Bioelectronic Interfaces: Market Strategies and Growth Potential

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bioelectronic Interfaces Evolution and Objectives

Bioelectronic interfaces represent a revolutionary convergence of electronics and biology, enabling direct communication between electronic devices and biological systems. This field has evolved significantly over the past three decades, transitioning from rudimentary neural implants to sophisticated, minimally invasive interfaces capable of bidirectional communication with living tissues.

The evolution of bioelectronic interfaces began in the 1970s with basic neural recording electrodes, progressing through several distinct phases. The 1990s saw the emergence of microelectrode arrays enabling multi-site neural recordings, while the 2000s brought significant miniaturization and improved biocompatibility. The 2010s marked a turning point with flexible and stretchable electronics that conform to biological tissues, reducing immune responses and improving long-term stability.

Recent technological breakthroughs include wireless power transmission, advanced materials science innovations, and AI-enhanced signal processing. These developments have collectively addressed historical limitations such as biocompatibility, longevity, and signal fidelity that previously constrained widespread adoption of bioelectronic interfaces.

The current technological trajectory points toward increasingly seamless integration between electronic systems and biological tissues. Emerging trends include biodegradable electronics that dissolve after completing their therapeutic function, self-healing materials that extend device longevity, and closed-loop systems capable of autonomous operation based on physiological feedback.

The primary objectives of contemporary bioelectronic interface development focus on several key areas. First, enhancing signal resolution and fidelity to capture more nuanced biological information. Second, improving long-term stability and biocompatibility to enable chronic implantation without tissue damage. Third, miniaturization and power efficiency to create less invasive devices with extended operational lifespans.

Additional objectives include developing standardized platforms to accelerate research and clinical translation, creating scalable manufacturing processes to reduce costs, and establishing comprehensive regulatory frameworks that balance innovation with patient safety. These objectives collectively aim to transform bioelectronic interfaces from specialized research tools to mainstream clinical and consumer applications.

The field is now approaching an inflection point where technological capabilities are beginning to meet clinical and commercial requirements. This convergence creates significant opportunities for market growth across medical therapeutics, diagnostics, human-computer interfaces, and consumer wellness applications, positioning bioelectronic interfaces as a transformative technology with substantial growth potential in the coming decade.

The evolution of bioelectronic interfaces began in the 1970s with basic neural recording electrodes, progressing through several distinct phases. The 1990s saw the emergence of microelectrode arrays enabling multi-site neural recordings, while the 2000s brought significant miniaturization and improved biocompatibility. The 2010s marked a turning point with flexible and stretchable electronics that conform to biological tissues, reducing immune responses and improving long-term stability.

Recent technological breakthroughs include wireless power transmission, advanced materials science innovations, and AI-enhanced signal processing. These developments have collectively addressed historical limitations such as biocompatibility, longevity, and signal fidelity that previously constrained widespread adoption of bioelectronic interfaces.

The current technological trajectory points toward increasingly seamless integration between electronic systems and biological tissues. Emerging trends include biodegradable electronics that dissolve after completing their therapeutic function, self-healing materials that extend device longevity, and closed-loop systems capable of autonomous operation based on physiological feedback.

The primary objectives of contemporary bioelectronic interface development focus on several key areas. First, enhancing signal resolution and fidelity to capture more nuanced biological information. Second, improving long-term stability and biocompatibility to enable chronic implantation without tissue damage. Third, miniaturization and power efficiency to create less invasive devices with extended operational lifespans.

Additional objectives include developing standardized platforms to accelerate research and clinical translation, creating scalable manufacturing processes to reduce costs, and establishing comprehensive regulatory frameworks that balance innovation with patient safety. These objectives collectively aim to transform bioelectronic interfaces from specialized research tools to mainstream clinical and consumer applications.

The field is now approaching an inflection point where technological capabilities are beginning to meet clinical and commercial requirements. This convergence creates significant opportunities for market growth across medical therapeutics, diagnostics, human-computer interfaces, and consumer wellness applications, positioning bioelectronic interfaces as a transformative technology with substantial growth potential in the coming decade.

Market Demand Analysis for Bioelectronic Solutions

The bioelectronic interfaces market is experiencing unprecedented growth, driven by increasing prevalence of chronic diseases and neurological disorders. Current market analysis indicates that the global bioelectronic medicine market reached approximately $17.5 billion in 2021 and is projected to grow at a compound annual growth rate of 7.6% through 2028. This growth trajectory is supported by rising healthcare expenditure worldwide and increasing adoption of implantable electronic devices for therapeutic purposes.

