Research on Antibacterial Coating Penetration in Global Markets

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Antibacterial Coating Evolution and Objectives

Antibacterial coatings have evolved significantly over the past several decades, transitioning from simple chemical formulations to sophisticated engineered surfaces with targeted antimicrobial properties. The earliest iterations emerged in the 1950s with silver-based coatings primarily used in medical settings. By the 1970s, triclosan and quaternary ammonium compounds expanded the application possibilities, though with limited efficacy and durability.

The 1990s marked a pivotal shift with the introduction of nanotechnology in antibacterial coatings, enabling enhanced performance through controlled release mechanisms and increased surface area contact. This period saw the first commercial applications beyond healthcare, including consumer products and food packaging. The early 2000s witnessed further refinement with photocatalytic coatings utilizing titanium dioxide, which could neutralize bacteria when exposed to light.

Recent advancements have focused on developing "smart" antibacterial coatings that respond to environmental triggers, such as pH changes or bacterial presence, releasing antimicrobial agents only when needed. This targeted approach minimizes unnecessary chemical exposure while maximizing effectiveness. Parallel to this, research into naturally derived antimicrobial compounds has accelerated, addressing growing consumer demand for sustainable and non-toxic solutions.

The global COVID-19 pandemic served as a significant catalyst, dramatically increasing awareness and demand for antibacterial surfaces across all market segments. This has accelerated research into novel coating technologies with broader spectrum efficacy against both bacteria and viruses, while maintaining environmental sustainability.

The primary objective of current antibacterial coating research is to develop solutions that balance several critical factors: broad-spectrum antimicrobial efficacy, minimal potential for developing resistance, environmental sustainability, cost-effectiveness, and durability under various conditions. Specifically, researchers aim to create coatings that maintain effectiveness for extended periods without leaching harmful chemicals into the environment.

Another key objective is to enhance market penetration by developing application-specific formulations tailored to diverse sectors including healthcare, food processing, transportation, consumer electronics, and residential construction. This requires understanding the unique requirements of each sector regarding regulatory compliance, performance standards, and cost constraints.

Looking forward, the field aims to integrate antibacterial coatings with other functional properties such as anti-fouling, self-cleaning, and self-healing capabilities, creating multifunctional surfaces that address multiple challenges simultaneously. The ultimate goal is to establish antibacterial surfaces as a standard feature across global industries, contributing to improved public health outcomes and reduced disease transmission.

The 1990s marked a pivotal shift with the introduction of nanotechnology in antibacterial coatings, enabling enhanced performance through controlled release mechanisms and increased surface area contact. This period saw the first commercial applications beyond healthcare, including consumer products and food packaging. The early 2000s witnessed further refinement with photocatalytic coatings utilizing titanium dioxide, which could neutralize bacteria when exposed to light.

Recent advancements have focused on developing "smart" antibacterial coatings that respond to environmental triggers, such as pH changes or bacterial presence, releasing antimicrobial agents only when needed. This targeted approach minimizes unnecessary chemical exposure while maximizing effectiveness. Parallel to this, research into naturally derived antimicrobial compounds has accelerated, addressing growing consumer demand for sustainable and non-toxic solutions.

The global COVID-19 pandemic served as a significant catalyst, dramatically increasing awareness and demand for antibacterial surfaces across all market segments. This has accelerated research into novel coating technologies with broader spectrum efficacy against both bacteria and viruses, while maintaining environmental sustainability.

The primary objective of current antibacterial coating research is to develop solutions that balance several critical factors: broad-spectrum antimicrobial efficacy, minimal potential for developing resistance, environmental sustainability, cost-effectiveness, and durability under various conditions. Specifically, researchers aim to create coatings that maintain effectiveness for extended periods without leaching harmful chemicals into the environment.

Another key objective is to enhance market penetration by developing application-specific formulations tailored to diverse sectors including healthcare, food processing, transportation, consumer electronics, and residential construction. This requires understanding the unique requirements of each sector regarding regulatory compliance, performance standards, and cost constraints.

Looking forward, the field aims to integrate antibacterial coatings with other functional properties such as anti-fouling, self-cleaning, and self-healing capabilities, creating multifunctional surfaces that address multiple challenges simultaneously. The ultimate goal is to establish antibacterial surfaces as a standard feature across global industries, contributing to improved public health outcomes and reduced disease transmission.

