Analysis of Market Trends for Bioelectronic Interface Technologies

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bioelectronic Interface Evolution and Objectives

Bioelectronic interfaces represent a revolutionary convergence of electronics and biology, enabling direct communication between electronic devices and biological systems. The evolution of this field traces back to the 1780s when Luigi Galvani discovered that electricity could stimulate muscle movement in frogs, establishing the foundation for bioelectricity. The modern era of bioelectronic interfaces began in the 1950s with the development of the first implantable cardiac pacemakers, demonstrating the practical application of electronic devices interfacing with biological systems.

The 1970s marked significant advancements with the emergence of cochlear implants, while the 1990s witnessed the development of deep brain stimulation technologies for treating neurological disorders. The early 2000s brought miniaturization and wireless capabilities, dramatically expanding the potential applications of bioelectronic interfaces. Recent years have seen exponential growth in this field, driven by nanotechnology, flexible electronics, and advanced materials science.

Current bioelectronic interface technologies encompass a wide spectrum of applications, including neural interfaces for brain-computer communication, retinal implants for vision restoration, and peripheral nerve stimulators for pain management. The integration of artificial intelligence and machine learning algorithms has further enhanced the adaptability and functionality of these systems, allowing for more personalized and responsive interventions.

The primary objective of bioelectronic interface development is to create seamless, biocompatible connections between electronic devices and biological tissues that can effectively transmit and receive signals with minimal invasiveness and maximum longevity. This involves overcoming significant challenges related to biocompatibility, power requirements, signal fidelity, and long-term stability in the biological environment.

Future objectives include developing fully implantable, self-powered systems that can operate autonomously within the body for extended periods. There is also a strong focus on creating bidirectional interfaces capable of both sensing biological signals and delivering precise therapeutic interventions. The ultimate goal is to develop interfaces that can integrate with the nervous system at the cellular level, enabling unprecedented control and restoration of biological functions.

The trajectory of bioelectronic interfaces is moving toward increasingly sophisticated, miniaturized, and personalized systems that can adapt to individual physiological conditions. As this technology continues to evolve, it promises to revolutionize healthcare by offering novel approaches to treating previously intractable conditions and enhancing human capabilities through direct electronic-biological integration.

The 1970s marked significant advancements with the emergence of cochlear implants, while the 1990s witnessed the development of deep brain stimulation technologies for treating neurological disorders. The early 2000s brought miniaturization and wireless capabilities, dramatically expanding the potential applications of bioelectronic interfaces. Recent years have seen exponential growth in this field, driven by nanotechnology, flexible electronics, and advanced materials science.

Current bioelectronic interface technologies encompass a wide spectrum of applications, including neural interfaces for brain-computer communication, retinal implants for vision restoration, and peripheral nerve stimulators for pain management. The integration of artificial intelligence and machine learning algorithms has further enhanced the adaptability and functionality of these systems, allowing for more personalized and responsive interventions.

The primary objective of bioelectronic interface development is to create seamless, biocompatible connections between electronic devices and biological tissues that can effectively transmit and receive signals with minimal invasiveness and maximum longevity. This involves overcoming significant challenges related to biocompatibility, power requirements, signal fidelity, and long-term stability in the biological environment.

Future objectives include developing fully implantable, self-powered systems that can operate autonomously within the body for extended periods. There is also a strong focus on creating bidirectional interfaces capable of both sensing biological signals and delivering precise therapeutic interventions. The ultimate goal is to develop interfaces that can integrate with the nervous system at the cellular level, enabling unprecedented control and restoration of biological functions.

The trajectory of bioelectronic interfaces is moving toward increasingly sophisticated, miniaturized, and personalized systems that can adapt to individual physiological conditions. As this technology continues to evolve, it promises to revolutionize healthcare by offering novel approaches to treating previously intractable conditions and enhancing human capabilities through direct electronic-biological integration.

Market Demand Analysis for Bioelectronic Solutions

The bioelectronic interface technology market is experiencing unprecedented growth, driven by increasing demand for advanced healthcare solutions and human-machine integration capabilities. Current market valuations indicate the global bioelectronic interface sector reached approximately 5.7 billion USD in 2022, with projections suggesting a compound annual growth rate of 12.3% through 2030. This remarkable expansion reflects the convergence of multiple market forces and evolving consumer needs across healthcare, consumer electronics, and industrial applications.