Consumer demand for non-invasive or minimally invasive treatment options represents a significant market driver. Patients increasingly prefer bioelectronic solutions over traditional pharmaceutical approaches due to reduced side effects and more targeted therapeutic outcomes. This shift in preference is particularly evident in treatment areas such as chronic pain management, where bioelectronic alternatives offer relief without the risks associated with opioid medications.

Healthcare providers are demonstrating growing interest in bioelectronic interfaces as complementary or alternative treatment modalities. The ability to provide personalized treatment protocols through programmable bioelectronic devices aligns with the broader industry trend toward precision medicine. Additionally, the potential for remote monitoring and adjustment of these devices supports the expanding telehealth ecosystem, creating synergistic market opportunities.

From a geographical perspective, North America currently dominates the bioelectronic interfaces market, accounting for approximately 42% of global revenue. However, the Asia-Pacific region is expected to witness the highest growth rate in the coming years, fueled by improving healthcare infrastructure, increasing disposable income, and growing awareness of advanced medical technologies.

Segmentation analysis reveals distinct market opportunities across various application areas. Cardiac rhythm management devices currently represent the largest market segment, followed by neurostimulation devices. However, emerging applications in inflammatory disease management and diabetes control are expected to exhibit the fastest growth rates over the next five years.

Reimbursement policies significantly influence market adoption rates. Countries with favorable insurance coverage for bioelectronic therapies show accelerated market penetration. Recent policy changes in major markets, including expanded Medicare coverage for certain neuromodulation therapies in the United States, are expected to further stimulate market growth.

Investment in the bioelectronic interfaces sector has seen remarkable growth, with venture capital funding exceeding $1.2 billion in 2022 alone. This influx of capital is enabling both established medical device companies and innovative startups to advance their research and development efforts, potentially accelerating time-to-market for next-generation bioelectronic solutions.

Consumer demand for non-invasive or minimally invasive treatment options represents a significant market driver. Patients increasingly prefer bioelectronic solutions over traditional pharmaceutical approaches due to reduced side effects and more targeted therapeutic outcomes. This shift in preference is particularly evident in treatment areas such as chronic pain management, where bioelectronic alternatives offer relief without the risks associated with opioid medications.

Healthcare providers are demonstrating growing interest in bioelectronic interfaces as complementary or alternative treatment modalities. The ability to provide personalized treatment protocols through programmable bioelectronic devices aligns with the broader industry trend toward precision medicine. Additionally, the potential for remote monitoring and adjustment of these devices supports the expanding telehealth ecosystem, creating synergistic market opportunities.

From a geographical perspective, North America currently dominates the bioelectronic interfaces market, accounting for approximately 42% of global revenue. However, the Asia-Pacific region is expected to witness the highest growth rate in the coming years, fueled by improving healthcare infrastructure, increasing disposable income, and growing awareness of advanced medical technologies.

Segmentation analysis reveals distinct market opportunities across various application areas. Cardiac rhythm management devices currently represent the largest market segment, followed by neurostimulation devices. However, emerging applications in inflammatory disease management and diabetes control are expected to exhibit the fastest growth rates over the next five years.

Reimbursement policies significantly influence market adoption rates. Countries with favorable insurance coverage for bioelectronic therapies show accelerated market penetration. Recent policy changes in major markets, including expanded Medicare coverage for certain neuromodulation therapies in the United States, are expected to further stimulate market growth.

Investment in the bioelectronic interfaces sector has seen remarkable growth, with venture capital funding exceeding $1.2 billion in 2022 alone. This influx of capital is enabling both established medical device companies and innovative startups to advance their research and development efforts, potentially accelerating time-to-market for next-generation bioelectronic solutions.

Technical Landscape and Barriers in Bioelectronics

The bioelectronics landscape is currently experiencing unprecedented growth, with global market projections reaching $25 billion by 2025. This emerging field sits at the intersection of electronics and biology, creating devices that can interface directly with biological systems. Despite significant advancements, the sector faces substantial technical challenges that impede widespread commercialization and adoption.

