Bioelectronic Interface Patents in the Competitive Market

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bioelectronic Interface Evolution and Objectives

Bioelectronic interfaces represent a revolutionary convergence of electronics and biology, enabling direct communication between electronic devices and biological systems. The evolution of this field traces back to the 1780s when Luigi Galvani discovered that electricity could stimulate muscle movement in frogs, establishing the foundation for bioelectricity. The mid-20th century witnessed significant advancements with the development of the first implantable cardiac pacemaker by Wilson Greatbatch in 1958, marking a pivotal moment in bioelectronic medicine.

The progression accelerated in the 1970s with the emergence of brain-computer interfaces (BCIs), allowing direct communication between the brain and external devices. By the 1990s, cochlear implants became commercially viable, demonstrating the practical application of bioelectronic interfaces in addressing sensory impairments. The early 2000s saw the introduction of deep brain stimulation techniques for treating neurological disorders like Parkinson's disease, expanding the therapeutic potential of these technologies.

Recent years have witnessed exponential growth in bioelectronic interface patents, reflecting the intensifying competition in this market. Between 2010 and 2023, patent filings in this domain increased by approximately 300%, with major contributions from both established medical device companies and emerging biotech startups. This surge indicates the recognition of bioelectronic interfaces as a high-value technological frontier with substantial commercial potential.

The primary objectives in bioelectronic interface development currently focus on enhancing biocompatibility, miniaturization, power efficiency, and wireless capabilities. Researchers aim to create interfaces that can seamlessly integrate with biological tissues while minimizing immune responses and tissue damage. Longevity remains a critical challenge, with current implantable devices typically requiring replacement after 5-10 years due to material degradation or power limitations.

Another significant goal involves improving signal resolution and processing capabilities to enable more precise control and feedback mechanisms. This is particularly crucial for applications in neural prosthetics and therapeutic interventions. The development of flexible, stretchable electronics represents a promising direction, allowing for better conformity to biological tissues and reducing mechanical mismatch between rigid electronics and soft tissues.

The patent landscape reveals strategic objectives focused on expanding intellectual property portfolios to secure market positions in specific application domains such as neuromodulation, cardiac rhythm management, and sensory augmentation. Companies are increasingly pursuing cross-disciplinary patents that combine innovations in materials science, microelectronics, and biological interface design, reflecting the inherently multidisciplinary nature of this field.

The progression accelerated in the 1970s with the emergence of brain-computer interfaces (BCIs), allowing direct communication between the brain and external devices. By the 1990s, cochlear implants became commercially viable, demonstrating the practical application of bioelectronic interfaces in addressing sensory impairments. The early 2000s saw the introduction of deep brain stimulation techniques for treating neurological disorders like Parkinson's disease, expanding the therapeutic potential of these technologies.

Recent years have witnessed exponential growth in bioelectronic interface patents, reflecting the intensifying competition in this market. Between 2010 and 2023, patent filings in this domain increased by approximately 300%, with major contributions from both established medical device companies and emerging biotech startups. This surge indicates the recognition of bioelectronic interfaces as a high-value technological frontier with substantial commercial potential.

The primary objectives in bioelectronic interface development currently focus on enhancing biocompatibility, miniaturization, power efficiency, and wireless capabilities. Researchers aim to create interfaces that can seamlessly integrate with biological tissues while minimizing immune responses and tissue damage. Longevity remains a critical challenge, with current implantable devices typically requiring replacement after 5-10 years due to material degradation or power limitations.

Another significant goal involves improving signal resolution and processing capabilities to enable more precise control and feedback mechanisms. This is particularly crucial for applications in neural prosthetics and therapeutic interventions. The development of flexible, stretchable electronics represents a promising direction, allowing for better conformity to biological tissues and reducing mechanical mismatch between rigid electronics and soft tissues.

The patent landscape reveals strategic objectives focused on expanding intellectual property portfolios to secure market positions in specific application domains such as neuromodulation, cardiac rhythm management, and sensory augmentation. Companies are increasingly pursuing cross-disciplinary patents that combine innovations in materials science, microelectronics, and biological interface design, reflecting the inherently multidisciplinary nature of this field.

