Analysis of Global Antibacterial Coating Market Trends

OCT 15, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Antibacterial Coating Technology Background and Objectives

Antibacterial coatings have emerged as a critical technology in the global fight against pathogenic microorganisms, with applications spanning healthcare, food processing, consumer goods, and construction industries. The evolution of this technology can be traced back to the early 1900s when silver was first recognized for its antimicrobial properties. However, significant advancements only began in the 1970s with the development of more sophisticated coating technologies incorporating various active agents such as silver ions, copper, zinc oxide, and quaternary ammonium compounds.

The technological landscape has witnessed accelerated growth over the past decade, driven by increasing healthcare-associated infections, growing awareness of hygiene, and the global COVID-19 pandemic which heightened focus on surface contamination. This evolution has moved from simple additive-based coatings to more complex, multi-functional systems that not only kill bacteria but also prevent biofilm formation and exhibit self-cleaning properties.

Current technological trends indicate a shift toward environmentally friendly and sustainable antibacterial coating solutions. Research is increasingly focused on developing non-toxic alternatives to traditional biocides, with particular emphasis on natural antimicrobial agents derived from plants and essential oils. Additionally, nanotechnology has revolutionized the field, enabling the creation of nanostructured surfaces that can physically disrupt bacterial cell membranes without relying on chemical agents.

The primary objectives of antibacterial coating technology development are multifaceted. First, to enhance efficacy against a broader spectrum of microorganisms, including antibiotic-resistant strains. Second, to improve durability and longevity of antimicrobial effects under various environmental conditions. Third, to develop cost-effective manufacturing processes that enable widespread commercial adoption. Fourth, to ensure biocompatibility and safety for human contact applications, particularly in medical devices and food packaging.

Looking forward, the technological trajectory points toward smart antibacterial coatings that can respond to environmental triggers, releasing antimicrobial agents only when needed. Integration with Internet of Things (IoT) technologies may enable real-time monitoring of surface contamination levels and coating effectiveness. Additionally, researchers are exploring the combination of antibacterial properties with other functionalities such as anti-fouling, anti-corrosion, and self-healing capabilities to create truly multifunctional coating systems.

The global research community is increasingly collaborative in this domain, with significant contributions coming from North America, Europe, and Asia-Pacific regions, each bringing unique perspectives and technological approaches to addressing the universal challenge of microbial contamination on surfaces.

The technological landscape has witnessed accelerated growth over the past decade, driven by increasing healthcare-associated infections, growing awareness of hygiene, and the global COVID-19 pandemic which heightened focus on surface contamination. This evolution has moved from simple additive-based coatings to more complex, multi-functional systems that not only kill bacteria but also prevent biofilm formation and exhibit self-cleaning properties.

Current technological trends indicate a shift toward environmentally friendly and sustainable antibacterial coating solutions. Research is increasingly focused on developing non-toxic alternatives to traditional biocides, with particular emphasis on natural antimicrobial agents derived from plants and essential oils. Additionally, nanotechnology has revolutionized the field, enabling the creation of nanostructured surfaces that can physically disrupt bacterial cell membranes without relying on chemical agents.

The primary objectives of antibacterial coating technology development are multifaceted. First, to enhance efficacy against a broader spectrum of microorganisms, including antibiotic-resistant strains. Second, to improve durability and longevity of antimicrobial effects under various environmental conditions. Third, to develop cost-effective manufacturing processes that enable widespread commercial adoption. Fourth, to ensure biocompatibility and safety for human contact applications, particularly in medical devices and food packaging.

Looking forward, the technological trajectory points toward smart antibacterial coatings that can respond to environmental triggers, releasing antimicrobial agents only when needed. Integration with Internet of Things (IoT) technologies may enable real-time monitoring of surface contamination levels and coating effectiveness. Additionally, researchers are exploring the combination of antibacterial properties with other functionalities such as anti-fouling, anti-corrosion, and self-healing capabilities to create truly multifunctional coating systems.

The global research community is increasingly collaborative in this domain, with significant contributions coming from North America, Europe, and Asia-Pacific regions, each bringing unique perspectives and technological approaches to addressing the universal challenge of microbial contamination on surfaces.