Material compatibility represents one of the most significant barriers in bioelectronic interfaces. Traditional electronic materials like silicon and metals often trigger foreign body responses when implanted, leading to inflammation, scarring, and eventual device failure. Researchers are exploring novel biocompatible materials including conducting polymers, hydrogels, and carbon-based nanomaterials, though each presents unique manufacturing and stability challenges.

Signal transduction between electronic and biological systems remains problematic due to the fundamental mismatch between ionic biological signaling and electron-based electronic systems. Current interface technologies struggle with signal-to-noise ratios, particularly in long-term implantable applications. This challenge is compounded by the dynamic nature of biological environments, where protein adsorption and cellular encapsulation progressively degrade device performance.

Power management constitutes another critical barrier. Implantable bioelectronic devices require miniaturized, long-lasting power sources that don't generate excessive heat or require frequent replacement. While wireless power transmission and energy harvesting technologies show promise, they remain insufficient for many high-demand applications like neural stimulation or continuous biosensing.

Miniaturization presents ongoing challenges, particularly for devices targeting specific cellular interactions. As devices approach cellular scales, traditional fabrication techniques become inadequate, necessitating novel nanofabrication approaches that maintain functionality at extremely small dimensions while ensuring reliability.

Data processing capabilities represent an emerging bottleneck as bioelectronic interfaces generate increasingly complex biological datasets. Edge computing solutions that can process information locally before transmission are needed to overcome bandwidth limitations and privacy concerns, particularly for continuous monitoring applications.

Regulatory pathways for bioelectronic devices remain complex and uncertain, with many novel interfaces falling between established medical device and pharmaceutical categories. This regulatory ambiguity increases development costs and timelines, particularly for startups and academic innovators with limited resources.

The geographical distribution of bioelectronics research shows concentration in North America, Western Europe, and East Asia, with the United States maintaining leadership in neural interfaces and Japan excelling in flexible electronics. China has rapidly expanded its research output, particularly in materials science applications for bioelectronics, while Europe leads in regulatory framework development.

Material compatibility represents one of the most significant barriers in bioelectronic interfaces. Traditional electronic materials like silicon and metals often trigger foreign body responses when implanted, leading to inflammation, scarring, and eventual device failure. Researchers are exploring novel biocompatible materials including conducting polymers, hydrogels, and carbon-based nanomaterials, though each presents unique manufacturing and stability challenges.

Signal transduction between electronic and biological systems remains problematic due to the fundamental mismatch between ionic biological signaling and electron-based electronic systems. Current interface technologies struggle with signal-to-noise ratios, particularly in long-term implantable applications. This challenge is compounded by the dynamic nature of biological environments, where protein adsorption and cellular encapsulation progressively degrade device performance.

Power management constitutes another critical barrier. Implantable bioelectronic devices require miniaturized, long-lasting power sources that don't generate excessive heat or require frequent replacement. While wireless power transmission and energy harvesting technologies show promise, they remain insufficient for many high-demand applications like neural stimulation or continuous biosensing.

Miniaturization presents ongoing challenges, particularly for devices targeting specific cellular interactions. As devices approach cellular scales, traditional fabrication techniques become inadequate, necessitating novel nanofabrication approaches that maintain functionality at extremely small dimensions while ensuring reliability.

Data processing capabilities represent an emerging bottleneck as bioelectronic interfaces generate increasingly complex biological datasets. Edge computing solutions that can process information locally before transmission are needed to overcome bandwidth limitations and privacy concerns, particularly for continuous monitoring applications.

Regulatory pathways for bioelectronic devices remain complex and uncertain, with many novel interfaces falling between established medical device and pharmaceutical categories. This regulatory ambiguity increases development costs and timelines, particularly for startups and academic innovators with limited resources.

The geographical distribution of bioelectronics research shows concentration in North America, Western Europe, and East Asia, with the United States maintaining leadership in neural interfaces and Japan excelling in flexible electronics. China has rapidly expanded its research output, particularly in materials science applications for bioelectronics, while Europe leads in regulatory framework development.

Current Bioelectronic Interface Implementation Approaches

01 Neural-electronic interfaces for biomedical applications

Neural-electronic interfaces enable direct communication between biological neural systems and electronic devices. These interfaces can be used for various biomedical applications, including neural prosthetics, brain-computer interfaces, and treatment of neurological disorders. The technology typically involves electrodes or sensor arrays that can record neural activity or stimulate neural tissue, facilitating bidirectional communication between biological systems and electronic devices.- Neural-electronic interfaces for biomedical applications: Neural-electronic interfaces enable direct communication between biological neural systems and electronic devices. These interfaces can be used for various biomedical applications, including neural prosthetics, brain-machine interfaces, and treatment of neurological disorders. The technology involves specialized electrodes and sensors that can record neural activity and deliver electrical stimulation to specific neural tissues, facilitating bidirectional communication between biological systems and electronic devices.