Global Market Demand Analysis for Antibacterial Solutions

The global market for antibacterial solutions has experienced significant growth in recent years, driven by increasing awareness of infection control and hygiene across multiple sectors. The COVID-19 pandemic has further accelerated this trend, creating unprecedented demand for antibacterial products across healthcare, consumer goods, food processing, and construction industries. Market research indicates that the global antibacterial coatings market reached approximately $3.6 billion in 2021 and is projected to grow at a compound annual growth rate of 7.2% through 2028.

Healthcare remains the dominant sector for antibacterial solutions, accounting for nearly 40% of the total market share. Hospitals and medical facilities worldwide are increasingly adopting antibacterial coatings for high-touch surfaces to reduce healthcare-associated infections (HAIs), which affect millions of patients annually and result in substantial healthcare costs. The aging population in developed countries has also contributed to this demand, as elderly individuals typically require more frequent healthcare interventions and are more susceptible to infections.

Consumer awareness regarding hygiene has transformed purchasing behaviors, particularly in household products, personal care items, and food packaging. Market surveys reveal that 78% of consumers now consider antimicrobial properties as an important factor when purchasing household items. This shift has prompted manufacturers across various industries to incorporate antibacterial features into their products as a value-added selling point.

Regional analysis shows varying levels of market penetration. North America and Europe currently lead in antibacterial coating adoption, primarily due to stringent regulatory frameworks and higher healthcare expenditure. However, the Asia-Pacific region is witnessing the fastest growth rate at 9.3% annually, driven by rapid industrialization, increasing healthcare infrastructure development, and growing middle-class populations with higher disposable incomes in countries like China and India.

Emerging economies present substantial growth opportunities, with increasing urbanization and healthcare infrastructure development creating new markets for antibacterial solutions. Latin America and Africa, while currently representing smaller market shares, are expected to see significant growth as public health awareness increases and regulatory standards evolve to address infection control concerns.

Industry-specific demands show distinct patterns. The food processing industry requires antibacterial coatings that are non-toxic and comply with strict food safety regulations. The construction sector seeks durable solutions for public spaces that can withstand frequent cleaning. Meanwhile, the electronics industry demands invisible coatings that don't interfere with device functionality or aesthetics.

Healthcare remains the dominant sector for antibacterial solutions, accounting for nearly 40% of the total market share. Hospitals and medical facilities worldwide are increasingly adopting antibacterial coatings for high-touch surfaces to reduce healthcare-associated infections (HAIs), which affect millions of patients annually and result in substantial healthcare costs. The aging population in developed countries has also contributed to this demand, as elderly individuals typically require more frequent healthcare interventions and are more susceptible to infections.

Consumer awareness regarding hygiene has transformed purchasing behaviors, particularly in household products, personal care items, and food packaging. Market surveys reveal that 78% of consumers now consider antimicrobial properties as an important factor when purchasing household items. This shift has prompted manufacturers across various industries to incorporate antibacterial features into their products as a value-added selling point.

Regional analysis shows varying levels of market penetration. North America and Europe currently lead in antibacterial coating adoption, primarily due to stringent regulatory frameworks and higher healthcare expenditure. However, the Asia-Pacific region is witnessing the fastest growth rate at 9.3% annually, driven by rapid industrialization, increasing healthcare infrastructure development, and growing middle-class populations with higher disposable incomes in countries like China and India.

Emerging economies present substantial growth opportunities, with increasing urbanization and healthcare infrastructure development creating new markets for antibacterial solutions. Latin America and Africa, while currently representing smaller market shares, are expected to see significant growth as public health awareness increases and regulatory standards evolve to address infection control concerns.

Industry-specific demands show distinct patterns. The food processing industry requires antibacterial coatings that are non-toxic and comply with strict food safety regulations. The construction sector seeks durable solutions for public spaces that can withstand frequent cleaning. Meanwhile, the electronics industry demands invisible coatings that don't interfere with device functionality or aesthetics.

Current Technological Landscape and Barriers

The global antibacterial coating market has experienced significant growth in recent years, driven by increasing awareness of infection control and hygiene across various sectors. Currently, the market is dominated by silver-based coatings, which account for approximately 45% of the total market share due to their broad-spectrum antimicrobial properties and relatively established manufacturing processes. Copper-based coatings follow at around 25%, while quaternary ammonium compounds and other technologies make up the remainder.