Market Demand Analysis for Antibacterial Coatings

The global antibacterial coating market has experienced significant growth in recent years, driven primarily by increasing healthcare-associated infections and growing awareness about hygiene and sanitation. The market was valued at approximately 3.6 billion USD in 2021 and is projected to reach 7.2 billion USD by 2028, representing a compound annual growth rate (CAGR) of 10.5% during the forecast period.

Healthcare sector remains the dominant application area, accounting for nearly 40% of the total market share. The COVID-19 pandemic has substantially accelerated demand in this sector, with hospitals, clinics, and other healthcare facilities increasingly adopting antibacterial coatings for surfaces to minimize cross-contamination risks. Medical devices, surgical instruments, and hospital furniture represent key application segments within healthcare.

Food and beverage industry constitutes the second-largest market segment, driven by stringent regulations regarding food safety and hygiene. Antibacterial coatings on food processing equipment, packaging materials, and storage containers help prevent bacterial contamination and extend shelf life of products. This segment is expected to grow at a CAGR of 11.2% through 2028.

Consumer electronics has emerged as a rapidly growing application area, particularly for smartphones, tablets, and wearable devices. Manufacturers are increasingly incorporating antibacterial coatings as a value-added feature to address consumer concerns about device hygiene. Market research indicates that 78% of consumers express willingness to pay premium prices for electronics with antibacterial properties.

Regionally, North America currently leads the market with approximately 35% share, followed by Europe (28%) and Asia-Pacific (25%). However, the Asia-Pacific region is projected to witness the fastest growth rate of 12.3% during the forecast period, driven by rapid industrialization, increasing healthcare expenditure, and growing awareness about hygiene in countries like China, India, and Japan.

Silver-based antibacterial coatings dominate the market with approximately 45% share due to their broad-spectrum antimicrobial efficacy. However, copper-based coatings are gaining traction due to their cost-effectiveness and comparable performance. Organic antibacterial coatings, particularly those utilizing quaternary ammonium compounds, are experiencing increased demand due to their environmental sustainability profile.

Market research indicates that 67% of end-users prioritize long-lasting antibacterial efficacy as the most important purchasing criterion, followed by ease of application (58%) and cost-effectiveness (52%). Additionally, 73% of industrial customers express preference for coatings that offer multiple functionalities beyond antibacterial properties, such as anti-corrosion or self-cleaning capabilities.

Healthcare sector remains the dominant application area, accounting for nearly 40% of the total market share. The COVID-19 pandemic has substantially accelerated demand in this sector, with hospitals, clinics, and other healthcare facilities increasingly adopting antibacterial coatings for surfaces to minimize cross-contamination risks. Medical devices, surgical instruments, and hospital furniture represent key application segments within healthcare.

Food and beverage industry constitutes the second-largest market segment, driven by stringent regulations regarding food safety and hygiene. Antibacterial coatings on food processing equipment, packaging materials, and storage containers help prevent bacterial contamination and extend shelf life of products. This segment is expected to grow at a CAGR of 11.2% through 2028.

Consumer electronics has emerged as a rapidly growing application area, particularly for smartphones, tablets, and wearable devices. Manufacturers are increasingly incorporating antibacterial coatings as a value-added feature to address consumer concerns about device hygiene. Market research indicates that 78% of consumers express willingness to pay premium prices for electronics with antibacterial properties.

Regionally, North America currently leads the market with approximately 35% share, followed by Europe (28%) and Asia-Pacific (25%). However, the Asia-Pacific region is projected to witness the fastest growth rate of 12.3% during the forecast period, driven by rapid industrialization, increasing healthcare expenditure, and growing awareness about hygiene in countries like China, India, and Japan.

Silver-based antibacterial coatings dominate the market with approximately 45% share due to their broad-spectrum antimicrobial efficacy. However, copper-based coatings are gaining traction due to their cost-effectiveness and comparable performance. Organic antibacterial coatings, particularly those utilizing quaternary ammonium compounds, are experiencing increased demand due to their environmental sustainability profile.

Market research indicates that 67% of end-users prioritize long-lasting antibacterial efficacy as the most important purchasing criterion, followed by ease of application (58%) and cost-effectiveness (52%). Additionally, 73% of industrial customers express preference for coatings that offer multiple functionalities beyond antibacterial properties, such as anti-corrosion or self-cleaning capabilities.

