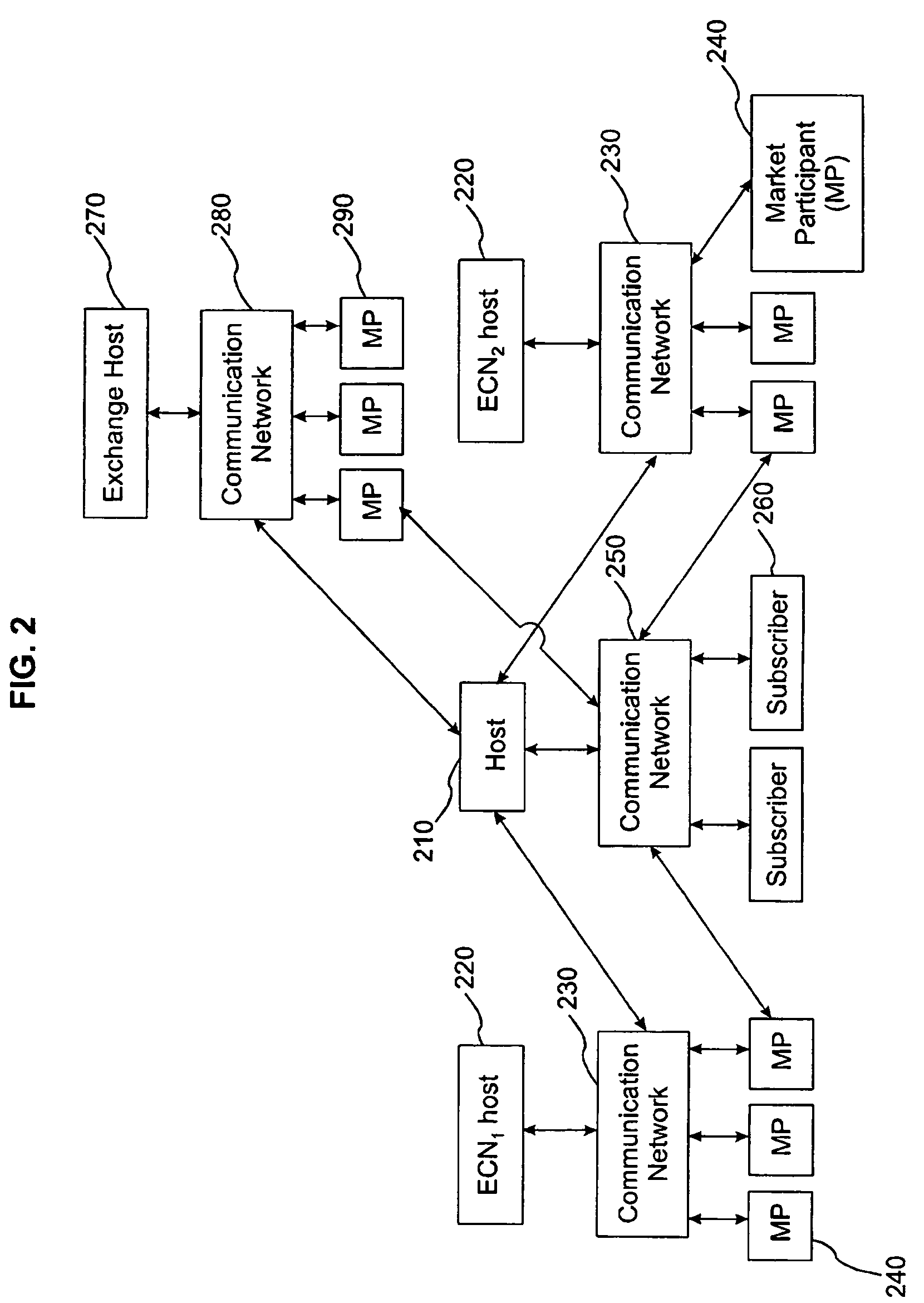

- A graphical market display system that integrates intra-day trading activity by classes of market participants and projected market impact as a function of trade size, using real-time calculations on the executable orders in an electronic securities trade execution network, generating weighted average prices and marginal execution price functions, and separating trade data by market participant class for enhanced analysis.