- Flexible and implantable bioelectronic devices: Flexible and implantable bioelectronic devices are designed to interface with biological tissues with minimal invasiveness and mechanical mismatch. These devices incorporate flexible substrates, stretchable electronics, and biocompatible materials to ensure long-term stability and functionality within the body. Applications include continuous health monitoring, targeted drug delivery, and therapeutic stimulation of tissues, offering advantages over rigid conventional electronics in terms of biocompatibility and conformability to biological surfaces.

- Biosensing interfaces with molecular recognition elements: Biosensing interfaces incorporate molecular recognition elements such as antibodies, enzymes, or nucleic acids to detect specific biological analytes. These interfaces translate biological recognition events into measurable electronic signals, enabling real-time monitoring of biomarkers, pathogens, or metabolites. The technology combines surface chemistry, nanomaterials, and transduction mechanisms to achieve high sensitivity and selectivity in complex biological environments, with applications in medical diagnostics, environmental monitoring, and food safety.

- Nanomaterial-based bioelectronic interfaces: Nanomaterial-based bioelectronic interfaces utilize nanoscale materials such as carbon nanotubes, graphene, quantum dots, and metal nanoparticles to enhance the performance of bioelectronic devices. These nanomaterials offer unique electrical, optical, and mechanical properties that improve signal transduction, sensitivity, and biocompatibility. The integration of nanomaterials enables miniaturization of devices while maintaining or enhancing functionality, leading to advanced biosensors, neural interfaces, and tissue engineering constructs with superior performance characteristics.

- Wireless and self-powered bioelectronic systems: Wireless and self-powered bioelectronic systems eliminate the need for external wiring or battery replacement, enhancing usability and longevity of implantable devices. These systems utilize energy harvesting mechanisms such as piezoelectric generators, biofuel cells, or wireless power transfer to maintain operation. Communication with external devices is achieved through various wireless protocols, enabling remote monitoring and control. This approach reduces infection risks associated with transcutaneous connections and allows for long-term deployment of bioelectronic interfaces in clinical and consumer health applications.

02 Flexible and implantable bioelectronic devices

Flexible and implantable bioelectronic devices are designed to interface with biological tissues with minimal invasiveness and mechanical mismatch. These devices can conform to the shape of tissues and organs, reducing inflammation and improving long-term stability. They often incorporate soft, stretchable materials and thin-film electronics that can bend and flex with the body's movements, making them suitable for long-term implantation and continuous monitoring of physiological signals.Expand Specific Solutions03 Biosensors and bioelectronic detection systems

Biosensors and bioelectronic detection systems integrate biological recognition elements with electronic transducers to detect and quantify biological analytes. These systems can be used for point-of-care diagnostics, environmental monitoring, and real-time health tracking. The technology often involves functionalized surfaces that can selectively bind to target molecules, coupled with electronic components that convert biological interactions into measurable electrical signals.Expand Specific Solutions04 Nanomaterials for bioelectronic interfaces

Nanomaterials play a crucial role in enhancing the performance of bioelectronic interfaces by improving electrical conductivity, biocompatibility, and signal transduction. Materials such as carbon nanotubes, graphene, and metal nanoparticles can be used to create high-performance electrodes with increased surface area and improved charge transfer capabilities. These nanomaterials can be functionalized with biomolecules to enhance specificity and reduce biofouling, leading to more sensitive and stable bioelectronic interfaces.Expand Specific Solutions05 Wireless and self-powered bioelectronic systems

Wireless and self-powered bioelectronic systems eliminate the need for external wires or batteries, making them more practical for in vivo applications. These systems can harvest energy from the body or environment, such as through mechanical movements, temperature gradients, or biochemical reactions. They often incorporate wireless data transmission technologies to communicate with external devices, enabling remote monitoring and control of implanted bioelectronic interfaces without the need for transcutaneous wires.Expand Specific Solutions