North America leads the global market with approximately 35% share, followed by Europe (30%) and Asia-Pacific (25%), with the latter showing the fastest growth rate at 8.5% annually. This geographical distribution reflects varying regulatory frameworks and adoption rates across regions, with developed economies generally showing earlier and more widespread implementation.

Despite the promising growth trajectory, several significant barriers impede wider market penetration. Regulatory hurdles present a primary challenge, with different countries maintaining distinct approval processes for antimicrobial products. The FDA in the United States, for instance, requires extensive efficacy and safety testing, while the EU's Biocidal Products Regulation imposes stringent documentation requirements that can delay market entry by 18-24 months.

Cost considerations represent another substantial barrier. The premium pricing of antibacterial coatings—typically 30-40% higher than conventional alternatives—limits adoption, particularly in price-sensitive markets and sectors. This cost differential stems from specialized raw materials, complex manufacturing processes, and necessary quality control measures.

Technical limitations further constrain market expansion. Current antibacterial coatings often demonstrate reduced efficacy over time, with many products losing significant antimicrobial properties after 6-12 months of use. Durability issues are particularly pronounced in high-traffic areas or environments requiring frequent cleaning with harsh chemicals. Additionally, compatibility problems arise when applying these coatings to certain substrates, limiting their application range.

Environmental concerns have also emerged as a growing barrier. Leaching of antimicrobial agents, particularly heavy metals like silver and copper, into the environment raises ecological questions. Several jurisdictions have begun implementing restrictions on certain antimicrobial compounds, forcing manufacturers to reformulate products and potentially compromise on efficacy or durability.

The fragmented nature of the market presents additional challenges, with over 200 companies worldwide offering antibacterial coating solutions, but few possessing the scale or resources to drive significant technological breakthroughs or market education initiatives. This fragmentation has resulted in inconsistent product quality and performance claims, creating market confusion and skepticism among potential adopters.

North America leads the global market with approximately 35% share, followed by Europe (30%) and Asia-Pacific (25%), with the latter showing the fastest growth rate at 8.5% annually. This geographical distribution reflects varying regulatory frameworks and adoption rates across regions, with developed economies generally showing earlier and more widespread implementation.

Despite the promising growth trajectory, several significant barriers impede wider market penetration. Regulatory hurdles present a primary challenge, with different countries maintaining distinct approval processes for antimicrobial products. The FDA in the United States, for instance, requires extensive efficacy and safety testing, while the EU's Biocidal Products Regulation imposes stringent documentation requirements that can delay market entry by 18-24 months.

Cost considerations represent another substantial barrier. The premium pricing of antibacterial coatings—typically 30-40% higher than conventional alternatives—limits adoption, particularly in price-sensitive markets and sectors. This cost differential stems from specialized raw materials, complex manufacturing processes, and necessary quality control measures.

Technical limitations further constrain market expansion. Current antibacterial coatings often demonstrate reduced efficacy over time, with many products losing significant antimicrobial properties after 6-12 months of use. Durability issues are particularly pronounced in high-traffic areas or environments requiring frequent cleaning with harsh chemicals. Additionally, compatibility problems arise when applying these coatings to certain substrates, limiting their application range.

Environmental concerns have also emerged as a growing barrier. Leaching of antimicrobial agents, particularly heavy metals like silver and copper, into the environment raises ecological questions. Several jurisdictions have begun implementing restrictions on certain antimicrobial compounds, forcing manufacturers to reformulate products and potentially compromise on efficacy or durability.

The fragmented nature of the market presents additional challenges, with over 200 companies worldwide offering antibacterial coating solutions, but few possessing the scale or resources to drive significant technological breakthroughs or market education initiatives. This fragmentation has resulted in inconsistent product quality and performance claims, creating market confusion and skepticism among potential adopters.

Mainstream Antibacterial Coating Technologies

01 Nanoparticle-based antibacterial coatings for enhanced penetration

Nanoparticle technology is utilized in antibacterial coatings to enhance penetration into surfaces and microorganisms. These nanoparticles, often silver or copper-based, can penetrate deeper into material structures due to their small size, providing long-lasting antibacterial protection. The nano-scale dimensions allow for better distribution within the coating matrix and improved interaction with bacterial cell walls, resulting in more effective antimicrobial activity at lower concentrations.- Nanoparticle-based antibacterial coatings for enhanced penetration: Nanoparticle technology is utilized in antibacterial coatings to enhance penetration into surfaces and microorganisms. The small size of nanoparticles allows for deeper penetration into porous materials and bacterial cell walls. These formulations often incorporate silver, copper, or zinc oxide nanoparticles that can effectively penetrate biofilms and provide sustained antimicrobial activity. The nanostructured coatings create a barrier with improved durability and penetration capabilities compared to conventional antibacterial treatments.