Regulatory Framework and Compliance Requirements

The regulatory landscape for bioelectronic interface technologies is complex and multifaceted, spanning across medical device regulations, data privacy laws, and ethical guidelines. In the United States, the Food and Drug Administration (FDA) classifies most bioelectronic interfaces as Class II or Class III medical devices, requiring either 510(k) clearance or premarket approval (PMA). The regulatory pathway depends on the specific application, invasiveness, and risk profile of the technology.

The European Union's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) impose stringent requirements for bioelectronic interfaces, including comprehensive clinical evaluation, post-market surveillance, and unique device identification. These regulations, fully implemented in 2021, have significantly increased the compliance burden for manufacturers seeking European market access.

Data privacy considerations are particularly critical for bioelectronic interfaces that collect physiological data. The General Data Protection Regulation (GDPR) in Europe and various state-level regulations in the US, such as the California Consumer Privacy Act (CCPA), mandate strict protocols for data collection, storage, processing, and sharing. These regulations necessitate robust data protection measures, informed consent procedures, and transparent data management policies.

Cybersecurity requirements represent another crucial regulatory dimension. The FDA has issued guidance on cybersecurity for medical devices, emphasizing the need for security risk management throughout the product lifecycle. Similar requirements exist in other major markets, reflecting growing concerns about potential vulnerabilities in connected bioelectronic devices.

International harmonization efforts, such as the Medical Device Single Audit Program (MDSAP) and the International Medical Device Regulators Forum (IMDRF), aim to streamline regulatory processes across different jurisdictions. However, significant regional variations persist, creating compliance challenges for global market entry strategies.

Emerging ethical frameworks and standards are also shaping the regulatory environment. Issues such as neural data rights, cognitive liberty, and equitable access are increasingly addressed in guidelines from organizations like the IEEE and the World Health Organization. These ethical considerations often precede formal regulations but can significantly influence market acceptance and institutional adoption.

Companies developing bioelectronic interface technologies must implement comprehensive regulatory strategies early in the product development cycle. This includes regulatory classification analysis, quality management systems compliant with ISO 13485, risk management processes aligned with ISO 14971, and biocompatibility testing according to ISO 10993 standards. Early engagement with regulatory authorities through pre-submission consultations can provide valuable guidance and potentially expedite the approval process.

The European Union's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) impose stringent requirements for bioelectronic interfaces, including comprehensive clinical evaluation, post-market surveillance, and unique device identification. These regulations, fully implemented in 2021, have significantly increased the compliance burden for manufacturers seeking European market access.

Data privacy considerations are particularly critical for bioelectronic interfaces that collect physiological data. The General Data Protection Regulation (GDPR) in Europe and various state-level regulations in the US, such as the California Consumer Privacy Act (CCPA), mandate strict protocols for data collection, storage, processing, and sharing. These regulations necessitate robust data protection measures, informed consent procedures, and transparent data management policies.

Cybersecurity requirements represent another crucial regulatory dimension. The FDA has issued guidance on cybersecurity for medical devices, emphasizing the need for security risk management throughout the product lifecycle. Similar requirements exist in other major markets, reflecting growing concerns about potential vulnerabilities in connected bioelectronic devices.

International harmonization efforts, such as the Medical Device Single Audit Program (MDSAP) and the International Medical Device Regulators Forum (IMDRF), aim to streamline regulatory processes across different jurisdictions. However, significant regional variations persist, creating compliance challenges for global market entry strategies.

Emerging ethical frameworks and standards are also shaping the regulatory environment. Issues such as neural data rights, cognitive liberty, and equitable access are increasingly addressed in guidelines from organizations like the IEEE and the World Health Organization. These ethical considerations often precede formal regulations but can significantly influence market acceptance and institutional adoption.

Companies developing bioelectronic interface technologies must implement comprehensive regulatory strategies early in the product development cycle. This includes regulatory classification analysis, quality management systems compliant with ISO 13485, risk management processes aligned with ISO 14971, and biocompatibility testing according to ISO 10993 standards. Early engagement with regulatory authorities through pre-submission consultations can provide valuable guidance and potentially expedite the approval process.