Global Antibacterial Coating Technology Status and Challenges

The global antibacterial coating technology landscape presents a complex mix of established solutions and emerging innovations. Currently, the market is dominated by silver-based antibacterial coatings, which account for approximately 45% of commercial applications due to their proven efficacy against a broad spectrum of pathogens. Copper and zinc oxide formulations follow with roughly 30% market share, while quaternary ammonium compounds and triclosan-based solutions comprise another 15%.

Despite significant advancements, the industry faces several critical challenges. Durability remains a primary concern, with many coatings demonstrating reduced efficacy after repeated cleaning or extended exposure to environmental factors. Studies indicate that up to 60% of antibacterial coatings show diminished performance after six months of regular use, particularly in high-touch or high-moisture environments.

Toxicity and environmental impact present another substantial hurdle. Many effective antibacterial agents, particularly those containing heavy metals or certain organic compounds, raise concerns regarding bioaccumulation and potential ecological damage. Regulatory bodies worldwide have increasingly scrutinized these materials, with the European Union's REACH regulations and similar frameworks in North America imposing stricter limitations on several common antibacterial compounds.

Cost-effectiveness continues to constrain widespread adoption, especially in price-sensitive sectors. Premium antibacterial coatings can increase product costs by 15-30%, creating significant barriers to implementation in developing markets and budget-conscious industries. This economic challenge is particularly evident in healthcare settings in emerging economies, where the need is often greatest but resources most limited.

Geographically, North America and Europe lead in technology development and patent activity, accounting for approximately 65% of global innovations in this field. However, Asia-Pacific regions, particularly China, Japan, and South Korea, have demonstrated accelerated growth in both research output and commercial applications, increasing their collective share of patents from 18% to 27% over the past five years.

The COVID-19 pandemic has dramatically accelerated interest in antibacterial coating technologies, with research publications increasing by 78% between 2019 and 2021. This surge has intensified focus on developing solutions for specific challenges, including the need for coatings effective against both bacteria and viruses, formulations compatible with diverse substrate materials, and technologies offering extended antimicrobial persistence without environmental concerns.

Standardization of testing protocols represents another significant challenge, with inconsistent methodologies making direct comparisons between different technologies difficult for end-users and regulators alike. This fragmentation has slowed adoption rates and complicated regulatory approval processes across multiple jurisdictions.

Despite significant advancements, the industry faces several critical challenges. Durability remains a primary concern, with many coatings demonstrating reduced efficacy after repeated cleaning or extended exposure to environmental factors. Studies indicate that up to 60% of antibacterial coatings show diminished performance after six months of regular use, particularly in high-touch or high-moisture environments.

Toxicity and environmental impact present another substantial hurdle. Many effective antibacterial agents, particularly those containing heavy metals or certain organic compounds, raise concerns regarding bioaccumulation and potential ecological damage. Regulatory bodies worldwide have increasingly scrutinized these materials, with the European Union's REACH regulations and similar frameworks in North America imposing stricter limitations on several common antibacterial compounds.

Cost-effectiveness continues to constrain widespread adoption, especially in price-sensitive sectors. Premium antibacterial coatings can increase product costs by 15-30%, creating significant barriers to implementation in developing markets and budget-conscious industries. This economic challenge is particularly evident in healthcare settings in emerging economies, where the need is often greatest but resources most limited.

Geographically, North America and Europe lead in technology development and patent activity, accounting for approximately 65% of global innovations in this field. However, Asia-Pacific regions, particularly China, Japan, and South Korea, have demonstrated accelerated growth in both research output and commercial applications, increasing their collective share of patents from 18% to 27% over the past five years.

The COVID-19 pandemic has dramatically accelerated interest in antibacterial coating technologies, with research publications increasing by 78% between 2019 and 2021. This surge has intensified focus on developing solutions for specific challenges, including the need for coatings effective against both bacteria and viruses, formulations compatible with diverse substrate materials, and technologies offering extended antimicrobial persistence without environmental concerns.

Standardization of testing protocols represents another significant challenge, with inconsistent methodologies making direct comparisons between different technologies difficult for end-users and regulators alike. This fragmentation has slowed adoption rates and complicated regulatory approval processes across multiple jurisdictions.