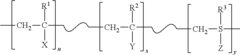

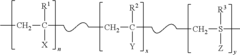

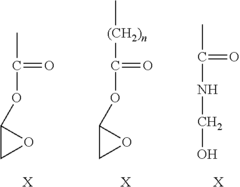

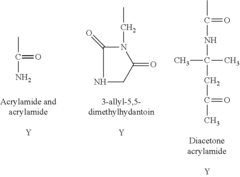

- Polymer-based delivery systems for antibacterial agents: Polymer matrices are engineered to control the release and penetration of antibacterial agents. These systems utilize hydrophilic or hydrophobic polymers that can swell or degrade in specific environments, facilitating the penetration of active ingredients into target surfaces. The polymer composition can be tailored to respond to environmental triggers such as pH, temperature, or moisture, enabling targeted delivery and enhanced penetration of antibacterial compounds. This approach provides sustained release of antimicrobial agents and improves their efficacy through controlled penetration.

- Surface modification techniques for improved coating adhesion and penetration: Various surface modification methods are employed to enhance the adhesion and penetration of antibacterial coatings. These techniques include plasma treatment, chemical etching, and functionalization with coupling agents that create anchor points for the coating. By altering the surface energy or creating micro-roughness, these modifications facilitate better wetting and penetration of the antibacterial formulation into the substrate. This approach is particularly effective for materials that are typically difficult to coat, such as certain polymers or metals, resulting in more durable and effective antibacterial protection.

- Penetration enhancers for antibacterial coatings: Specific additives are incorporated into antibacterial formulations to improve their penetration capabilities. These penetration enhancers include surfactants, solvents, and chelating agents that can disrupt cell membranes or biofilms, allowing antimicrobial agents to penetrate more effectively. Some formulations utilize natural compounds like essential oils or terpenes that have inherent penetration-enhancing properties. The strategic combination of these enhancers with antibacterial agents results in coatings that can reach deeper into porous surfaces or biological materials, providing more comprehensive protection against microbial contamination.

- Multi-layer coating systems with progressive penetration capabilities: Advanced antibacterial protection is achieved through multi-layer coating systems designed with progressive penetration capabilities. These systems typically consist of an outer layer with immediate release properties, middle layers with controlled diffusion characteristics, and a base layer that provides long-term sustained release. The layered approach allows for initial surface disinfection followed by gradual penetration into the substrate, creating a comprehensive antimicrobial barrier. Some systems incorporate different antibacterial agents in each layer to target various types of microorganisms and prevent resistance development, while maintaining effective penetration throughout the coating lifetime.

02 Polymer-based delivery systems for controlled penetration

Polymer matrices are engineered to control the release and penetration of antibacterial agents into target surfaces. These systems utilize various polymers that can be tailored to specific penetration requirements based on the substrate material and environmental conditions. The polymers can be designed to respond to specific triggers such as pH, temperature, or moisture, allowing for targeted release of antibacterial compounds and enhanced penetration into difficult-to-reach areas or biofilms.Expand Specific Solutions03 Surface modification techniques for improved coating adhesion and penetration

Various surface modification methods are employed to enhance the adhesion and penetration of antibacterial coatings. These techniques include plasma treatment, chemical etching, and surface functionalization that create micro-roughness or reactive sites on the substrate. By altering the surface properties, these modifications allow antibacterial agents to penetrate more effectively into the material structure, resulting in stronger bonding and more durable antibacterial protection.Expand Specific Solutions04 Penetration enhancers and carrier molecules for antibacterial agents

Specific compounds are incorporated into antibacterial coatings to enhance the penetration of active ingredients. These penetration enhancers may include surfactants, solvents, and carrier molecules that facilitate the transport of antibacterial agents through various barriers. By reducing surface tension, increasing solubility, or forming complexes with active ingredients, these enhancers improve the depth and uniformity of antibacterial coating penetration, particularly in porous materials or complex surface geometries.Expand Specific Solutions05 Multilayer coating systems for sustained antibacterial penetration