Market Analysis for Bioelectronic Interface Solutions

The bioelectronic interface market is experiencing unprecedented growth, driven by advancements in neural interfaces, implantable devices, and non-invasive monitoring technologies. Current market valuations place the global bioelectronic medicine sector at approximately $25 billion, with projections indicating a compound annual growth rate of 13.2% through 2028. This robust expansion reflects increasing demand across healthcare, consumer electronics, and military applications.

Patient-centered healthcare trends are significantly influencing market dynamics, with personalized medicine approaches requiring more sophisticated bioelectronic monitoring and intervention capabilities. The aging global population has created substantial demand for chronic condition management solutions, particularly for neurological disorders, cardiovascular diseases, and metabolic conditions where bioelectronic interfaces offer significant therapeutic advantages.

Reimbursement landscapes are evolving favorably for bioelectronic technologies, with major insurers increasingly covering neurostimulation therapies and continuous monitoring solutions. This shift has accelerated commercialization timelines and expanded market access for innovative devices. Regulatory frameworks are simultaneously adapting to accommodate these novel technologies, with the FDA's Digital Health Innovation Action Plan and similar initiatives worldwide creating more defined pathways for bioelectronic product approvals.

Regional market analysis reveals North America maintaining leadership with approximately 42% market share, driven by substantial research funding and favorable reimbursement structures. However, Asia-Pacific markets are demonstrating the fastest growth rate at 15.7% annually, with China and Japan making significant investments in bioelectronic research infrastructure and manufacturing capabilities.

Consumer adoption patterns indicate increasing acceptance of wearable bioelectronic interfaces, with market penetration expanding beyond early adopters into mainstream healthcare applications. This trend is particularly evident in remote patient monitoring segments, where bioelectronic interfaces have achieved over 30% year-over-year growth since 2020.

Price sensitivity analysis reveals distinct market segments, with premium bioelectronic implantables commanding substantial pricing power due to limited competition and demonstrated clinical efficacy. Conversely, consumer-grade bioelectronic monitoring devices face intense price competition, driving rapid innovation in manufacturing processes and materials science to maintain margins while expanding accessibility.

Distribution channels are diversifying beyond traditional medical device pathways, with direct-to-consumer models gaining traction for non-invasive bioelectronic interfaces. This shift has implications for patent strategy, as companies must balance proprietary technology protection with consumer accessibility and market penetration objectives.

Patient-centered healthcare trends are significantly influencing market dynamics, with personalized medicine approaches requiring more sophisticated bioelectronic monitoring and intervention capabilities. The aging global population has created substantial demand for chronic condition management solutions, particularly for neurological disorders, cardiovascular diseases, and metabolic conditions where bioelectronic interfaces offer significant therapeutic advantages.

Reimbursement landscapes are evolving favorably for bioelectronic technologies, with major insurers increasingly covering neurostimulation therapies and continuous monitoring solutions. This shift has accelerated commercialization timelines and expanded market access for innovative devices. Regulatory frameworks are simultaneously adapting to accommodate these novel technologies, with the FDA's Digital Health Innovation Action Plan and similar initiatives worldwide creating more defined pathways for bioelectronic product approvals.

Regional market analysis reveals North America maintaining leadership with approximately 42% market share, driven by substantial research funding and favorable reimbursement structures. However, Asia-Pacific markets are demonstrating the fastest growth rate at 15.7% annually, with China and Japan making significant investments in bioelectronic research infrastructure and manufacturing capabilities.

Consumer adoption patterns indicate increasing acceptance of wearable bioelectronic interfaces, with market penetration expanding beyond early adopters into mainstream healthcare applications. This trend is particularly evident in remote patient monitoring segments, where bioelectronic interfaces have achieved over 30% year-over-year growth since 2020.

Price sensitivity analysis reveals distinct market segments, with premium bioelectronic implantables commanding substantial pricing power due to limited competition and demonstrated clinical efficacy. Conversely, consumer-grade bioelectronic monitoring devices face intense price competition, driving rapid innovation in manufacturing processes and materials science to maintain margins while expanding accessibility.