Healthcare remains the dominant market segment, accounting for over 60% of current bioelectronic interface applications. Within this sector, neurostimulation devices for pain management and neurological disorder treatment represent the fastest-growing subsegment, expanding at nearly 15% annually. The aging global population and rising prevalence of chronic conditions have created substantial demand for minimally invasive therapeutic options that bioelectronic interfaces can provide.

Consumer demand for bioelectronic solutions is increasingly driven by personalization requirements. Market research indicates that 78% of potential users express strong preference for customizable bioelectronic interfaces that adapt to individual physiological characteristics. This trend is particularly pronounced in wearable health monitoring devices, where user experience and comfort significantly influence adoption rates.

Emerging markets in Asia-Pacific, particularly China and India, are showing the highest growth potential, with adoption rates increasing by 18% annually. These regions benefit from expanding healthcare infrastructure, rising disposable incomes, and favorable regulatory environments for medical technology innovation. Market penetration in these regions remains relatively low compared to North America and Europe, suggesting substantial untapped potential.

Reimbursement policies and insurance coverage represent critical market enablers. Analysis shows that bioelectronic solutions with established reimbursement pathways achieve market penetration rates approximately 3.5 times higher than those without such coverage. This factor is particularly significant for high-cost implantable interfaces, where out-of-pocket expenses can otherwise limit accessibility.

Industrial applications for bioelectronic interfaces, including enhanced human-machine interfaces for manufacturing and specialized environments, constitute a rapidly expanding market segment growing at 14% annually. This growth is driven by increasing automation and the need for more intuitive control systems in complex operational settings.

Market barriers include concerns about data privacy, with surveys indicating 67% of potential users express significant reservations about the collection and use of their physiological data. Additionally, high initial development and manufacturing costs continue to limit broader market penetration, particularly in price-sensitive segments and regions.

Healthcare remains the dominant market segment, accounting for over 60% of current bioelectronic interface applications. Within this sector, neurostimulation devices for pain management and neurological disorder treatment represent the fastest-growing subsegment, expanding at nearly 15% annually. The aging global population and rising prevalence of chronic conditions have created substantial demand for minimally invasive therapeutic options that bioelectronic interfaces can provide.

Consumer demand for bioelectronic solutions is increasingly driven by personalization requirements. Market research indicates that 78% of potential users express strong preference for customizable bioelectronic interfaces that adapt to individual physiological characteristics. This trend is particularly pronounced in wearable health monitoring devices, where user experience and comfort significantly influence adoption rates.

Emerging markets in Asia-Pacific, particularly China and India, are showing the highest growth potential, with adoption rates increasing by 18% annually. These regions benefit from expanding healthcare infrastructure, rising disposable incomes, and favorable regulatory environments for medical technology innovation. Market penetration in these regions remains relatively low compared to North America and Europe, suggesting substantial untapped potential.

Reimbursement policies and insurance coverage represent critical market enablers. Analysis shows that bioelectronic solutions with established reimbursement pathways achieve market penetration rates approximately 3.5 times higher than those without such coverage. This factor is particularly significant for high-cost implantable interfaces, where out-of-pocket expenses can otherwise limit accessibility.

Industrial applications for bioelectronic interfaces, including enhanced human-machine interfaces for manufacturing and specialized environments, constitute a rapidly expanding market segment growing at 14% annually. This growth is driven by increasing automation and the need for more intuitive control systems in complex operational settings.

Market barriers include concerns about data privacy, with surveys indicating 67% of potential users express significant reservations about the collection and use of their physiological data. Additionally, high initial development and manufacturing costs continue to limit broader market penetration, particularly in price-sensitive segments and regions.

Current Technological Landscape and Barriers

The bioelectronic interface technology landscape has evolved significantly over the past decade, with remarkable advancements in both invasive and non-invasive neural interfaces. Currently, the field is dominated by electrode-based systems, including microelectrode arrays (MEAs), flexible electronics, and electrocorticography (ECoG) grids. These technologies have enabled direct recording and stimulation of neural activity with varying degrees of spatial and temporal resolution. Alongside these, optical technologies such as optogenetics and functional near-infrared spectroscopy (fNIRS) have emerged as complementary approaches for neural interfacing.