Key Industry Players and Competitive Dynamics

The bioelectronic interfaces market is currently in a growth phase, characterized by increasing convergence between electronics and biological systems. The global market is projected to expand significantly, driven by applications in healthcare monitoring, neural interfaces, and therapeutic devices. While academic institutions like MIT, University of Michigan, and Rice University lead fundamental research, commercial development is dominated by established players such as Agilent Technologies and Infineon Technologies, alongside emerging specialists like Sceneray Co. and ACEA Bio. The technology maturity varies across applications—with biosensors reaching commercial maturity while neural interfaces remain largely experimental. This competitive landscape reflects a dynamic ecosystem where academic-industry partnerships are accelerating innovation and commercialization pathways in this interdisciplinary field.

Massachusetts Institute of Technology

Technical Solution: MIT has pioneered significant advancements in bioelectronic interfaces through their development of flexible, ultrathin electronic systems that can seamlessly integrate with biological tissues. Their technology utilizes stretchable electronics fabricated on polymer substrates with thickness comparable to cellular dimensions (less than 10 μm), enabling conformal contact with soft tissues without causing mechanical damage[1]. MIT researchers have developed wireless, implantable devices capable of real-time monitoring of neural activity and delivering targeted therapeutic stimulation. Their platform incorporates advanced materials science, including conducting polymers and carbon nanomaterials, to create biocompatible interfaces with enhanced signal transduction properties[3]. MIT's approach also includes closed-loop systems that can detect specific biological signals and respond with appropriate electrical or pharmacological interventions, particularly valuable for neurological conditions like epilepsy and Parkinson's disease[5].

Strengths: Superior flexibility and biocompatibility allowing long-term implantation with minimal immune response; advanced wireless capabilities enabling remote monitoring and control; interdisciplinary approach combining materials science, electrical engineering, and biology. Weaknesses: High manufacturing costs limiting widespread clinical adoption; challenges in scaling production for commercial applications; potential long-term reliability issues in biological environments.

Infineon Technologies AG

Technical Solution: Infineon has developed a comprehensive bioelectronic interface platform centered around their specialized biosensor chips and integrated circuit solutions. Their technology incorporates highly sensitive CMOS-based sensor arrays capable of detecting minute electrical signals from biological systems with exceptional signal-to-noise ratios[2]. Infineon's bioelectronic interfaces feature proprietary signal processing algorithms that filter biological noise and enhance relevant biomarkers, particularly valuable for applications requiring precise measurements such as neural recording and cardiac monitoring. Their platform integrates wireless communication protocols (including Bluetooth Low Energy and proprietary RF solutions) with ultra-low power consumption architectures, enabling continuous operation for extended periods while maintaining data security through hardware-based encryption[4]. Infineon has particularly focused on miniaturization, achieving complete bioelectronic systems with dimensions suitable for minimally invasive implantation or wearable applications while maintaining robust performance in challenging biological environments.

Strengths: Industry-leading miniaturization capabilities; exceptional power efficiency extending operational lifetime; strong security features protecting sensitive biological data; established manufacturing infrastructure enabling scalable production. Weaknesses: Less experience with direct biological integration compared to academic institutions; higher costs compared to simpler solutions; potential challenges in achieving regulatory approval for implantable applications due to corporate focus on broader semiconductor markets.

Critical Patents and Research in Bioelectronic Interfaces

Bioresorbable organic bioelectronics

PatentWO2024205474A1

Innovation

- A composition comprising a polymer of formula (I) and one or more compounds of formula (II) or formula (III), which self-assemble into biocompatible, bioresorbable, and conductive electrodes that can be precisely placed in the body using minimally invasive techniques, allowing for controlled cellular responses and integration with bioelectrical circuits without causing tissue damage.

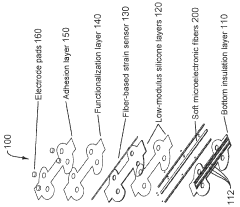

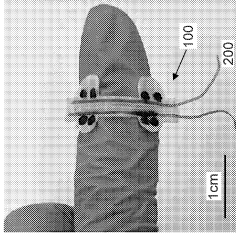

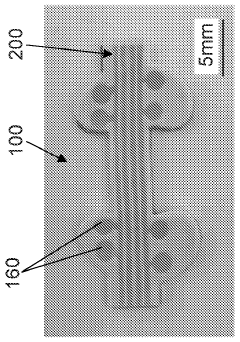

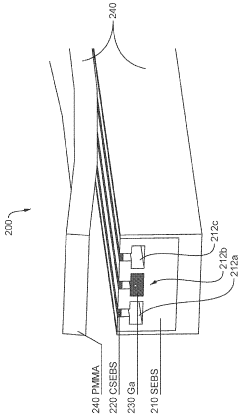

Stretchable microelectronic fibers and assemblies as multifunctional bioelectronic interfaces for whole organs