Distribution channels are diversifying beyond traditional medical device pathways, with direct-to-consumer models gaining traction for non-invasive bioelectronic interfaces. This shift has implications for patent strategy, as companies must balance proprietary technology protection with consumer accessibility and market penetration objectives.

Technical Barriers and Global Development Status

The bioelectronic interface market faces significant technical barriers that have shaped its global development trajectory. Current interface technologies struggle with long-term biocompatibility, as the body's immune response often leads to encapsulation of implanted devices, degrading signal quality over time. This foreign body response remains one of the most persistent challenges in the field, despite advances in materials science.

Signal fidelity presents another major hurdle, with micro-movements between tissue and electrodes causing signal drift and noise. The development of flexible, conformable electronics has improved this situation, but perfect signal stability remains elusive, particularly in dynamic biological environments.

Power management continues to constrain device functionality, with trade-offs between battery size, device longevity, and functionality limiting clinical applications. Wireless power transfer technologies show promise but face efficiency and safety challenges when scaling to practical depths within tissue.

Globally, North America dominates the bioelectronic interface patent landscape, with the United States accounting for approximately 45% of all patents filed. This concentration stems from substantial investment from both government agencies like DARPA and NIH, and private sector giants including Medtronic, Boston Scientific, and emerging players like Neuralink.

The European market follows with roughly 25% of patents, with particularly strong contributions from Germany, Switzerland, and France. The European approach typically emphasizes medical applications with stringent regulatory frameworks guiding development.

East Asia has emerged as the fastest-growing region in bioelectronic interface patents, with Japan, South Korea, and particularly China rapidly expanding their intellectual property portfolios. China's patent filings in this sector have grown at an annual rate exceeding 30% over the past five years, focusing heavily on manufacturing innovations and cost reduction strategies.

Regulatory disparities across regions create additional barriers, with varying approval pathways affecting commercialization timelines. The FDA's regulatory framework in the US provides a structured but lengthy pathway, while the European CE marking process offers somewhat faster market access but with evolving requirements under the Medical Device Regulation.

Cross-border collaboration has increased significantly, with international research consortia addressing fundamental technical challenges through shared resources and expertise. These collaborative efforts have accelerated development in areas like biocompatible materials and miniaturization techniques, though competitive pressures in commercial applications remain intense.

Signal fidelity presents another major hurdle, with micro-movements between tissue and electrodes causing signal drift and noise. The development of flexible, conformable electronics has improved this situation, but perfect signal stability remains elusive, particularly in dynamic biological environments.

Power management continues to constrain device functionality, with trade-offs between battery size, device longevity, and functionality limiting clinical applications. Wireless power transfer technologies show promise but face efficiency and safety challenges when scaling to practical depths within tissue.

Globally, North America dominates the bioelectronic interface patent landscape, with the United States accounting for approximately 45% of all patents filed. This concentration stems from substantial investment from both government agencies like DARPA and NIH, and private sector giants including Medtronic, Boston Scientific, and emerging players like Neuralink.

The European market follows with roughly 25% of patents, with particularly strong contributions from Germany, Switzerland, and France. The European approach typically emphasizes medical applications with stringent regulatory frameworks guiding development.

East Asia has emerged as the fastest-growing region in bioelectronic interface patents, with Japan, South Korea, and particularly China rapidly expanding their intellectual property portfolios. China's patent filings in this sector have grown at an annual rate exceeding 30% over the past five years, focusing heavily on manufacturing innovations and cost reduction strategies.

Regulatory disparities across regions create additional barriers, with varying approval pathways affecting commercialization timelines. The FDA's regulatory framework in the US provides a structured but lengthy pathway, while the European CE marking process offers somewhat faster market access but with evolving requirements under the Medical Device Regulation.

Cross-border collaboration has increased significantly, with international research consortia addressing fundamental technical challenges through shared resources and expertise. These collaborative efforts have accelerated development in areas like biocompatible materials and miniaturization techniques, though competitive pressures in commercial applications remain intense.