Current Antibacterial Coating Technical Solutions

01 Metal-based antibacterial coatings

Metal-based compounds, particularly silver, copper, and zinc, are widely used in antibacterial coatings due to their inherent antimicrobial properties. These metals can be incorporated into various coating matrices as nanoparticles, ions, or complexes. The mechanism of action typically involves the release of metal ions that disrupt bacterial cell membranes, interfere with enzyme functions, or generate reactive oxygen species. These coatings are particularly effective against a broad spectrum of bacteria and can provide long-lasting protection on various surfaces.- Metal-based antibacterial coatings: Metal-based compounds such as silver, copper, and zinc can be incorporated into coatings to provide antibacterial properties. These metals release ions that disrupt bacterial cell membranes and interfere with cellular processes, effectively killing or inhibiting the growth of bacteria. These coatings can be applied to various surfaces including medical devices, textiles, and household items to prevent bacterial contamination and growth.

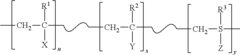

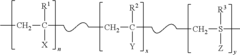

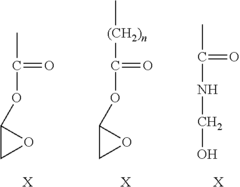

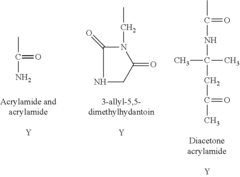

- Polymer-based antibacterial coatings: Polymeric materials can be formulated with antibacterial properties by incorporating active ingredients or through chemical modification. These polymers can form durable coatings that provide long-lasting protection against bacterial growth. Some polymers inherently possess antibacterial properties, while others serve as carriers for antibacterial agents. These coatings are particularly useful for medical implants, food packaging, and high-touch surfaces.

- Natural compound-based antibacterial coatings: Plant extracts, essential oils, and other natural compounds can be used to create environmentally friendly antibacterial coatings. These natural alternatives offer reduced toxicity compared to synthetic chemicals while still providing effective antimicrobial protection. Compounds such as chitosan, plant polyphenols, and essential oil components can be incorporated into coating formulations to inhibit bacterial growth on various surfaces.

- Nanoparticle-enhanced antibacterial coatings: Nanoparticles can significantly enhance the antibacterial efficacy of coatings due to their high surface area and unique physical properties. Materials such as nano-silver, nano-zinc oxide, and nano-titanium dioxide can be dispersed in coating matrices to provide potent antibacterial activity. These nanoparticle-enhanced coatings can achieve bacterial inhibition at lower concentrations of active ingredients and often demonstrate improved durability and sustained release characteristics.

- Smart responsive antibacterial coatings: Advanced coating technologies that respond to environmental stimuli such as pH, temperature, or bacterial presence can provide targeted antibacterial action. These smart coatings can release antibacterial agents only when needed, extending their effective lifespan and reducing unnecessary exposure to antimicrobial compounds. Some designs incorporate mechanisms that are triggered by bacterial enzymes or changes in local conditions associated with bacterial growth.

02 Polymer-based antibacterial coatings

Polymer matrices serve as effective carriers for antibacterial agents, providing controlled release mechanisms and improved durability. These coatings can be formulated with inherently antibacterial polymers like chitosan or modified polymers that contain quaternary ammonium compounds. The polymer structure allows for tunable properties such as hydrophobicity, adhesion, and release kinetics of active ingredients. These coatings can be applied to various surfaces through methods including dip-coating, spray-coating, or electrospinning, resulting in uniform coverage with sustained antibacterial efficacy.Expand Specific Solutions03 Natural compound-based antibacterial coatings

Antibacterial coatings derived from natural sources offer environmentally friendly alternatives to synthetic chemicals. These include plant extracts, essential oils, enzymes, and peptides with inherent antimicrobial properties. The active compounds typically contain phenolics, terpenes, or alkaloids that disrupt bacterial cell membranes or inhibit critical metabolic pathways. These natural coatings are particularly valuable in applications requiring biocompatibility, such as food packaging, medical devices, and consumer products, where toxicity concerns exist with traditional antimicrobial agents.Expand Specific Solutions04 Photocatalytic antibacterial coatings

Photocatalytic materials, particularly titanium dioxide (TiO2) and zinc oxide (ZnO), can be incorporated into coatings to provide light-activated antibacterial properties. When exposed to UV or visible light, these materials generate reactive oxygen species that damage bacterial cell components. These coatings offer the advantage of self-cleaning and continuous antibacterial action without depleting the active ingredient. The technology can be enhanced by doping with metals or non-metals to improve visible light activity, making them suitable for indoor applications where UV exposure is limited.Expand Specific Solutions05 Multi-functional antibacterial coatings