Despite these advancements, the field faces substantial technical challenges. Biocompatibility remains a critical barrier, as long-term implantation often triggers foreign body responses leading to electrode encapsulation and signal degradation. Current materials struggle to match the mechanical properties of neural tissue, creating micro-motion that damages surrounding cells and compromises interface stability. Additionally, achieving high spatial resolution while maintaining minimal invasiveness presents an ongoing engineering dilemma.

Power management constitutes another significant hurdle, particularly for implantable devices that require miniaturization while maintaining sufficient energy for continuous operation. Wireless power transmission technologies have improved but still face efficiency and safety limitations when deployed in biological environments. Data bandwidth constraints further complicate real-time neural signal processing, especially for high-channel-count interfaces necessary for complex applications.

From a geographical perspective, North America leads in bioelectronic interface research and commercialization, with major innovation hubs in California's Silicon Valley and Boston's biotech corridor. Europe follows closely, with strong academic-industrial partnerships in countries like Switzerland, Germany, and the UK. The Asia-Pacific region, particularly Japan, South Korea, and increasingly China, has demonstrated rapid growth in patent filings and research output in this domain over the past five years.

Regulatory frameworks present another significant barrier to widespread adoption. The FDA in the United States and similar bodies globally have established stringent requirements for neural interface technologies, particularly those intended for human implantation. The lengthy approval processes, which can extend beyond a decade for invasive technologies, significantly impact commercialization timelines and investment strategies in the sector.

Standardization issues further complicate technology development, with limited consensus on testing protocols, performance metrics, and interoperability standards. This fragmentation impedes cross-platform compatibility and slows the integration of bioelectronic interfaces into broader healthcare and consumer ecosystems, ultimately constraining market expansion despite the promising technological foundations.

Despite these advancements, the field faces substantial technical challenges. Biocompatibility remains a critical barrier, as long-term implantation often triggers foreign body responses leading to electrode encapsulation and signal degradation. Current materials struggle to match the mechanical properties of neural tissue, creating micro-motion that damages surrounding cells and compromises interface stability. Additionally, achieving high spatial resolution while maintaining minimal invasiveness presents an ongoing engineering dilemma.

Power management constitutes another significant hurdle, particularly for implantable devices that require miniaturization while maintaining sufficient energy for continuous operation. Wireless power transmission technologies have improved but still face efficiency and safety limitations when deployed in biological environments. Data bandwidth constraints further complicate real-time neural signal processing, especially for high-channel-count interfaces necessary for complex applications.

From a geographical perspective, North America leads in bioelectronic interface research and commercialization, with major innovation hubs in California's Silicon Valley and Boston's biotech corridor. Europe follows closely, with strong academic-industrial partnerships in countries like Switzerland, Germany, and the UK. The Asia-Pacific region, particularly Japan, South Korea, and increasingly China, has demonstrated rapid growth in patent filings and research output in this domain over the past five years.

Regulatory frameworks present another significant barrier to widespread adoption. The FDA in the United States and similar bodies globally have established stringent requirements for neural interface technologies, particularly those intended for human implantation. The lengthy approval processes, which can extend beyond a decade for invasive technologies, significantly impact commercialization timelines and investment strategies in the sector.

Standardization issues further complicate technology development, with limited consensus on testing protocols, performance metrics, and interoperability standards. This fragmentation impedes cross-platform compatibility and slows the integration of bioelectronic interfaces into broader healthcare and consumer ecosystems, ultimately constraining market expansion despite the promising technological foundations.

Current Bioelectronic Interface Solutions

01 Neural interface technologies for bioelectronic systems

Neural interfaces enable direct communication between electronic devices and the nervous system, forming the foundation of bioelectronic medicine. These technologies include implantable electrodes, sensors, and stimulation devices that can record neural activity or deliver therapeutic stimulation. Advanced materials and designs improve biocompatibility, signal quality, and long-term stability for applications in neurological disorders, prosthetics, and brain-computer interfaces.- Neural interfaces for bioelectronic applications: Neural interfaces enable direct communication between electronic devices and the nervous system, allowing for monitoring and modulation of neural activity. These technologies incorporate electrodes, sensors, and signal processing components to record neural signals and deliver stimulation. Advanced neural interfaces can be used for prosthetic control, treatment of neurological disorders, and brain-computer interfaces that enable direct control of external devices through thought.