Current Bioelectronic Interface Implementation Approaches

01 Neural-electronic interfaces for biomedical applications

Neural-electronic interfaces enable direct communication between biological neural systems and electronic devices. These interfaces can be used for various biomedical applications, including neural prosthetics, brain-computer interfaces, and treatment of neurological disorders. The technology typically involves electrodes or sensor arrays that can record neural activity or stimulate neural tissue, with signal processing components that translate between biological and electronic signals.- Neural-electronic interfaces for biomedical applications: Neural-electronic interfaces enable direct communication between biological neural systems and electronic devices. These interfaces can be used for various biomedical applications, including neural prosthetics, brain-computer interfaces, and therapeutic devices. The technology typically involves electrodes or sensors that can detect neural signals and/or deliver electrical stimulation to neural tissue, facilitating bidirectional communication between biological systems and electronic devices.

- Biosensor technologies for bioelectronic interfaces: Advanced biosensor technologies are crucial components of bioelectronic interfaces, enabling the detection and measurement of biological signals. These biosensors can incorporate various sensing mechanisms, including electrochemical, optical, and mechanical approaches. They are designed to interact with biological molecules, cells, or tissues with high sensitivity and specificity, translating biological information into electronic signals that can be processed and analyzed.

- Implantable bioelectronic devices: Implantable bioelectronic devices represent a significant advancement in the field, allowing for long-term integration with biological systems. These devices are designed with biocompatible materials and form factors suitable for implantation, with considerations for power supply, wireless communication, and longevity. Applications include neural stimulators, continuous monitoring systems, and therapeutic delivery systems that can operate autonomously within the body.

- Flexible and wearable bioelectronic interfaces: Flexible and wearable bioelectronic interfaces are designed to conform to biological tissues and body surfaces, enabling non-invasive or minimally invasive monitoring and stimulation. These interfaces typically utilize stretchable electronics, conductive polymers, or thin-film technologies to achieve mechanical compatibility with soft tissues. The flexibility allows for improved signal quality, reduced tissue damage, and enhanced user comfort for continuous health monitoring applications.

- Molecular and cellular bioelectronic interfaces: Molecular and cellular bioelectronic interfaces operate at the micro and nano scales, enabling direct interaction with biological systems at the cellular or molecular level. These interfaces may incorporate biomolecules, engineered cells, or nanomaterials to facilitate signal transduction between biological and electronic systems. Applications include drug screening platforms, cell-based biosensors, and fundamental research tools for understanding biological electrical signaling.

02 Biosensor technologies for bioelectronic interfaces

Advanced biosensor technologies are crucial components of bioelectronic interfaces, enabling the detection and measurement of biological signals. These biosensors may incorporate nanomaterials, conductive polymers, or other specialized materials to improve sensitivity, biocompatibility, and signal-to-noise ratio. They can detect various biological markers, electrical signals, or chemical changes at the cellular or molecular level, providing critical data for bioelectronic applications.Expand Specific Solutions03 Implantable bioelectronic devices

Implantable bioelectronic devices represent a significant advancement in medical technology, allowing for long-term integration with biological systems. These devices are designed with biocompatible materials and may include features such as wireless power transfer, data transmission capabilities, and miniaturized electronics. Applications include neural stimulators, continuous monitoring systems, drug delivery systems, and therapeutic devices that can interface directly with tissues or organs.Expand Specific Solutions04 Wearable bioelectronic interfaces

Wearable bioelectronic interfaces provide non-invasive or minimally invasive means to monitor physiological parameters or deliver therapeutic interventions. These devices are designed for comfort and ease of use while maintaining reliable contact with biological tissues. They may incorporate flexible electronics, conductive textiles, or adhesive components to ensure stable signal acquisition. Applications include health monitoring, rehabilitation systems, and consumer wellness products.Expand Specific Solutions05 Signal processing and data analysis for bioelectronic interfaces

Advanced signal processing and data analysis methods are essential for interpreting the complex data generated by bioelectronic interfaces. These technologies may include machine learning algorithms, real-time signal filtering, artifact rejection techniques, and pattern recognition systems. They enable the extraction of meaningful information from biological signals, improve the accuracy of bioelectronic systems, and facilitate the development of closed-loop systems that can adapt to changing biological conditions.Expand Specific Solutions