Advanced antibacterial coatings combine multiple functionalities beyond microbial control, such as anti-fouling, self-healing, or stimuli-responsive properties. These coatings often incorporate a combination of different antibacterial mechanisms to prevent bacterial resistance development. Layer-by-layer assembly techniques allow precise control over the release of multiple active agents. Smart coatings can respond to environmental triggers like pH, temperature, or bacterial presence to release antibacterial agents only when needed, thereby extending the coating's effective lifetime while minimizing environmental impact.Expand Specific Solutions

Key Players in Global Antibacterial Coating Industry

The global antibacterial coating market is experiencing robust growth, currently in a mature expansion phase with increasing adoption across healthcare, food processing, and consumer goods sectors. The market size is projected to reach significant value due to rising hygiene awareness and healthcare-associated infection concerns. Technologically, the field shows varying maturity levels, with established players like Nippon Paint Holdings, LG Chem, and TOTO Ltd leading commercial applications through proprietary technologies. Research institutions including Massachusetts Institute of Technology, California Institute of Technology, and Industrial Technology Research Institute are advancing next-generation solutions. The competitive landscape features both specialized coating manufacturers and diversified chemical companies like Asahi Kasei Corp and CNOOC Changzhou, indicating a market transitioning from niche applications to mainstream adoption.

Nippon Paint Holdings Co., Ltd.

Technical Solution: Nippon Paint has developed advanced antibacterial coating technologies under their "Antivirus" series, which incorporates silver-ion technology to inhibit bacterial growth on surfaces. Their proprietary formulation combines silver nanoparticles with specialized polymers to create durable antibacterial surfaces that maintain efficacy for extended periods. The company has expanded their antibacterial coating portfolio to include solutions for healthcare facilities, food processing plants, and residential applications. Their technology has been clinically tested to be effective against a wide range of bacteria including E. coli and MRSA, with efficacy rates exceeding 99.9% within 24 hours of bacterial contact[1]. Nippon Paint has also developed water-based antibacterial coatings with low VOC content to meet increasing environmental regulations while maintaining high performance standards.

Strengths: Strong R&D capabilities with established global distribution networks; comprehensive product range covering multiple sectors; environmentally friendly formulations with proven efficacy. Weaknesses: Higher price point compared to conventional coatings; performance may degrade over time in harsh environments; requires specific application techniques for optimal results.

TOTO Ltd.

Technical Solution: TOTO has pioneered the HYDROTECT antibacterial coating technology, primarily based on photocatalytic titanium dioxide that creates a self-cleaning and antibacterial surface when exposed to light. Their technology works through a photocatalytic process where UV light activates the titanium dioxide coating to break down organic substances and kill bacteria. TOTO has expanded this technology beyond bathroom fixtures to include architectural materials and air purification systems. Their latest generation of HYDROTECT incorporates copper ions to enhance antibacterial properties even in low-light conditions, achieving bacterial reduction rates of over 99% in standardized tests[2]. The company has successfully commercialized this technology in healthcare settings, public facilities, and residential applications across Asia, Europe, and North America, with documented case studies showing significant reduction in surface contamination levels in high-traffic areas.

Strengths: Proprietary photocatalytic technology with proven long-term durability; works passively without additional chemical treatments; environmentally sustainable approach. Weaknesses: Reduced effectiveness in low-light environments despite copper ion enhancements; higher initial installation costs; requires periodic maintenance to maintain optimal performance.

Core Patents and Innovations in Antibacterial Coating Technology

Antimicrobial surface coatings

PatentActiveUS20150315389A1

Innovation

- Development of durable and rechargeable N-halamine surface coatings that can be covalently bound to various surfaces, including textiles, inorganic mediums, and plastics, using water-soluble polymeric N-halamine precursors that form nitrogen-halogen bonds, effectively inactivating bacteria, fungi, and viruses upon contact, with the ability to regenerate biocidal activity.

Antimicrobial coatings

PatentWO2020035483A1

Innovation

- An antimicrobial liquid crystal composition comprising amphiphilic lipids, antimicrobial agents, and water that forms stable liquid crystals at room temperature, providing sustained and adhesive antimicrobial properties without requiring additional surfactants or polymers, and can be adapted by stimuli like humidity and pH to enhance antimicrobial efficacy.