- Bioelectronic sensors and detection systems: Bioelectronic sensors integrate biological components with electronic systems to detect specific analytes, biomarkers, or physiological parameters. These sensors utilize various transduction mechanisms to convert biological responses into measurable electrical signals. Applications include point-of-care diagnostics, continuous health monitoring, environmental sensing, and detection of pathogens or toxins with high sensitivity and specificity.

- Implantable bioelectronic devices: Implantable bioelectronic devices are designed to function within the body for extended periods, providing therapeutic interventions or monitoring capabilities. These devices incorporate biocompatible materials, miniaturized electronics, and power management systems to ensure long-term functionality and safety. Examples include cardiac pacemakers, neurostimulators, drug delivery systems, and implantable sensors that can continuously monitor physiological parameters.

- Flexible and wearable bioelectronic interfaces: Flexible and wearable bioelectronic interfaces conform to the body's contours, enabling comfortable, continuous monitoring of physiological signals. These technologies utilize stretchable electronics, conductive polymers, and thin-film fabrication techniques to create devices that can bend and flex with body movement. Applications include skin-mounted sensors, electronic tattoos, smart textiles, and wearable health monitors that can track vital signs and other biomarkers non-invasively.

- Bioelectronic materials and fabrication methods: Advanced materials and fabrication techniques are essential for creating effective bioelectronic interfaces. These include conductive polymers, hydrogels, nanomaterials, and biocompatible coatings that improve the integration between electronic components and biological tissues. Novel fabrication methods such as 3D printing, soft lithography, and microfluidic techniques enable the creation of complex bioelectronic structures with precise control over their properties and functions.

02 Biosensor platforms for bioelectronic detection

Biosensor technologies integrate biological recognition elements with electronic transduction mechanisms to detect biomolecules, pathogens, or physiological parameters. These platforms utilize various sensing modalities including electrochemical, optical, and impedance-based detection methods. Innovations in microfluidics, nanomaterials, and surface functionalization enhance sensitivity, specificity, and multiplexing capabilities for applications in diagnostics, environmental monitoring, and personalized medicine.Expand Specific Solutions03 Flexible and wearable bioelectronic devices

Flexible and wearable bioelectronic technologies enable continuous health monitoring through non-invasive or minimally invasive approaches. These devices incorporate stretchable electronics, conductive polymers, and thin-film technologies to conform to biological tissues while maintaining electronic functionality. Innovations in power management, wireless communication, and data processing support real-time monitoring of physiological parameters for preventive healthcare and chronic disease management.Expand Specific Solutions04 Bioelectronic materials and fabrication methods

Advanced materials and fabrication techniques enable the development of biocompatible electronic components that can interface with biological systems. These include conducting polymers, hydrogels, and nanomaterials that mimic tissue properties while maintaining electronic functionality. Novel manufacturing methods such as 3D bioprinting, soft lithography, and directed assembly techniques allow precise patterning of bioelectronic components for improved integration with living tissues and reduced foreign body response.Expand Specific Solutions05 Bioelectronic systems for therapeutic applications

Therapeutic bioelectronic systems deliver targeted electrical or electrochemical stimulation to modulate physiological processes for treatment of various conditions. These technologies include implantable neuromodulation devices, electroceuticals, and closed-loop systems that can sense biological signals and respond with appropriate therapeutic interventions. Applications span from management of chronic pain and inflammatory disorders to regulation of organ function and drug delivery, offering alternatives to conventional pharmaceutical approaches.Expand Specific Solutions

Key Industry Players and Competitive Dynamics

The bioelectronic interface technology market is currently in a growth phase, characterized by increasing convergence between electronics and biological systems. The global market size is expanding rapidly, projected to reach significant valuation as healthcare applications proliferate. From a technological maturity perspective, the landscape shows varied development stages with established players like Agilent Technologies, Infineon Technologies, and Philips leading commercial applications, while academic institutions (MIT, Johns Hopkins, Zhejiang University) drive fundamental research innovations. Companies like DexCom and ACEA Bio are advancing specialized applications in continuous monitoring and cell-based assays respectively. The competitive dynamics reveal a blend of large electronics corporations, specialized biotech firms, and research institutions forming strategic partnerships to overcome the multidisciplinary challenges of integrating electronic systems with biological environments.