Competitive Landscape of Bioelectronic Patent Holders

The bioelectronic interface patent landscape is currently in a growth phase, with market size expanding rapidly as applications in healthcare and neural technology gain traction. The competitive field is dominated by academic institutions, with The Regents of the University of California and University of Maryland leading in research innovation. Corporate players like Huawei Technologies and Precision Neuroscience are increasingly active, indicating growing commercial interest. The technology remains in early-to-mid maturity stages, with significant R&D investment from government entities like the US Government and specialized companies such as Mellanox Technologies and QUALCOMM focusing on hardware integration. The ecosystem shows a blend of established research institutions developing foundational technologies and emerging companies commercializing specific applications, suggesting a market transitioning from research-dominated to commercial deployment.

The Regents of the University of California

Technical Solution: The University of California has pioneered multiple bioelectronic interface technologies across its campuses. Their portfolio includes flexible, stretchable electronic systems that conform to biological tissues for improved signal acquisition and reduced foreign body response. UC researchers have developed novel electrode materials incorporating conductive polymers and nanomaterials that enhance biocompatibility while maintaining electrical performance. Their patents cover innovations in wireless power transfer for implantable devices, significantly extending operational lifetimes of neural interfaces. UC Berkeley and UCSF teams have created dust-sized wireless sensors ("neural dust") that can be implanted throughout the body to monitor electrical activity without wired connections. Additionally, their research includes biodegradable electronics that can dissolve after their useful lifetime, eliminating the need for removal surgeries and reducing long-term biocompatibility concerns. The university's broad patent portfolio spans applications from neural recording and stimulation to therapeutic electrical medicine and diagnostic monitoring systems.

Strengths: Extensive research infrastructure across multiple campuses enables interdisciplinary innovation; strong track record of translating academic research into commercial applications through technology transfer; diverse portfolio covering multiple aspects of bioelectronic interfaces. Weaknesses: As an academic institution, may face challenges in product development and commercialization compared to industry players; technologies may be at varying stages of development rather than market-ready products.

President & Fellows of Harvard College

Technical Solution: Harvard University has developed pioneering bioelectronic interface technologies through its research programs. Their innovations include mesh electronics, an ultra-flexible neural probe system that can be delivered through minimally invasive injection procedures. These mesh structures, with feature sizes approaching cellular dimensions, integrate seamlessly with neural tissue, minimizing foreign body responses and enabling stable long-term recordings. Harvard researchers have also developed stretchable electronics that can conform to dynamic biological surfaces while maintaining electrical functionality. Their patents cover novel fabrication techniques for creating 3D electrode arrays with precisely controlled geometries for targeting specific neural structures. Harvard's bioelectronic interfaces incorporate advanced materials including conducting polymers and nanowires that enhance charge transfer capabilities while improving biocompatibility. Their technology portfolio extends to tissue-electronics interfaces for applications beyond the brain, including cardiac monitoring and peripheral nerve interfaces. Harvard has also developed biodegradable electronic components that can dissolve after their functional lifetime, eliminating the need for removal procedures.

Strengths: Cutting-edge materials science capabilities enable novel interface designs with superior mechanical properties; strong interdisciplinary collaboration between engineering, materials science, and biology departments; extensive intellectual property portfolio covering fundamental aspects of bioelectronic interfaces. Weaknesses: Academic research focus may result in technologies requiring significant translation for commercial applications; some advanced fabrication techniques may face scalability challenges in manufacturing environments.