Regulatory Framework and Compliance Requirements

The global antibacterial coating market operates within a complex regulatory landscape that varies significantly across regions and industries. In the United States, the Environmental Protection Agency (EPA) regulates antimicrobial products under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), requiring manufacturers to register their products and demonstrate both efficacy and safety. Similarly, the Food and Drug Administration (FDA) oversees antibacterial coatings used in medical devices and food contact surfaces, implementing stringent approval processes that can take several years and cost millions in development and testing.

The European Union employs the Biocidal Products Regulation (BPR) to govern antibacterial coatings, mandating comprehensive risk assessments and authorization procedures. The regulation specifically addresses active substances and requires manufacturers to prove that their products pose no unacceptable risks to human health or the environment. Additionally, the EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation imposes further compliance requirements for chemical substances used in these coatings.

In Asia-Pacific markets, regulatory frameworks show considerable variation. Japan's Ministry of Health, Labor and Welfare enforces strict standards for antimicrobial products, while China has recently strengthened its regulatory oversight through the National Medical Products Administration. These divergent approaches create significant challenges for global manufacturers seeking multi-market compliance.

Industry-specific regulations add another layer of complexity. Healthcare applications face particularly rigorous standards, with hospital-grade antibacterial coatings subject to additional testing for compatibility with sterilization procedures and resistance to hospital-specific cleaning agents. The construction sector must adhere to building codes that increasingly incorporate antimicrobial requirements, especially in public facilities.

Environmental regulations are progressively influencing the market, with growing restrictions on certain biocides like triclosan and silver nanoparticles due to ecological concerns. This regulatory pressure is driving innovation toward more sustainable alternatives, including naturally-derived antimicrobial compounds and physical rather than chemical antibacterial mechanisms.

Compliance costs represent a significant market barrier, particularly for smaller companies. Testing requirements, documentation, and ongoing monitoring can consume substantial resources, often necessitating specialized regulatory affairs teams. Market leaders have responded by developing standardized compliance protocols and investing in regulatory intelligence systems to navigate this complex landscape efficiently.

Looking forward, regulatory harmonization efforts are emerging through international standards organizations like ISO, which has developed specific standards for testing antimicrobial activity. These initiatives aim to reduce compliance burdens while maintaining safety and efficacy standards, potentially opening opportunities for market expansion and technological innovation in the antibacterial coating sector.

The European Union employs the Biocidal Products Regulation (BPR) to govern antibacterial coatings, mandating comprehensive risk assessments and authorization procedures. The regulation specifically addresses active substances and requires manufacturers to prove that their products pose no unacceptable risks to human health or the environment. Additionally, the EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation imposes further compliance requirements for chemical substances used in these coatings.

In Asia-Pacific markets, regulatory frameworks show considerable variation. Japan's Ministry of Health, Labor and Welfare enforces strict standards for antimicrobial products, while China has recently strengthened its regulatory oversight through the National Medical Products Administration. These divergent approaches create significant challenges for global manufacturers seeking multi-market compliance.

Industry-specific regulations add another layer of complexity. Healthcare applications face particularly rigorous standards, with hospital-grade antibacterial coatings subject to additional testing for compatibility with sterilization procedures and resistance to hospital-specific cleaning agents. The construction sector must adhere to building codes that increasingly incorporate antimicrobial requirements, especially in public facilities.

Environmental regulations are progressively influencing the market, with growing restrictions on certain biocides like triclosan and silver nanoparticles due to ecological concerns. This regulatory pressure is driving innovation toward more sustainable alternatives, including naturally-derived antimicrobial compounds and physical rather than chemical antibacterial mechanisms.

Compliance costs represent a significant market barrier, particularly for smaller companies. Testing requirements, documentation, and ongoing monitoring can consume substantial resources, often necessitating specialized regulatory affairs teams. Market leaders have responded by developing standardized compliance protocols and investing in regulatory intelligence systems to navigate this complex landscape efficiently.

Looking forward, regulatory harmonization efforts are emerging through international standards organizations like ISO, which has developed specific standards for testing antimicrobial activity. These initiatives aim to reduce compliance burdens while maintaining safety and efficacy standards, potentially opening opportunities for market expansion and technological innovation in the antibacterial coating sector.