PatentWO2023201131A1

Innovation

- Development of soft and stretchable bioelectronic interfaces using elastic microelectronic fibers with liquid metal conductors and integrated microelectronic components, such as micro LEDs and sensors, which are fabricated through thermal drawing and integrated into a low-modulus elastomeric substrate for scalable, multifunctional bioelectronic therapies.

Regulatory Framework and Compliance Requirements

The bioelectronic interfaces sector operates within a complex and evolving regulatory landscape that varies significantly across global markets. In the United States, the FDA has established a specialized framework for bioelectronic devices through its Center for Devices and Radiological Health (CDRH), categorizing these technologies based on risk profiles and intended use. Class III devices, which include many implantable bioelectronic interfaces, require premarket approval (PMA) with extensive clinical trial data demonstrating safety and efficacy.

The European Union's regulatory approach has undergone significant transformation with the implementation of the Medical Device Regulation (MDR) in 2021, introducing more stringent requirements for clinical evidence, post-market surveillance, and unique device identification. This has created additional compliance hurdles for bioelectronic interface developers seeking European market access, particularly for novel technologies without substantial equivalence to existing approved devices.

Data privacy regulations present another critical compliance dimension, with GDPR in Europe and HIPAA in the US imposing strict requirements on the handling of health data generated by bioelectronic interfaces. These regulations necessitate robust data protection measures, informed consent protocols, and secure data transmission systems, adding layers of complexity to product development and deployment strategies.

Reimbursement pathways represent a significant regulatory consideration affecting market viability. In the US, obtaining favorable coverage decisions from the Centers for Medicare & Medicaid Services (CMS) and private insurers requires demonstrating not only clinical efficacy but also cost-effectiveness, which demands specialized health economics and outcomes research.

International harmonization efforts, such as the Medical Device Single Audit Program (MDSAP) and International Medical Device Regulators Forum (IMDRF) initiatives, are gradually reducing regulatory fragmentation, though significant market-specific requirements persist. Companies must navigate these variations while maintaining compliance across their target markets.

Emerging regulatory frameworks for AI and machine learning components in bioelectronic interfaces are creating additional uncertainty. The FDA's proposed regulatory framework for AI/ML-based Software as a Medical Device (SaMD) signals increasing scrutiny of adaptive algorithms that may change device functionality over time through continuous learning.

Environmental compliance requirements, including RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) directives, impose additional design and end-of-life management considerations for bioelectronic interface manufacturers, particularly for implantable devices that may contain restricted materials.

The European Union's regulatory approach has undergone significant transformation with the implementation of the Medical Device Regulation (MDR) in 2021, introducing more stringent requirements for clinical evidence, post-market surveillance, and unique device identification. This has created additional compliance hurdles for bioelectronic interface developers seeking European market access, particularly for novel technologies without substantial equivalence to existing approved devices.

Data privacy regulations present another critical compliance dimension, with GDPR in Europe and HIPAA in the US imposing strict requirements on the handling of health data generated by bioelectronic interfaces. These regulations necessitate robust data protection measures, informed consent protocols, and secure data transmission systems, adding layers of complexity to product development and deployment strategies.

Reimbursement pathways represent a significant regulatory consideration affecting market viability. In the US, obtaining favorable coverage decisions from the Centers for Medicare & Medicaid Services (CMS) and private insurers requires demonstrating not only clinical efficacy but also cost-effectiveness, which demands specialized health economics and outcomes research.

International harmonization efforts, such as the Medical Device Single Audit Program (MDSAP) and International Medical Device Regulators Forum (IMDRF) initiatives, are gradually reducing regulatory fragmentation, though significant market-specific requirements persist. Companies must navigate these variations while maintaining compliance across their target markets.

Emerging regulatory frameworks for AI and machine learning components in bioelectronic interfaces are creating additional uncertainty. The FDA's proposed regulatory framework for AI/ML-based Software as a Medical Device (SaMD) signals increasing scrutiny of adaptive algorithms that may change device functionality over time through continuous learning.