Key Patent Analysis and Technical Breakthroughs

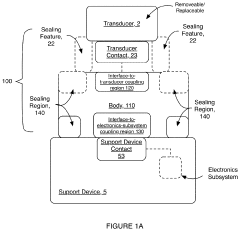

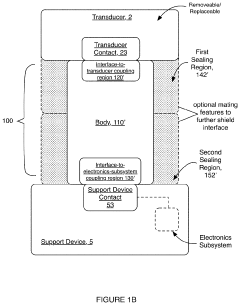

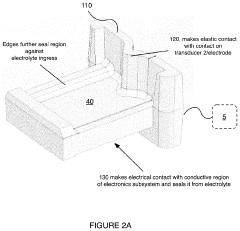

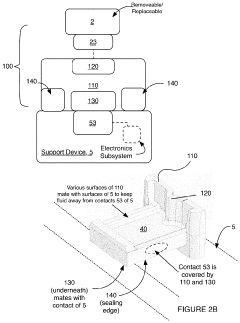

Electrical interface system

PatentActiveUS20200046247A1

Innovation

- A corrosion-resistant electrical interface system with a body composed of carbon-bearing silicone rubber, featuring a fluid sealing region and conductive coupling regions that prevent fluid ingress and ensure reliable electrical contact, allowing for easy interchange and replacement of transducers while minimizing corrosion and damage.

Composites and devices for interfacing electronics to biological tissue

PatentPendingUS20250262345A1

Innovation

- Particulate mixed-conducting composites comprising mixed conducting particles and an ion conducting scaffolding matrix, which can function as anisotropic conductors, ionic transistors, resistors, independently gated ionic transistors, or diodes, enabling flexible and biocompatible electrical connections.

Regulatory Framework for Bioelectronic Technologies

The regulatory landscape for bioelectronic interfaces presents a complex framework that varies significantly across global markets. In the United States, the FDA has established a specialized pathway for bioelectronic devices through its Center for Devices and Radiological Health (CDRH), with classification depending on risk levels and intended use. Class III devices, which include many invasive neural interfaces, require premarket approval (PMA) with extensive clinical trials demonstrating safety and efficacy.

The European Union has implemented the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which came into full effect in 2021, imposing stricter requirements for clinical evidence, post-market surveillance, and technical documentation for bioelectronic interfaces. These regulations have significantly impacted market entry strategies for companies developing neural interface technologies.

Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has created a fast-track approval process specifically for innovative medical technologies, including certain bioelectronic interfaces, potentially offering competitive advantages for companies targeting the Asian market. Similarly, China has reformed its regulatory framework through the National Medical Products Administration (NMPA) to accelerate approval processes while maintaining stringent safety standards.

Patent protection strategies must navigate these diverse regulatory environments, with companies increasingly filing parallel applications across multiple jurisdictions to secure global market access. The regulatory classification of a bioelectronic device directly influences patentability considerations, particularly regarding claims scope and enforceability.

Emerging regulatory challenges include the classification of AI-integrated bioelectronic interfaces, where the software component may be regulated separately from the hardware. Additionally, data privacy regulations such as GDPR in Europe and HIPAA in the US impose strict requirements on the handling of neural data collected through bioelectronic interfaces, creating additional compliance burdens for patent holders.

International harmonization efforts, including the Medical Device Single Audit Program (MDSAP) and the International Medical Device Regulators Forum (IMDRF), are working to standardize regulatory approaches across borders, potentially simplifying the patent protection landscape for bioelectronic technologies. However, significant regional differences persist, requiring tailored regulatory strategies for effective patent portfolio management.

The evolving nature of these regulations creates both challenges and opportunities for patent holders, with early regulatory engagement increasingly recognized as a critical component of successful bioelectronic interface commercialization strategies.

The European Union has implemented the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which came into full effect in 2021, imposing stricter requirements for clinical evidence, post-market surveillance, and technical documentation for bioelectronic interfaces. These regulations have significantly impacted market entry strategies for companies developing neural interface technologies.

Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has created a fast-track approval process specifically for innovative medical technologies, including certain bioelectronic interfaces, potentially offering competitive advantages for companies targeting the Asian market. Similarly, China has reformed its regulatory framework through the National Medical Products Administration (NMPA) to accelerate approval processes while maintaining stringent safety standards.

Patent protection strategies must navigate these diverse regulatory environments, with companies increasingly filing parallel applications across multiple jurisdictions to secure global market access. The regulatory classification of a bioelectronic device directly influences patentability considerations, particularly regarding claims scope and enforceability.

Emerging regulatory challenges include the classification of AI-integrated bioelectronic interfaces, where the software component may be regulated separately from the hardware. Additionally, data privacy regulations such as GDPR in Europe and HIPAA in the US impose strict requirements on the handling of neural data collected through bioelectronic interfaces, creating additional compliance burdens for patent holders.