Multilayer coating architectures are designed to provide sustained antibacterial penetration over extended periods. These systems typically consist of a base layer for adhesion, intermediate layers containing antibacterial agents, and top layers that control release rates. The layered structure allows for gradual diffusion of antibacterial compounds into the substrate, creating a reservoir effect that maintains effective concentrations at the surface while continuously penetrating deeper into the material structure.Expand Specific Solutions

Leading Companies and Competitive Dynamics

The antibacterial coating market is currently in a growth phase, with increasing global penetration driven by heightened hygiene awareness post-pandemic. The market size is expanding rapidly, projected to reach significant valuation as healthcare, food processing, and consumer goods industries adopt these technologies. Technical maturity varies across applications, with companies demonstrating different specialization levels. Jiangsu Biosurf Biotech and CNOOC Changzhou Paint & Coatings Research Institute lead in advanced surface modification technologies, while Fraunhofer-Gesellschaft and MIT contribute cutting-edge research innovations. CodiKoat represents emerging players with novel rapid-action solutions. Established manufacturers like Rust-Oleum and Asian Paints (through Harind Chemicals) are integrating antibacterial properties into mainstream coating products, accelerating market adoption across diverse geographical regions.

Jiangsu Biosurf Biotech Co., Ltd.

Technical Solution: Jiangsu Biosurf has developed a comprehensive range of antimicrobial coating solutions based on their proprietary bioactive polymer technology. Their flagship product line utilizes chitosan derivatives combined with silver nanoparticles to create durable antimicrobial surfaces for various applications. The company's technology employs a unique cross-linking mechanism that ensures strong adhesion to substrates while maintaining antimicrobial efficacy for extended periods. Their coatings feature controlled-release mechanisms that provide an initial burst of antimicrobial activity followed by sustained protection for up to 24 months. Biosurf has successfully commercialized these technologies across Asian markets, particularly in healthcare environments, public transportation, and food processing facilities. Their products have undergone extensive testing according to JIS Z 2801 and ISO 22196 standards, demonstrating >99.9% efficacy against common pathogens including E. coli, S. aureus, and various fungi. The company has established manufacturing facilities capable of producing over 5,000 tons of antimicrobial coating materials annually, positioning them as a major supplier in the Asia-Pacific region.

Strengths: Cost-effective manufacturing processes allowing competitive pricing, established distribution network throughout Asia, and formulations specifically optimized for high-humidity environments. Weaknesses: Limited market penetration in North American and European markets, and potential regulatory hurdles for certain applications due to nanomaterial content.

Fraunhofer-Gesellschaft eV

Technical Solution: Fraunhofer has developed multiple advanced antimicrobial coating technologies through its network of research institutes. Their most notable innovation is a plasma-enhanced chemical vapor deposition (PECVD) process that creates diamond-like carbon coatings infused with silver or copper nanoparticles. This technology enables the controlled release of antimicrobial metal ions over extended periods, providing sustained protection against a broad spectrum of pathogens. Additionally, Fraunhofer has pioneered antimicrobial sol-gel coatings that incorporate quaternary ammonium compounds for contact-killing properties. Their research extends to photocatalytic titanium dioxide coatings that generate reactive oxygen species under ambient light conditions. Fraunhofer's technologies have been successfully applied in healthcare settings, food processing facilities, and public transportation systems across Europe. Their antimicrobial coatings have demonstrated efficacy in reducing surface contamination by up to 99.99% in field tests, with durability extending to several years depending on the application environment.

Strengths: Extensive R&D capabilities across multiple coating technologies, strong industry partnerships for commercialization, and proven scalability from laboratory to industrial applications. Weaknesses: Complex technology transfer process between research and commercial implementation, and higher production costs compared to conventional antimicrobial treatments.

Key Patents and Scientific Breakthroughs

Antimicrobial surface coatings

PatentActiveUS20150315389A1

Innovation

- Development of durable and rechargeable N-halamine surface coatings that can be covalently bound to various surfaces, including textiles, inorganic mediums, and plastics, using water-soluble polymeric N-halamine precursors that form nitrogen-halogen bonds, effectively inactivating bacteria, fungi, and viruses upon contact, with the ability to regenerate biocidal activity.