Environmental compliance requirements, including RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) directives, impose additional design and end-of-life management considerations for bioelectronic interface manufacturers, particularly for implantable devices that may contain restricted materials.

Investment Landscape and Funding Opportunities

The bioelectronic interfaces sector has witnessed substantial investment growth over the past five years, with venture capital funding increasing at a CAGR of approximately 27%. Major funding rounds have been concentrated in companies developing neural interfaces, implantable sensors, and non-invasive monitoring technologies, reflecting investor confidence in the long-term commercial potential of these applications.

Private equity firms have shown particular interest in later-stage bioelectronic companies with proven clinical efficacy and clear regulatory pathways. Notable investments include Blackstone's $635 million funding of Synchron and General Atlantic's strategic investment in BIOS Health, both focusing on neural interface technologies with therapeutic applications.

Government funding represents another significant capital source, with the NIH Brain Initiative allocating over $500 million specifically to bioelectronic research since 2018. The European Commission's Horizon Europe program has similarly earmarked €320 million for bioelectronic medicine projects through 2027, emphasizing the public sector's recognition of this field's strategic importance.

Corporate venture capital has emerged as a key player, with pharmaceutical giants establishing dedicated investment vehicles targeting bioelectronic startups. Johnson & Johnson Innovation, GSK's Action Potential Venture Capital, and Merck Ventures have collectively deployed over $1.2 billion into early and growth-stage companies, seeking strategic alignments with their therapeutic portfolios.

The investment landscape exhibits geographic concentration, with North America accounting for approximately 62% of total funding, followed by Europe (24%) and Asia-Pacific (14%). However, Chinese investments in bioelectronic interfaces have grown at twice the global rate since 2020, suggesting an emerging shift in the funding geography.

For emerging companies, non-dilutive funding pathways have proven increasingly valuable. SBIR/STTR grants specifically for bioelectronic interfaces have increased by 35% annually, while disease-focused foundations like the Michael J. Fox Foundation and the Epilepsy Foundation have established dedicated funding mechanisms for bioelectronic solutions targeting their respective conditions.

Return on investment timelines remain extended compared to digital health ventures, with investors typically expecting 7-10 years to liquidity events. This has created opportunities for patient capital providers, including family offices and sovereign wealth funds, which have increased their allocation to bioelectronic ventures by approximately 40% since 2019, attracted by the potential for outsized returns despite longer development cycles.

Private equity firms have shown particular interest in later-stage bioelectronic companies with proven clinical efficacy and clear regulatory pathways. Notable investments include Blackstone's $635 million funding of Synchron and General Atlantic's strategic investment in BIOS Health, both focusing on neural interface technologies with therapeutic applications.

Government funding represents another significant capital source, with the NIH Brain Initiative allocating over $500 million specifically to bioelectronic research since 2018. The European Commission's Horizon Europe program has similarly earmarked €320 million for bioelectronic medicine projects through 2027, emphasizing the public sector's recognition of this field's strategic importance.

Corporate venture capital has emerged as a key player, with pharmaceutical giants establishing dedicated investment vehicles targeting bioelectronic startups. Johnson & Johnson Innovation, GSK's Action Potential Venture Capital, and Merck Ventures have collectively deployed over $1.2 billion into early and growth-stage companies, seeking strategic alignments with their therapeutic portfolios.

The investment landscape exhibits geographic concentration, with North America accounting for approximately 62% of total funding, followed by Europe (24%) and Asia-Pacific (14%). However, Chinese investments in bioelectronic interfaces have grown at twice the global rate since 2020, suggesting an emerging shift in the funding geography.

For emerging companies, non-dilutive funding pathways have proven increasingly valuable. SBIR/STTR grants specifically for bioelectronic interfaces have increased by 35% annually, while disease-focused foundations like the Michael J. Fox Foundation and the Epilepsy Foundation have established dedicated funding mechanisms for bioelectronic solutions targeting their respective conditions.

Return on investment timelines remain extended compared to digital health ventures, with investors typically expecting 7-10 years to liquidity events. This has created opportunities for patient capital providers, including family offices and sovereign wealth funds, which have increased their allocation to bioelectronic ventures by approximately 40% since 2019, attracted by the potential for outsized returns despite longer development cycles.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!