Environmental Impact and Sustainability Considerations

The antibacterial coating industry faces increasing scrutiny regarding its environmental footprint, particularly concerning the chemicals used in traditional antimicrobial formulations. Many conventional antibacterial coatings contain heavy metals such as silver, copper, and zinc, which can accumulate in ecosystems and potentially disrupt aquatic environments when leached during product lifecycle. Recent studies indicate that nanosilver particles, commonly used in antibacterial applications, may persist in the environment and affect non-target organisms, raising concerns about their long-term ecological impact.

Regulatory bodies worldwide are responding with stricter guidelines on chemical usage in coatings. The European Union's REACH regulations and the EPA's antimicrobial registration requirements in the United States have become increasingly stringent, pushing manufacturers toward greener alternatives. This regulatory landscape is reshaping market dynamics, with companies investing in eco-friendly innovations to maintain compliance and market access.

The industry is witnessing a significant shift toward bio-based and biodegradable antibacterial coating solutions. Plant-derived compounds such as essential oils, chitosan from crustacean shells, and polyphenols from agricultural waste are emerging as sustainable alternatives. These natural antimicrobials offer comparable efficacy while substantially reducing environmental toxicity. Market analysis reveals that products featuring these green credentials commanded a premium of 15-20% in 2022, indicating strong consumer willingness to pay for sustainable options.

Life Cycle Assessment (LCA) has become a critical tool for evaluating the environmental performance of antibacterial coatings. Recent LCA studies demonstrate that bio-based coatings typically reduce carbon footprint by 30-45% compared to conventional petroleum-based alternatives. Additionally, water consumption during manufacturing can be reduced by up to 60% when implementing closed-loop production systems, which several market leaders have begun adopting.

The circular economy concept is gaining traction in the antibacterial coating sector. Innovations in recyclable coating formulations and recovery systems are emerging, with some manufacturers implementing take-back programs for coating containers and developing water-based systems that eliminate volatile organic compounds (VOCs). These initiatives not only reduce environmental impact but also create cost efficiencies that improve market competitiveness.

Consumer awareness regarding environmental issues is driving demand for transparent sustainability practices. Companies that clearly communicate their environmental initiatives through certification programs like Cradle to Cradle, GreenGuard, or Environmental Product Declarations are experiencing stronger brand loyalty and market share growth. This trend is particularly pronounced in healthcare, food processing, and consumer goods sectors, where end-users increasingly factor sustainability into purchasing decisions.

Regulatory bodies worldwide are responding with stricter guidelines on chemical usage in coatings. The European Union's REACH regulations and the EPA's antimicrobial registration requirements in the United States have become increasingly stringent, pushing manufacturers toward greener alternatives. This regulatory landscape is reshaping market dynamics, with companies investing in eco-friendly innovations to maintain compliance and market access.

The industry is witnessing a significant shift toward bio-based and biodegradable antibacterial coating solutions. Plant-derived compounds such as essential oils, chitosan from crustacean shells, and polyphenols from agricultural waste are emerging as sustainable alternatives. These natural antimicrobials offer comparable efficacy while substantially reducing environmental toxicity. Market analysis reveals that products featuring these green credentials commanded a premium of 15-20% in 2022, indicating strong consumer willingness to pay for sustainable options.

Life Cycle Assessment (LCA) has become a critical tool for evaluating the environmental performance of antibacterial coatings. Recent LCA studies demonstrate that bio-based coatings typically reduce carbon footprint by 30-45% compared to conventional petroleum-based alternatives. Additionally, water consumption during manufacturing can be reduced by up to 60% when implementing closed-loop production systems, which several market leaders have begun adopting.

The circular economy concept is gaining traction in the antibacterial coating sector. Innovations in recyclable coating formulations and recovery systems are emerging, with some manufacturers implementing take-back programs for coating containers and developing water-based systems that eliminate volatile organic compounds (VOCs). These initiatives not only reduce environmental impact but also create cost efficiencies that improve market competitiveness.

Consumer awareness regarding environmental issues is driving demand for transparent sustainability practices. Companies that clearly communicate their environmental initiatives through certification programs like Cradle to Cradle, GreenGuard, or Environmental Product Declarations are experiencing stronger brand loyalty and market share growth. This trend is particularly pronounced in healthcare, food processing, and consumer goods sectors, where end-users increasingly factor sustainability into purchasing decisions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!