Antimicrobial additives containing metal nanoparticles along with quaternary ammonium salt for powder and pigmented paint coating

PatentActiveIN202221002371A

Innovation

- A stable antimicrobial powder composition incorporating silver nanoparticles and quaternary ammonium salts, specifically formulated to be heat and light stable, and easily dispersible in powder paint matrices, using finely grounded aluminosilicate powder as a carrier, with a novel synthesis process that ensures long-lasting antimicrobial efficacy without agglomeration or leaching.

Regulatory Framework Across Key Markets

The regulatory landscape for antibacterial coatings varies significantly across global markets, creating a complex environment for manufacturers seeking international expansion. In the United States, the FDA maintains stringent oversight through multiple regulatory pathways depending on the intended use of the coating. Antibacterial coatings for medical devices must undergo premarket approval processes, while those for food contact surfaces fall under FDA's Food Contact Substance Notification Program. The EPA regulates antimicrobial coatings classified as pesticides under FIFRA, requiring extensive efficacy and safety data.

The European Union implements a more unified but equally rigorous approach through the Biocidal Products Regulation (BPR), which specifically addresses substances intended to control harmful organisms. Antibacterial coatings must undergo authorization processes that evaluate both active substances and finished products. The EU's REACH regulation adds another layer of compliance requirements for chemical substances in these coatings. Additionally, the Medical Device Regulation (MDR) imposes specific requirements for coatings used in healthcare settings.

Asian markets present varying regulatory frameworks. Japan's regulatory system operates through the Ministry of Health, Labour and Welfare for medical applications and the Ministry of Economy, Trade and Industry for industrial uses. China has implemented the China Food and Drug Administration guidelines for medical applications while industrial coatings fall under the purview of the Ministry of Ecology and Environment's chemical substance regulations.

Emerging markets typically demonstrate less developed regulatory frameworks but are rapidly evolving. Brazil's ANVISA and India's Central Drugs Standard Control Organization have established guidelines specifically addressing antimicrobial technologies, though enforcement remains inconsistent. These markets often reference international standards while developing their domestic regulatory capabilities.

Cross-border harmonization efforts are gradually emerging through organizations like the International Organization for Standardization (ISO), which has developed standards for testing antimicrobial efficacy. The Global Harmonization Task Force for medical devices also works toward regulatory convergence, though significant regional differences persist.

Companies pursuing global market penetration must navigate these diverse regulatory landscapes through comprehensive compliance strategies. This often necessitates region-specific product formulations, testing protocols, and documentation systems. Successful market entry typically requires early engagement with regulatory authorities and strategic partnerships with local regulatory experts to navigate jurisdiction-specific requirements efficiently.

The European Union implements a more unified but equally rigorous approach through the Biocidal Products Regulation (BPR), which specifically addresses substances intended to control harmful organisms. Antibacterial coatings must undergo authorization processes that evaluate both active substances and finished products. The EU's REACH regulation adds another layer of compliance requirements for chemical substances in these coatings. Additionally, the Medical Device Regulation (MDR) imposes specific requirements for coatings used in healthcare settings.

Asian markets present varying regulatory frameworks. Japan's regulatory system operates through the Ministry of Health, Labour and Welfare for medical applications and the Ministry of Economy, Trade and Industry for industrial uses. China has implemented the China Food and Drug Administration guidelines for medical applications while industrial coatings fall under the purview of the Ministry of Ecology and Environment's chemical substance regulations.

Emerging markets typically demonstrate less developed regulatory frameworks but are rapidly evolving. Brazil's ANVISA and India's Central Drugs Standard Control Organization have established guidelines specifically addressing antimicrobial technologies, though enforcement remains inconsistent. These markets often reference international standards while developing their domestic regulatory capabilities.

Cross-border harmonization efforts are gradually emerging through organizations like the International Organization for Standardization (ISO), which has developed standards for testing antimicrobial efficacy. The Global Harmonization Task Force for medical devices also works toward regulatory convergence, though significant regional differences persist.

Companies pursuing global market penetration must navigate these diverse regulatory landscapes through comprehensive compliance strategies. This often necessitates region-specific product formulations, testing protocols, and documentation systems. Successful market entry typically requires early engagement with regulatory authorities and strategic partnerships with local regulatory experts to navigate jurisdiction-specific requirements efficiently.