Healthcare Integration and Clinical Applications

The integration of bioelectronic interface technologies into healthcare systems represents a critical frontier for advancing patient care and clinical outcomes. Healthcare providers are increasingly recognizing the value of these technologies in monitoring, diagnosing, and treating various conditions with unprecedented precision and personalization.

Clinical applications of bioelectronic interfaces span multiple medical specialties. In neurology, these technologies enable real-time monitoring of brain activity for patients with epilepsy, allowing for more timely interventions and improved seizure management. Cardiology departments utilize bioelectronic monitoring systems for continuous cardiac assessment, particularly beneficial for patients with arrhythmias or those recovering from cardiac events.

The demand for seamless integration into existing healthcare infrastructures presents both challenges and opportunities. Electronic health record (EHR) compatibility remains a primary concern, with healthcare institutions seeking bioelectronic solutions that can efficiently transmit, store, and analyze patient data within established systems. This integration requirement has spurred development of standardized communication protocols and interoperability frameworks specifically designed for bioelectronic devices.

Clinical validation represents another crucial aspect of healthcare integration. Medical professionals increasingly demand robust clinical trial evidence demonstrating not only the efficacy of bioelectronic interfaces but also their practical implementation within routine clinical workflows. Technologies that minimize disruption to established procedures while enhancing diagnostic or therapeutic capabilities receive preferential adoption.

Remote patient monitoring applications have emerged as a particularly high-demand segment, accelerated by recent global healthcare challenges. Bioelectronic interfaces that enable continuous monitoring outside traditional healthcare settings reduce hospitalization rates while improving patient outcomes through early intervention. This trend aligns with the broader shift toward decentralized healthcare delivery models.

Regulatory pathways for bioelectronic medical devices continue to evolve, with healthcare systems requiring technologies that meet increasingly stringent safety and efficacy standards. Solutions that address regulatory compliance while maintaining clinical utility position themselves advantageously in this competitive landscape.

Cost-effectiveness analysis has become integral to healthcare integration decisions. Bioelectronic technologies demonstrating clear economic benefits through reduced hospitalization rates, decreased complication incidence, or improved treatment efficiency gain significant traction among healthcare administrators and insurance providers, who increasingly influence technology adoption decisions.

Clinical applications of bioelectronic interfaces span multiple medical specialties. In neurology, these technologies enable real-time monitoring of brain activity for patients with epilepsy, allowing for more timely interventions and improved seizure management. Cardiology departments utilize bioelectronic monitoring systems for continuous cardiac assessment, particularly beneficial for patients with arrhythmias or those recovering from cardiac events.

The demand for seamless integration into existing healthcare infrastructures presents both challenges and opportunities. Electronic health record (EHR) compatibility remains a primary concern, with healthcare institutions seeking bioelectronic solutions that can efficiently transmit, store, and analyze patient data within established systems. This integration requirement has spurred development of standardized communication protocols and interoperability frameworks specifically designed for bioelectronic devices.

Clinical validation represents another crucial aspect of healthcare integration. Medical professionals increasingly demand robust clinical trial evidence demonstrating not only the efficacy of bioelectronic interfaces but also their practical implementation within routine clinical workflows. Technologies that minimize disruption to established procedures while enhancing diagnostic or therapeutic capabilities receive preferential adoption.

Remote patient monitoring applications have emerged as a particularly high-demand segment, accelerated by recent global healthcare challenges. Bioelectronic interfaces that enable continuous monitoring outside traditional healthcare settings reduce hospitalization rates while improving patient outcomes through early intervention. This trend aligns with the broader shift toward decentralized healthcare delivery models.

Regulatory pathways for bioelectronic medical devices continue to evolve, with healthcare systems requiring technologies that meet increasingly stringent safety and efficacy standards. Solutions that address regulatory compliance while maintaining clinical utility position themselves advantageously in this competitive landscape.

Cost-effectiveness analysis has become integral to healthcare integration decisions. Bioelectronic technologies demonstrating clear economic benefits through reduced hospitalization rates, decreased complication incidence, or improved treatment efficiency gain significant traction among healthcare administrators and insurance providers, who increasingly influence technology adoption decisions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!