Massachusetts Institute of Technology

Technical Solution: MIT has pioneered advanced bioelectronic interfaces through their development of flexible, ultra-thin electronics that can seamlessly integrate with biological tissues. Their technology includes conformable electrode arrays that can record neural activity with unprecedented spatial resolution while minimizing tissue damage. MIT researchers have created biocompatible materials that reduce foreign body responses, enabling long-term implantation with stable performance. Their neural dust platform represents a significant breakthrough, consisting of millimeter-sized, wireless sensors that can be implanted deep within the body to monitor physiological parameters and neural activity without the need for transcutaneous wires. Additionally, MIT has developed closed-loop neuromodulation systems that can detect specific neural patterns and deliver targeted stimulation in real-time, offering potential treatments for neurological disorders.

Strengths: Exceptional materials science expertise enabling flexible, biocompatible interfaces; strong interdisciplinary collaboration between engineering and biology departments; extensive intellectual property portfolio. Weaknesses: Technologies often require significant further development for commercial applications; high manufacturing costs for specialized materials; regulatory approval pathways remain challenging.

Institute of Electronics Chinese Academy of Sciences

Technical Solution: The Institute of Electronics at the Chinese Academy of Sciences has made significant advances in bioelectronic interface technologies through their development of high-density microelectrode arrays for neural recording and stimulation. Their proprietary fabrication techniques allow for the creation of ultra-thin, flexible electrode arrays with channel counts exceeding 1,024 sites, enabling unprecedented spatial resolution for neural interfaces. The Institute has pioneered novel materials combining graphene and conducting polymers that significantly reduce electrode impedance while increasing charge injection capacity, critical parameters for effective neural stimulation. Their bioelectronic platforms incorporate advanced CMOS (Complementary Metal-Oxide-Semiconductor) circuits that enable on-chip signal amplification and multiplexing, dramatically reducing system size and power requirements. Recent innovations include wireless power and data transmission systems operating at frequencies optimized for biological tissue penetration, allowing fully implantable neural interface systems with no transcutaneous components. The Institute has also developed specialized coating technologies that elute anti-inflammatory compounds to mitigate foreign body responses.

Strengths: Strong integration of materials science, microelectronics, and neural engineering; substantial government funding support; rapidly expanding intellectual property portfolio. Weaknesses: International collaboration limitations may restrict technology transfer; less established regulatory approval experience for medical devices; challenges in clinical translation outside domestic market.

Critical Patents and Research Breakthroughs

Organic transistor-based system for electrophysiological monitoring of cells and method for the monitoring of the cells

PatentActiveUS20180031520A1

Innovation

- A system comprising a plurality of organic thin film transistors with a floating gate electrode, source and drain electrodes, and an insulating layer, operated at low voltages (0.5 V to 2 V) to detect dynamic charge variations in the frequency range of cell electrical activity (1 Hz to 1000 Hz) without an external reference electrode, using a biocompatible sensing area with apertures to expose floating gates to cells, allowing for spatial mapping of cell activity.