Environmental Impact and Sustainability Considerations

The environmental impact of antibacterial coatings represents a critical consideration as these technologies gain wider market penetration globally. Traditional antibacterial solutions often contain heavy metals such as silver, copper, and zinc, which can accumulate in ecosystems and potentially disrupt aquatic environments when leached from products during their lifecycle. Recent environmental assessments indicate that nanosilver particles, commonly used in antibacterial coatings, may persist in water systems and affect non-target organisms.

Regulatory bodies worldwide are increasingly scrutinizing these environmental concerns, with the European Union's REACH regulations and the EPA in the United States implementing stricter guidelines for antibacterial compounds. This regulatory landscape is driving manufacturers toward developing more environmentally responsible alternatives that maintain efficacy while reducing ecological footprints.

The sustainability profile of antibacterial coatings extends beyond their environmental impact to encompass their production processes. Current manufacturing methods often involve energy-intensive processes and volatile organic compounds (VOCs) that contribute to air pollution and climate change. Market analysis reveals growing consumer preference for products with transparent environmental credentials, creating economic incentives for companies to invest in greener technologies.

Emerging sustainable alternatives include bio-based antibacterial agents derived from plant extracts, enzymes, and peptides that offer biodegradability advantages over synthetic counterparts. Research indicates these natural alternatives can achieve comparable efficacy while significantly reducing environmental persistence. For instance, chitosan-based coatings derived from crustacean shells demonstrate promising antibacterial properties with minimal ecological impact.

Life cycle assessment (LCA) studies comparing traditional and eco-friendly antibacterial coatings show that while bio-based solutions may currently have higher production costs, their reduced environmental externalities often result in lower total societal costs. This holistic economic perspective is increasingly influencing procurement decisions in healthcare, food processing, and consumer goods sectors.

The circular economy principles are also being applied to antibacterial coating development, with innovations focusing on recyclability and end-of-life considerations. Some pioneering companies have implemented take-back programs for products with antibacterial treatments, ensuring proper disposal or recycling of potentially harmful compounds. These initiatives represent emerging best practices that may become industry standards as sustainability considerations continue to shape market dynamics.

As global markets for antibacterial coatings expand, particularly in developing economies, technology transfer must include environmental safeguards to prevent pollution havens. International collaboration on environmental standards and sustainable practices will be essential to ensure that market growth does not come at the expense of ecological health or exacerbate environmental inequality between regions.

Regulatory bodies worldwide are increasingly scrutinizing these environmental concerns, with the European Union's REACH regulations and the EPA in the United States implementing stricter guidelines for antibacterial compounds. This regulatory landscape is driving manufacturers toward developing more environmentally responsible alternatives that maintain efficacy while reducing ecological footprints.

The sustainability profile of antibacterial coatings extends beyond their environmental impact to encompass their production processes. Current manufacturing methods often involve energy-intensive processes and volatile organic compounds (VOCs) that contribute to air pollution and climate change. Market analysis reveals growing consumer preference for products with transparent environmental credentials, creating economic incentives for companies to invest in greener technologies.

Emerging sustainable alternatives include bio-based antibacterial agents derived from plant extracts, enzymes, and peptides that offer biodegradability advantages over synthetic counterparts. Research indicates these natural alternatives can achieve comparable efficacy while significantly reducing environmental persistence. For instance, chitosan-based coatings derived from crustacean shells demonstrate promising antibacterial properties with minimal ecological impact.

Life cycle assessment (LCA) studies comparing traditional and eco-friendly antibacterial coatings show that while bio-based solutions may currently have higher production costs, their reduced environmental externalities often result in lower total societal costs. This holistic economic perspective is increasingly influencing procurement decisions in healthcare, food processing, and consumer goods sectors.

The circular economy principles are also being applied to antibacterial coating development, with innovations focusing on recyclability and end-of-life considerations. Some pioneering companies have implemented take-back programs for products with antibacterial treatments, ensuring proper disposal or recycling of potentially harmful compounds. These initiatives represent emerging best practices that may become industry standards as sustainability considerations continue to shape market dynamics.

As global markets for antibacterial coatings expand, particularly in developing economies, technology transfer must include environmental safeguards to prevent pollution havens. International collaboration on environmental standards and sustainable practices will be essential to ensure that market growth does not come at the expense of ecological health or exacerbate environmental inequality between regions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!