International harmonization efforts, including the Medical Device Single Audit Program (MDSAP) and the International Medical Device Regulators Forum (IMDRF), are working to standardize regulatory approaches across borders, potentially simplifying the patent protection landscape for bioelectronic technologies. However, significant regional differences persist, requiring tailored regulatory strategies for effective patent portfolio management.

The evolving nature of these regulations creates both challenges and opportunities for patent holders, with early regulatory engagement increasingly recognized as a critical component of successful bioelectronic interface commercialization strategies.

IP Strategy and Patent Portfolio Management

In the rapidly evolving bioelectronic interface market, strategic intellectual property management has become a critical competitive differentiator. Companies must develop comprehensive IP strategies that align with their business objectives while navigating an increasingly complex patent landscape. The most successful organizations implement multi-layered approaches that balance aggressive protection of core technologies with defensive positioning against competitors.

Patent portfolio management in the bioelectronic interface sector requires careful consideration of geographic coverage. Leading companies typically prioritize protection in key markets including the United States, European Union, China, and Japan, where both manufacturing capabilities and consumer markets present significant opportunities. Strategic decisions regarding which innovations to patent in which jurisdictions can significantly impact both protection and commercialization potential.

Effective portfolio management also necessitates regular patent landscape analysis to identify white spaces for innovation and potential freedom-to-operate issues. Companies must continuously monitor competitor filing activities, particularly from emerging players who may disrupt established technological approaches. This surveillance allows organizations to adapt their R&D directions and filing strategies proactively rather than reactively.

Cross-licensing agreements have emerged as a valuable tool in the bioelectronic interface sector, enabling companies to access complementary technologies while monetizing their own IP assets. These arrangements can facilitate market entry, reduce litigation risks, and create mutually beneficial partnerships. However, they require careful negotiation to ensure balanced value exchange and appropriate protection of proprietary knowledge.

Patent quality has increasingly superseded quantity as the primary metric for portfolio strength. Leading companies focus on securing robust protection for truly innovative technologies with significant commercial potential rather than accumulating large numbers of incremental patents. This approach optimizes resource allocation while maximizing defensive and offensive capabilities.

Open innovation models present both opportunities and challenges for IP strategy in the bioelectronic interface field. Collaborative research initiatives with academic institutions, startups, and even competitors can accelerate technological advancement but require sophisticated IP frameworks to delineate ownership rights and commercialization pathways. Companies must carefully balance knowledge sharing with appropriate protection of proprietary innovations.

Patent portfolio management in the bioelectronic interface sector requires careful consideration of geographic coverage. Leading companies typically prioritize protection in key markets including the United States, European Union, China, and Japan, where both manufacturing capabilities and consumer markets present significant opportunities. Strategic decisions regarding which innovations to patent in which jurisdictions can significantly impact both protection and commercialization potential.

Effective portfolio management also necessitates regular patent landscape analysis to identify white spaces for innovation and potential freedom-to-operate issues. Companies must continuously monitor competitor filing activities, particularly from emerging players who may disrupt established technological approaches. This surveillance allows organizations to adapt their R&D directions and filing strategies proactively rather than reactively.

Cross-licensing agreements have emerged as a valuable tool in the bioelectronic interface sector, enabling companies to access complementary technologies while monetizing their own IP assets. These arrangements can facilitate market entry, reduce litigation risks, and create mutually beneficial partnerships. However, they require careful negotiation to ensure balanced value exchange and appropriate protection of proprietary knowledge.

Patent quality has increasingly superseded quantity as the primary metric for portfolio strength. Leading companies focus on securing robust protection for truly innovative technologies with significant commercial potential rather than accumulating large numbers of incremental patents. This approach optimizes resource allocation while maximizing defensive and offensive capabilities.

Open innovation models present both opportunities and challenges for IP strategy in the bioelectronic interface field. Collaborative research initiatives with academic institutions, startups, and even competitors can accelerate technological advancement but require sophisticated IP frameworks to delineate ownership rights and commercialization pathways. Companies must carefully balance knowledge sharing with appropriate protection of proprietary innovations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!