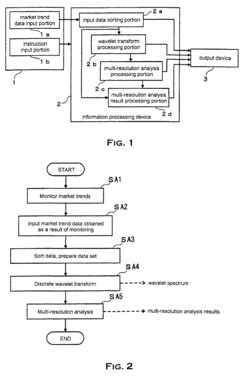

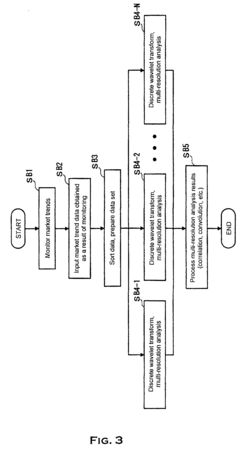

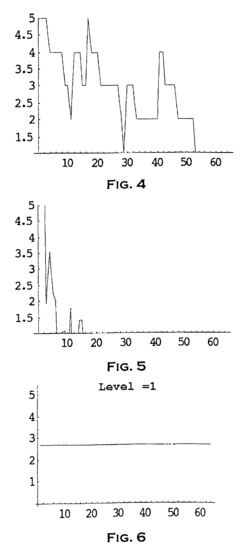

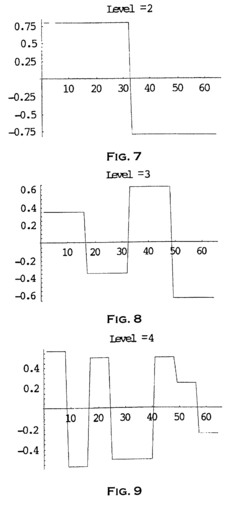

Method and system to analyze market trend

PatentInactiveEP1253526A1

Innovation

- The use of wavelet transforms for objective analysis of market trend data, allowing for multi-resolution analysis and feature extraction from unorganized data, enabling a more comprehensive and objective evaluation of market trends.

Regulatory Framework for Bioelectronic Devices

The regulatory landscape for bioelectronic interface technologies is complex and evolving rapidly as these innovative devices bridge the gap between traditional medical devices and emerging technologies. In the United States, the Food and Drug Administration (FDA) has established a tiered risk-based approach for bioelectronic devices, with Class I devices facing minimal regulation while Class III devices undergo rigorous premarket approval processes. The FDA's Digital Health Innovation Action Plan specifically addresses software components in bioelectronic interfaces, recognizing the unique challenges posed by devices that combine hardware with sophisticated algorithms.

The European Union's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) implemented in 2021 have significantly impacted bioelectronic device manufacturers, introducing more stringent requirements for clinical evidence and post-market surveillance. These regulations have extended classification criteria to include software and AI components integral to many bioelectronic interfaces, requiring manufacturers to demonstrate ongoing safety and performance.

In Asia, regulatory frameworks vary considerably. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has established the SAKIGAKE designation system to expedite approval for innovative medical technologies, including certain bioelectronic interfaces. China has reformed its regulatory system through the National Medical Products Administration (NMPA), implementing special approval pathways for innovative medical devices while maintaining strict control over data security aspects of connected bioelectronic technologies.

Global harmonization efforts through the International Medical Device Regulators Forum (IMDRF) are attempting to standardize requirements for Software as a Medical Device (SaMD), which impacts many bioelectronic interfaces. However, significant regulatory divergence remains, creating market entry barriers for manufacturers seeking multi-regional deployment.

Privacy and data protection regulations present additional compliance challenges for bioelectronic interfaces that collect physiological data. The EU's General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and similar frameworks worldwide impose strict requirements on data processing, storage, and transfer, with particularly stringent provisions for health-related information collected by bioelectronic devices.

Emerging regulatory considerations include cybersecurity requirements, with the FDA and other agencies developing frameworks to address vulnerability management throughout device lifecycles. Additionally, regulatory bodies are beginning to address ethical considerations surrounding brain-computer interfaces and neural devices, with organizations like the OECD developing principles for responsible innovation in neurotechnology that may inform future regulatory approaches.

The European Union's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) implemented in 2021 have significantly impacted bioelectronic device manufacturers, introducing more stringent requirements for clinical evidence and post-market surveillance. These regulations have extended classification criteria to include software and AI components integral to many bioelectronic interfaces, requiring manufacturers to demonstrate ongoing safety and performance.

In Asia, regulatory frameworks vary considerably. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has established the SAKIGAKE designation system to expedite approval for innovative medical technologies, including certain bioelectronic interfaces. China has reformed its regulatory system through the National Medical Products Administration (NMPA), implementing special approval pathways for innovative medical devices while maintaining strict control over data security aspects of connected bioelectronic technologies.

Global harmonization efforts through the International Medical Device Regulators Forum (IMDRF) are attempting to standardize requirements for Software as a Medical Device (SaMD), which impacts many bioelectronic interfaces. However, significant regulatory divergence remains, creating market entry barriers for manufacturers seeking multi-regional deployment.

Privacy and data protection regulations present additional compliance challenges for bioelectronic interfaces that collect physiological data. The EU's General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and similar frameworks worldwide impose strict requirements on data processing, storage, and transfer, with particularly stringent provisions for health-related information collected by bioelectronic devices.

Emerging regulatory considerations include cybersecurity requirements, with the FDA and other agencies developing frameworks to address vulnerability management throughout device lifecycles. Additionally, regulatory bodies are beginning to address ethical considerations surrounding brain-computer interfaces and neural devices, with organizations like the OECD developing principles for responsible innovation in neurotechnology that may inform future regulatory approaches.

Healthcare Integration Strategies

The integration of bioelectronic interface technologies into healthcare systems represents a critical challenge that requires strategic planning and implementation. Healthcare providers must develop comprehensive frameworks that address both technical and organizational aspects of integration. These frameworks should consider existing clinical workflows, regulatory requirements, and the need for seamless data exchange between bioelectronic devices and electronic health record (EHR) systems.

Successful integration strategies typically follow a phased approach, beginning with pilot programs in specialized departments before expanding to broader implementation. This allows healthcare organizations to identify and address integration challenges in controlled environments while building institutional knowledge and expertise. Early adopters have demonstrated that integration success depends heavily on cross-functional collaboration between clinical, IT, and administrative stakeholders.

Data standardization emerges as a fundamental requirement for effective integration. Healthcare organizations must establish protocols for bioelectronic data formatting, storage, and transmission that align with existing healthcare data standards such as HL7 FHIR and DICOM. This standardization facilitates interoperability between bioelectronic interfaces and other clinical systems, enabling comprehensive patient monitoring and analysis.

Training programs for healthcare professionals constitute another essential component of integration strategies. These programs should address both technical operation of bioelectronic interfaces and interpretation of the resulting data. Evidence suggests that clinician adoption rates improve significantly when training emphasizes clinical applications and benefits rather than focusing exclusively on technical specifications.

Privacy and security considerations must be embedded throughout the integration process. As bioelectronic interfaces collect increasingly sensitive patient data, healthcare organizations must implement robust security protocols that comply with regulations like HIPAA in the United States and GDPR in Europe. This includes encryption of data in transit and at rest, strict access controls, and comprehensive audit trails.

Cost-benefit analysis should guide integration decisions, with organizations carefully evaluating both immediate implementation costs and long-term operational impacts. While initial investment in bioelectronic interface technologies can be substantial, strategic integration can yield significant returns through improved clinical outcomes, reduced readmission rates, and enhanced operational efficiency.

Finally, successful integration strategies incorporate continuous evaluation and refinement processes. Healthcare organizations should establish metrics for measuring integration success, including clinical outcome improvements, user satisfaction, and technical performance indicators. These metrics enable data-driven adjustments to integration approaches as technologies evolve and organizational needs change.

Successful integration strategies typically follow a phased approach, beginning with pilot programs in specialized departments before expanding to broader implementation. This allows healthcare organizations to identify and address integration challenges in controlled environments while building institutional knowledge and expertise. Early adopters have demonstrated that integration success depends heavily on cross-functional collaboration between clinical, IT, and administrative stakeholders.

Data standardization emerges as a fundamental requirement for effective integration. Healthcare organizations must establish protocols for bioelectronic data formatting, storage, and transmission that align with existing healthcare data standards such as HL7 FHIR and DICOM. This standardization facilitates interoperability between bioelectronic interfaces and other clinical systems, enabling comprehensive patient monitoring and analysis.

Training programs for healthcare professionals constitute another essential component of integration strategies. These programs should address both technical operation of bioelectronic interfaces and interpretation of the resulting data. Evidence suggests that clinician adoption rates improve significantly when training emphasizes clinical applications and benefits rather than focusing exclusively on technical specifications.

Privacy and security considerations must be embedded throughout the integration process. As bioelectronic interfaces collect increasingly sensitive patient data, healthcare organizations must implement robust security protocols that comply with regulations like HIPAA in the United States and GDPR in Europe. This includes encryption of data in transit and at rest, strict access controls, and comprehensive audit trails.

Cost-benefit analysis should guide integration decisions, with organizations carefully evaluating both immediate implementation costs and long-term operational impacts. While initial investment in bioelectronic interface technologies can be substantial, strategic integration can yield significant returns through improved clinical outcomes, reduced readmission rates, and enhanced operational efficiency.

Finally, successful integration strategies incorporate continuous evaluation and refinement processes. Healthcare organizations should establish metrics for measuring integration success, including clinical outcome improvements, user satisfaction, and technical performance indicators. These metrics enable data-driven adjustments to integration approaches as technologies evolve and organizational needs change.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!